Fly Free With Southwest Rewards and Companion Pass

Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

After overcoming my initial skepticism, I started experimenting with travel credit card rewards in 2016. By focusing on simple strategies to obtain the most valuable rewards, I’ve obtained thousands of dollars of free travel every year since.

Much of my effort has focused on obtaining Southwest Rapid Rewards points because they are valuable and easy to use.

With some effort and intentionality, you can also obtain a Companion Pass. This pass enables a companion to fly free with you on every flight you take, even if booked with points. This enables your points to go twice as far.

Chase currently has several co-branded Southwest Credit Cards with outstanding sign-up bonuses through December 7. There are two viable paths to earn a Companion Pass.

Many of us are hungry to return to traveling. If flying free on Southwest interests you, read on to learn more about these offers and specific actions to take to make the most of them….

Why I Love Southwest Rapid Rewards Points

Before explaining how to best take advantage of the current offers, I want to share three reasons I prefer Southwest Airlines over any of the other domestic airline’s rewards programs. Southwest Rapid Reward Points are easy to obtain, easy to use, and valuable.

Easy to Obtain

Southwest is always our first choice of airlines when flying. We typically do at least 1-2 cross country trips with our family of three every year. I can’t recall the last time I’ve paid cash for a non-business related flight because we didn’t have points.

There are three ways that we accumulate Southwest Rapid Rewards points:

- Flying Southwest (paying cash)

- Earning Chase Ultimate Rewards points and transferring them to Southwest

- Earning rewards directly with a Chase/Southwest co-branded credit card.

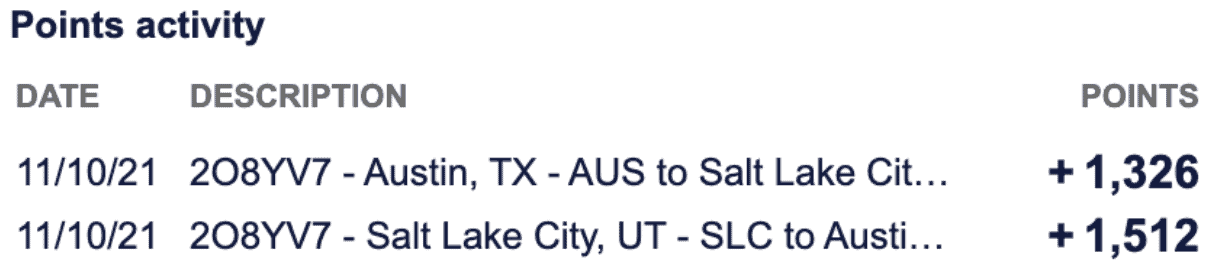

I’ve included a screenshot of Kim’s Southwest Points activity from a recent work related flight to Austin. She accumulated about 2,800 points on this round trip flight. As you’ll see shortly, this is a long, slow way to accumulate these valuable reward points.

You can accumulate points much more quickly by using credit card rewards. We’ll focus on the co-branded Southwest cards in this article because they currently offer outstanding sign-up bonuses on several of their cards.

Easy to Use

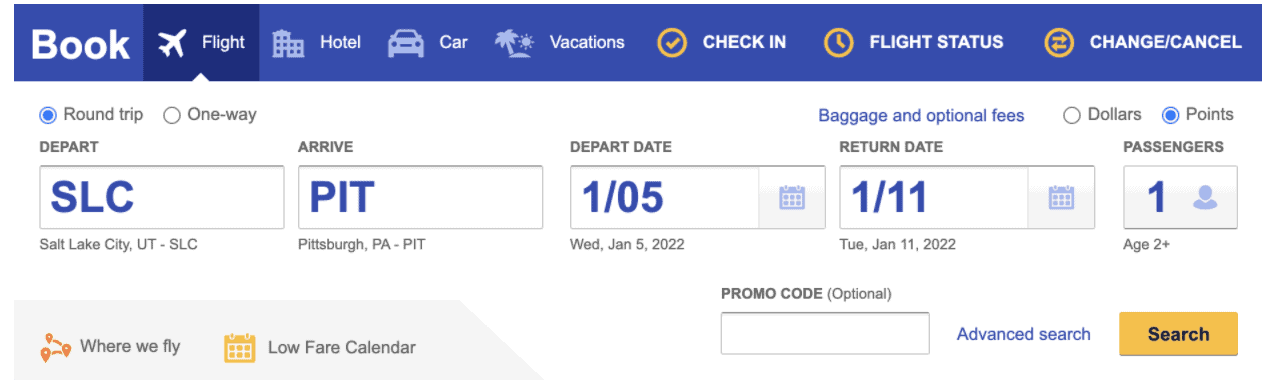

Once you accumulate the Southwest reward points, they are easy to use. Simply go to the Southwest website and select where and when you want to go.

You can display airfare in dollars or points. Click points and search for flights.

