Creating and Adjusting an Investment Policy Statement — With Free Downloadable PDF

Our Investment Policy Statement (IPS) includes our investment objectives, asset allocation, strategies to control investment fees and taxes, and plans for managing the portfolio.

A written investment policy statement is vital to achieving investment objectives. It helps prevent making bad decisions driven by fear or greed. It’s also helpful to have this document to refer back to because inevitably we forget things.

Our IPS was written when we were in accumulation mode. It served us well during this time.

However, as we shift from accumulation to decumulation mode we’ve realized a new plan is necessary. So we’re updating our investment policy statement.

We’re sharing our original IPS, changes we’re making as we transition to a new stage in life, and a downloadable PDF to help you create your own IPS.

Our Investment Policy Statement

I’ll share our investment policy statement as originally written. That may be helpful to others saving towards financial independence. This will be in italic font for consistency.

I’ll then provide commentary to share key things we got right, where we’ve veered from our written plan, and how our plan continues to evolve. My commentary will be in normal font.

Investment Objectives

This plan will be followed to build our assets to reach financial independence and provide for financial security in early retirement.

During our accumulation period, we were essentially living off one of our salaries and saving the other. We were focused on growing our investment portfolio.

Now that we’ve achieved our original financial goals, our investment plan will shift. Our investment objectives now are to protect our assets from unrecoverable losses and to employ a strategy that will enable our investment portfolio to support our spending needs indefinitely.

Assets Included In Allocation

Assets included in our portfolio include our retirement and taxable investment accounts and cash savings.

Investment Accounts

Investment accounts include taxable, rollover IRA, and Roth IRA accounts. We will also include our current work retirement accounts. These accounts will be considered together for the purpose of planning and asset allocation.

Since we wrote our original plan, Kim switched jobs, and I’ve terminated my employment. We rolled over her old 403(b) and my 401(k) to IRAs with Vanguard. This means that the vast majority of our funds are held with one brokerage firm.

Related: 5 Factors to Consider Before You Roll Your 401(k) to an IRA

Having this concentration of funds in one place is mildly troubling from a security perspective. However, we feel the simplicity of having our accounts in one place as well as the benefits that come with having a larger account balance outweigh the security risks.

We have no immediate plans to move any funds to another brokerage. It is something we may consider in the future.

We began using a high deductible health plan when I left my job in 2017. This made us eligible to utilize a health savings account (HSA). We’ve been contributing the maximum allowable amount each year since. We now include this account in our asset allocation.

Related: Using an HSA to Save for Retirement

I recently researched the benefits of IBonds. After doing so, I opened an account with TreasuryDirect to buy IBonds. I now include these bonds in our asset allocation as well.

Related: I Bonds vs. TIPS

Cash

Part of our financial plan will include having cash to serve as an emergency/opportunity fund and to hold money we plan to spend in the near term when in retirement. Cash held in a high-yield savings account and money market account will be included as part of our allocation.

We will always keep at least 6 months of living expenses in cash. We will never carry more than 2 years of living expenses in cash at any time to avoid excessive drag on investment returns.

Cash held in checking accounts that will be used to deposit paychecks and cover normal spending will be omitted from the plan/allocation.

Cash was our biggest point of contention when initially developing our asset allocation and IPS. I’ve never liked holding cash because of the drag on investment returns. It seemed wasteful to me to have money sitting around when we had abundant cash flow and a high savings rate.

Kim always loved the feeling of security a large cash cushion provides. We generally settled on keeping our cash reserves at about 3-6 months living expenses when both of us were working.

Deciding how much cash to hold continues to be challenging for two reasons. Our “high yield” savings account currently yields only .5%, unlikely to keep pace with inflation. As our investments have grown substantially, 5% of our portfolio accounts for over a year and a half of living expenses, which feels excessive.

We’ve settled on keeping about one year of expenses in cash. We’ll allocate extra cash to bonds.

IBonds offer tax deferral similar to retirement accounts, but they do so without the associated age related restrictions of retirement accounts. That makes IBonds attractive to us as an alternative to holding excessive cash.

Assets Not Included in Our Allocation

Our Home

Part of our plan will be to own our home. We currently own our home outright, valued at approximately $250k. This also will not be included in our investment plan, asset allocation, or our assets factored into reaching financial independence (FI).

When developing our IPS, our thinking was heavily influenced by Rick Ferri, CFA. In his book, “All About Asset Allocation”, he wrote that your primary residence should not be included as part of your portfolio because it is illiquid, produces no income, and typically appreciates only at about the general inflation rate.

Still, our home is a large piece of our net worth. Since we wrote our IPS, our home value has nearly doubled.

I’ve started to look at home ownership as a potential investment. We bought our current home, in part, because it could be used as an AirBNB rental to produce income if needed or desired.

We still don’t include our home directly into our asset allocation. I have written in detail about how home ownership can fit into an investment portfolio and financial plan. Benefits of owning our home include having an inflation hedge, because we don’t have to pay rent.

Having a paid off home keeps our monthly expenses low, which will help us optimize premium tax credits when we start buying our own health insurance on the Marketplace. We also have the option to downsize, utilize geoarbitrage, a HELOC, or a reverse mortgage to create cash flow in the future.

Thus owning our home both decreases the amount of risk we need to take while simultaneously increasing the amount of risk we can afford to take with our other investments.

Writing Projects

When we wrote our original IPS, I was blogging but not earning money doing so. Since leaving my career, I’ve invested time writing a book and working on this blog. Each produces regular monthly income which decreases stress on our portfolio.

This blog is also a business. Similar to a stock, its value fluctuates over time in addition to producing regular income. Unlike a stock, it is not easy to sell or buy shares in this small business.

So ultimately, we consider my writing projects in our IPS similarly to home ownership. We don’t factor these assets directly into our asset allocation for the purpose of managing the portfolio. However, they do help shape the amount of risk taken and strategies employed in managing our portfolio.

College Savings

We will keep an account for our daughter that will be used to fund college. These funds will be invested in a taxable account. We’ll continue to consider tax advantaged accounts if the tax savings outweigh the restrictions on the accounts.

These funds will be held in a separate account and will not be considered as part of our investment asset allocation or assets factored into reaching FI. This will eventually be her money, but we will have control over how it is used.

Since developing our initial IPS, we’ve saved aggressively for our daughter’s college education. We’ve reached our funding goal, and have stopped saving for her since I quit working.

This money remains invested in a separate taxable investment account in our names. Theoretically this is another backup that we could tap into without penalty if needed. However, that would be an absolute last resort.

Related: Saving For Your Children’s College Education vs. Saving For Your Retirement

Social Security

We will periodically monitor our Social Security benefits. Given the long time frame until we are eligible to claim benefits and the political uncertainty around Social Security, we won’t factor these benefits into our plan. Instead, we’ll consider benefits we eventually receive as a bonus and backup to our plan.

Since we originally developed our IPS I’ve become more interested in Social Security. Helping my parents with their finances and interacting with readers of this blog who are at or nearing traditional retirement age has made me truly appreciate how valuable these benefits are.

Related: How Does Retiring Early Impact Social Security Benefits?

As I’ve gained a better understanding of our benefits I’ve started checking them annually on the MySSA website. I use these numbers when running our retirement scenarios with the NewRetirement PlannerPlus or Pralana Gold high fidelity retirement planning tools.

But we’re still 20+ years from claiming Social Security benefits. We still need to navigate a few decades of early retirement before we become eligible for Social Security at traditional retirement age. So we don’t factor these benefits into our investment allocation.

Asset Allocation

We will begin with an asset allocation of 80% stocks, 15% bonds and 5% cash distributed across these different accounts.

This was roughly our asset allocation during our accumulation period. It was actually a bit more aggressive than that. We generally held less cash.

Many people agonize over their asset allocation. We did initially. Should we allocate an extra 10% here… or 5% there?

At the end of the day, if you have a reasonable allocation and you’re saving aggressively towards financial independence and early retirement… your exact asset allocation doesn’t matter very much.

We’ve accumulated a substantial portfolio. We’re not saving as consistently and are transitioning to spending from our investments. Asset allocation is more important now.

Stay too aggressive, and we make ourselves vulnerable to a bad early sequence of returns that we can’t recover from. Get too conservative, and inflation can erode the spending power of our portfolio. Kind of like Goldilocks, we want to find the combination that is just right.

To those ends, I’ve gotten a lot of value out of the free ”My Portfolio tool” at Portfolio Charts. It allows you to compare different portfolios and see a number of variables based on back tested data.

We settled on an allocation of 70% stocks, 20% bonds, 5% cash, and 5% gold. This is the allocation we’ll likely hold for the foreseeable future.

Stocks

During our accumulation phase we held about 80% of our portfolio in a collection of stock index funds. Of our total portfolio, 55% was allocated to domestic stock funds and 25% was allocated to international stock funds.

We’ve gradually been shifting our allocation as we transition to semi-retirement and eventually early retirement. We now allocate 70% of our portfolio to stock index funds. Of our total portfolio, 46% is allocated to domestic stock funds and 24% is allocated to international stock funds.

Domestic

- 35% Vanguard US Total Stock Market Index Fund (VTSAX)

- 10% Vanguard Small Cap Value Index Fund (VSIAX)

- 10% Vanguard REIT Index Fund (VGSLX)

When we started managing our own portfolio, we considered all our old actively managed funds as part of our VTSAX allocation until we were able to gradually sell them off in a tax-efficient manner.

While invested in my 401(k), I didn’t have the option to invest in the exact funds specified in our IPS. I used the Vanguard S&P 500 (VFIAX) index fund as a proxy for VTSAX and the Vanguard Small Cap Index Fund (VSMAX) as a proxy for VSIAX.

We’re staying with our general allocation within domestic stocks. As we’ve gotten a bit more conservative since I’ve left my job we’ve been gradually shaving a few percentage points off each asset class.

Our current domestic stock allocation is:

- 30% Vanguard US Total Stock Market Index Fund (VTSAX)

- 8% Vanguard Small Cap Value Index Fund (VSIAX)

- 8% Vanguard REIT Index Fund (VGSLX)

International

- 10% Vanguard European Stock Index Fund (VEUSX)

- 10% Vanguard Pacific Rim Stock Index Fund (VPADX)

- 5% Vanguard Emerging Markets Index Fund (VEMAX)

When we built our portfolio, we decided to divide up our international holdings by region. This approach may provide a little extra return over time due to rebalancing.

If I had this to do over again, I would just combine these holdings into one fund such as Vanguard’s Total International Stock Index (VTIAX) or their FTSE All-World ex-US Index (VFWAX) for simplicity.

Since we set up our portfolio, international stock investments held in taxable accounts have accumulated substantial gains. It makes sense not to simplify due to tax consequences.

When I rolled over my 401(k) several years ago, we shifted 5% of our allocation from VTSAX to VEMAX to give us a little more international exposure.

As with our domestic stock allocation, we’ve gradually been shaving a few percentage points off each asset class in our international stock allocation to take some risk off the table.

Our current international stock allocation is:

- 8% Vanguard European Stock Index Fund (VEUSX)

- 8% Vanguard Pacific Rim Stock Index Fund (VPADX)

- 8% Vanguard Emerging Markets Index Fund (VEMAX)

All our stock funds are in Vanguard Admiral shares, the lowest cost share class available to retail investors with Vanguard.

The only portion of our stock portfolio not currently held in these exact funds are shares of SPDR Portfolio Total Stock Market ETF (SPTM) held as a proxy for VTSAX in our HSA account.

Bonds

- 10% Vanguard Total Bond Market Index Fund (VBTLX)

- 5% Vanguard Inflation-Protected Securities (TIPS) Fund (VAIPX)

I was not excited about holding bonds during our accumulation phase. Kim liked the idea of having some bonds in our portfolio, so we initially settled on allocating 15% to bonds.

On paper, we settled on a ratio of 2:1 Total Bond Index to TIPS when designing our portfolio. We never actually purchased the TIPS until I rolled over my 401(k) to an IRA. Prior to that we didn’t have a space in our portfolio to hold TIPS in a tax and cost efficient manner.

We assumed we would shift more of our allocation from stocks to bonds as we approached early retirement. However, with interest rates remaining low, we let things ride without increasing our bond allocation.

Related: Retiring With Extreme Low Interest Rates

The bull market rages on. Our investment balances continue to swell. So we recently considered increasing our bond allocation to decrease portfolio volatility risk.

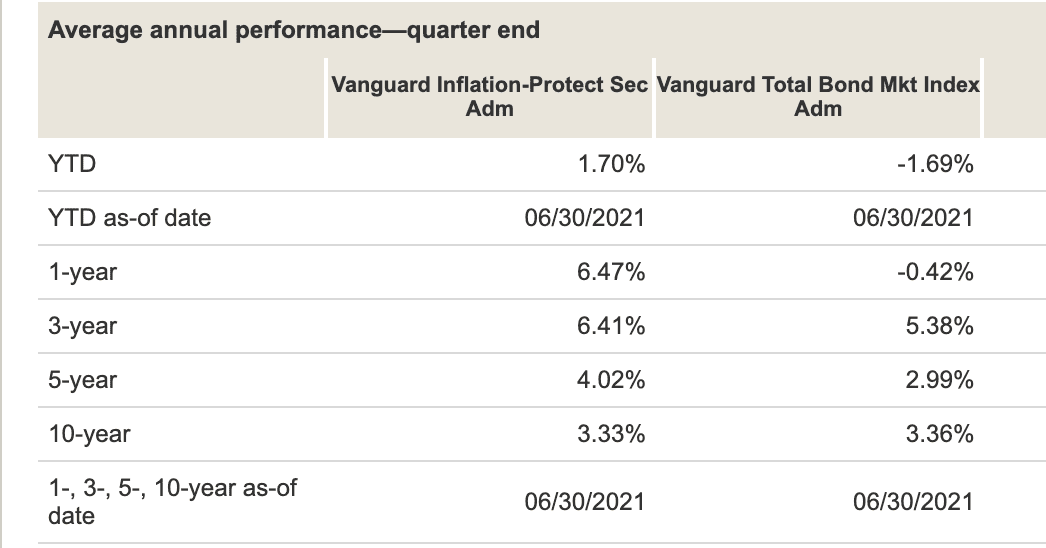

I was pleasantly surprised to see how well our TIPS have done compared to our total bond index despite low inflation over the past few years.

We increased our allocation to inflation protected bonds from 5% to 10% of our portfolio. Most of this allocation continues to be held in TIPS, but we recently began buying IBonds and will continue to do so.

I’m most comfortable with IBonds which mitigate both inflation and interest rate risk. But annual purchases are limited.

Our current bond allocation is:

- 10% Vanguard Total Bond Market Index Fund (VBTLX)

- 10% Vanguard Inflation-Protected Securities (TIPS) Fund (VAIPX) + IBonds

Kim’s 401(k) is currently 100% bonds, invested in the John Hancock Total Bond Market Fund (JTBMX). Our HSA is also predominantly bonds, held in SPDR Portfolio Aggregate Bond ETF (SPAB).

Prior to leaving my job, I held a portion of my portfolio in the Federated Total Return Bond Fund (FTRBX) until rolling my 401(k) over to an IRA.

Each of these funds are/were held as a proxy to VBTLX.

Cash

- 5% Held in online savings and money market accounts.

This is the portion of our IPS we’ve followed least strictly. We’ve typically held only a few months of cash during our accumulation phase.

Moving forward, we’ll likely keep about a year’s living expenses in cash. Beyond that, any additional cash allocation will be used to purchase safe bonds which should provide a higher yield with minimal volatility risk.

GOLD

When we wrote our IPS a decade ago, gold was nowhere on our radar. After doing a lot of reading and backtesting, we decided that adding a bit of gold to our portfolio made more sense than an equivalent amount of bonds. I’ve written in detail about our decision making process around adding gold to our portfolio.

Our target allocation to gold is now 5% of our portfolio. We’ve been dollar cost averaging, regularly buying shares of iShares Gold Trust ETF (IAU) over the past year. We recently reached our target allocation.

Changing Our Allocation

- We will adjust our allocation only when we mutually agree and only when something fundamentally changes to the point that it would be beneficial to do so. Examples would be shifting to a more conservative allocation as we meet investment goals, exiting an asset class if it no longer meets our investing objectives, or adding asset classes if they become available in a cost efficient way as we combine accounts over time.

- If we choose to shift our allocation from stocks to bonds (or bonds to stocks), the relative percentages within each category will be kept the same.

- If we exceed 2 years of expenses in cash, we will shift excess money into bonds.

In the decade since we began managing our portfolio, we’ve made very few changes. We made no changes during our accumulation phase.

Transitioning from two incomes to one and rolling over my 401(k) account provided a good opportunity to revisit our plan a few years ago. The only changes we made were to add TIPS (as had already been in our IPS), increase our allocation to emerging markets, and get our cash holdings in better alignment with our stated allocation.

Last year, we decided to add gold to our portfolio as outlined above. Recently we decided to take some more volatility risk off the table and increase our bond allocation as we’ve become less certain about Kim’s future earnings.

We have had only one disagreement about changing our investments. I wanted to add more value stocks to our portfolio a few years ago. Kim did not like the idea of adding more complexity to our portfolio when she didn’t see a compelling argument for that change.

Per our written policy, if we couldn’t both agree to a change, we wouldn’t make it. So we didn’t.

Cost Control Strategy

- For cost and simplicity, we will use Vanguard funds whenever possible to meet our goals. When this is not possible, we will use the closest alternative that meets our investment objectives.

- We will attempt to choose index funds and avoid any actively managed funds unless none are available to meet our needs (in work sponsored retirement accounts).

- We will consider funds only if the expense ratio is less than .3% annually unless there is no other option available (in work sponsored retirement accounts).

We’ve been happy watching expenses progressively decrease since we began managing our portfolio.

We sold off our expensive actively managed funds at opportune times. Since selling them, we’ve reduced fees on that portion of our portfolio by over 95%! We’ve also eliminated short and long-term capital gains taxes by switching to tax-efficient index funds in our taxable accounts.

We substantially lowered expenses when rolling over my 401(k) plan after leaving my job. Kim’s 401(k) is our last high fee remnant. It currently constitutes only about 6% of our portfolio balance, while generating over 50% of our investment fees! We plan to roll it over to her IRA as soon as it is possible.

Related: Do High 401(k) Fees Outweigh the Benefit of Participating

Since we started investing, there has been a fee war among the major brokerages. Our IPS statement about using Vanguard funds exclusively is no longer relevant. There are now lower fee funds with Schwab and/or Fidelity.

The difference in fees is not significant enough to warrant the effort of switching. If starting over, I may choose one of those brokerages. In the future, we may diversify some of our holdings to one of them.

Tax Control Strategy

- We will make every attempt to locate assets in the most tax efficient places. (Bonds, index funds with higher turnover, and REITS in tax sheltered accounts, broad stock index funds and cash in taxable accounts.)

- We will limit transaction fees by rebalancing only once annually. Rebalancing will be done on May 1 each year after filing our previous year tax returns, at which point we will make our ROTH IRA contribution for the year.

- We will limit capital gains taxes by rebalancing within our tax advantaged accounts. We will sell funds in our taxable accounts only for tax-gain or tax-loss harvesting when to our benefit.

We’ve had similar success reducing our taxes since we started managing our own investments. We’ve eliminated capital gains taxes by holding tax efficient Vanguard index funds in our taxable accounts and rebalancing only in our tax advantaged accounts.

Index funds still produce taxable dividends. Our lower household income means qualified dividends are taxed at 0%.

I’ve made two tax loss harvesting transactions since beginning to manage our portfolio. The first was in mid-December 2015, selling off funds we held in taxable accounts that had dropped in value. I moved that money back to the original funds in late January 2016 after the markets fell more. I harvested enough losses in those transactions that we carried losses forward through our 2020 tax return.

Now that our income is lower, tax loss harvesting doesn’t make sense for us. We now look for opportunities to harvest capital gains that will be taxed at the long term 0% capital gains rate.

I have explored Roth IRA conversions with both the NewRetirement PlannerPlus and Pralana Gold retirement calculators. Both confirmed my suspicions that Roth conversions would not be beneficial for us at this point. I’ll continue to re-evaluate this decision in lower income years.

Future Contributions

- We will contribute the maximum amount to our work sponsored tax-deferred accounts each paycheck.

- We will make the maximum allowable annual contribution to our Roth IRA accounts.

- After maxing out our tax deferred accounts and Roth IRA, we will invest any other available money into our taxable accounts monthly via automatic transaction.

These were no brainer decisions when we were both working. Maxing out our 401(k) accounts offered substantial tax savings. Our combined incomes were always too high to also contribute to a deductible IRA, but well below the limit where Roth contributions were restricted. This made the Roth vs.Traditional IRA decision easy.

I love making financial decisions one time, automating them, and focusing on the things that matter most in life. This was easy for us when we had stable incomes and a large savings rate. It’s proven substantially harder in this phase of early/semi-retirement.

Related: Financial Autopilot

We’re continuously reconsidering this portion of our plan. Now that we have a lower income and lower tax rates, the deduction for investing in a 401(k) isn’t as valuable, particularly when weighed against high fees.

Our goal in this phase of part-time work/semi-retirement is to keep annual recognized income low enough that qualified dividends will be taxed at 0%. We’ll continue to analyze our numbers and determine the best way to use our tax advantaged accounts as circumstances change.

Related: Order of Operations for Tax Advantaged Investing

We also recognize the need to develop a system to take money from our portfolio. At this point, we are net savers more months than we are net spenders. When we need to take from our portfolio we take it from cash savings, and to this point we’ve been able to replenish it with new savings.

Portfolio Monitoring

One area we neglected in our original IPS was monitoring our portfolio.

The first metric I started monitoring was fees. Fees are one of the few things investors can control, so we focus on getting fees as low as possible without adding complexity.

The aggregate expense ratio for all our investments is currently .16% to hold a widely diversified portfolio. As soon as we are able to get Kim’s 401(k) rolled over, that number will drop to under .1%.

The other metric we’ve begun monitoring is the tax status of our investments. Two articles got me thinking about this. The first was Darrow’s post on this site, A Surprising Contender for Tax Efficient Retirement Saving. The other was Physician on FIRE’s My Money Is Worth More Than Your Money.

We focus on limiting our current year tax burden, with an eye on getting more money to Roth and taxable accounts over time. Those dollars will be more valuable when we start consistently drawing down our portfolio.

We’re happy with our tax diversification. Our current breakdown is 49% tax-deferred, 37% taxable, 12% Roth, and 2% in our HSA.

Over the past few years, I’ve started tracking more variables to make investment management easier. This was helpful due to our unpredictable income and cash flow month to month.

I dedicated an entire blog post to this topic: How to Monitor Your Investments.

Investment Returns

So what have our returns been since we began managing our investments? I have no idea. We don’t monitor investment returns.

We’ve decided on a buy and hold approach to investing. This means accepting the returns the markets give us.

It’s tempting to calculate returns, but I think calculating investment returns would have potential for doing more harm than good. So I don’t do it.

Knowing I beat an arbitrary benchmark may make me feel smarter than I am and lead me to start tinkering with the portfolio. Knowing I applied extra effort and paid more fees to under perform a benchmark may tempt me to bail on our strategy at the wrong time. Either scenario is possible in any given year.

I’m happy to be willfully ignorant of our returns. We focus on things we can control, such as limiting portfolio fees, taxes, and complexity while building a portfolio that should do well in a variety of scenarios.

Otherwise, we let the chips fall where they may, confident that our plan will work out over the long term.

Downloadable Investment Policy Statement Template

If you would like to create your own IPS, I’ve created a free downloadable PDF to help you. Share any suggestions on how I can improve it below.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

Editor’s Note: It’s been a while since we’ve mentioned Chief Income Strategist Marc Lichtenfeld’s core investing system, the 10-11-12…

Copyright © 2024 Retiring & Happy. All rights reserved.