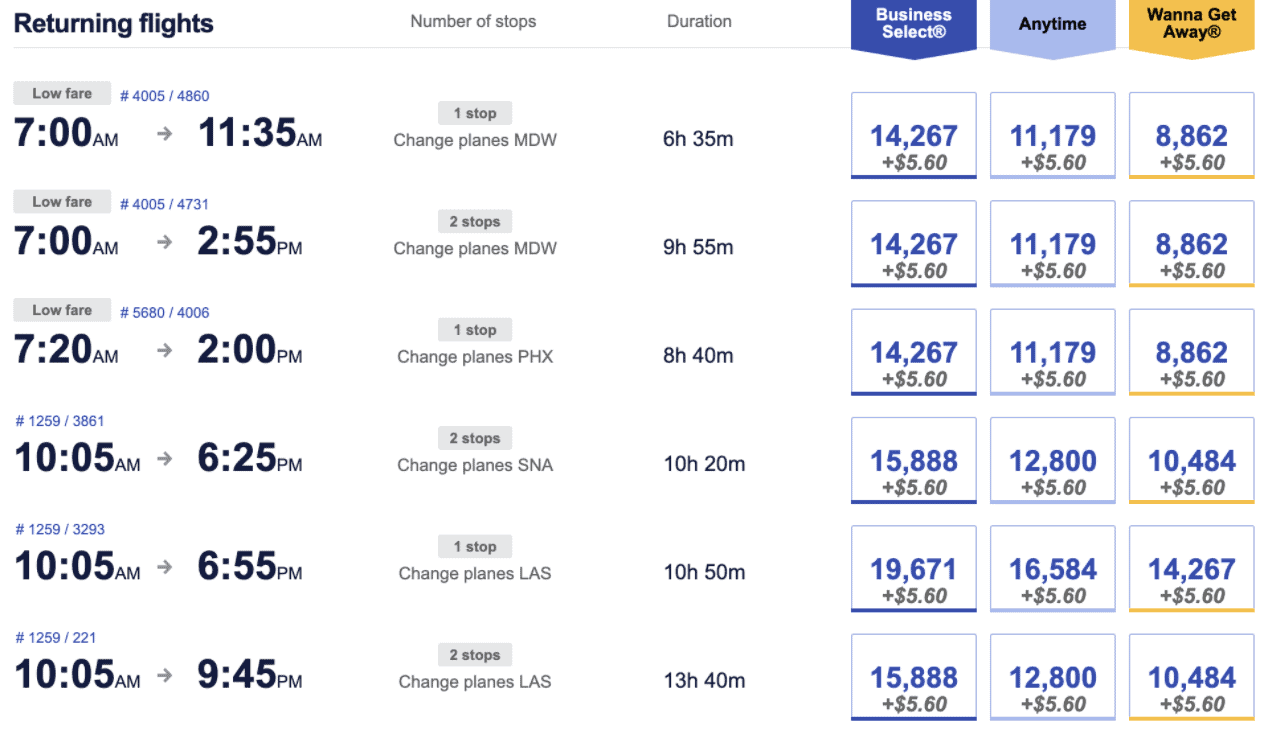

Flights then display with airfare represented in points (plus $5.60, the U.S. 9/11 security fee, which you have to pay for every one-way domestic flight). Click the flight you want, book your flight, and points are deducted from your account.

Southwest does not black out dates for rewards points. They also don’t limit the number of seats that can be booked on points, which is great for families. For example, our family of three recently booked roundtrip flights for Christmas week using points.

If you cancel or change travel plans, your points are fully credited back to your account with no change fees as long as you do so ten minutes prior to your scheduled departure time.

Value

Southwest points offer great value. Many airlines have a fixed cost to flights such as 25,000 points for one flight. Southwest points correspond to the price of the flight. So for those of us with flexible schedules, you can get great deals.

For example, I try to find cross-country flights for less than 10,000 points each way. When I can do that, 100,000 points would be good for at least 5 cross country flights.

Unlike many airlines, Southwest doesn’t nickel and dime you with hidden fees. You can check two bags for free. This includes oversized items including golf clubs and skis.

Beyond saving on airfare and baggage fees, booking with rewards points (this is true of any airline or credit card reward points rather than cash) eliminates all taxes. The lone exception is the $5.60 U.S. 9/11 Security Fee which can’t be avoided on any one-way ($11.20 round-trip) domestic flight.

We pay a total of $33.60 to fly our family of three cross-country and back using points. That’s less than the price to park our car at the airport!

Even better, Southwest offers the Companion Pass. Let’s review what that is, how you can earn it, and how to use it once you do.

The Southwest Companion Pass

Southwest’s Companion Pass is an incredible deal. You choose one person to fly with you free of airline charges every time you fly.

This includes when you book with reward points, potentially making your travel rewards twice as valuable. You can also change who you designate as your companion.

Just like when booking with your Rapid Reward points, any time a seat is available on a flight you can use the companion pass. There are no blackouts or limitations.

I currently have the Companion Pass. I used it for our Christmas week flights.

Also like with Southwest’s reward points, their Companion Pass is extremely easy to use. Simply book your flight, then you’ll be asked if you will be taking your companion. Click yes, book your companion’s flight, and you are done.

There are two ways to earn the Companion Pass. The first is to fly 100 qualifying one-way flights. The second is to earn 125,000 qualifying rewards points. Either must be accomplished in one calendar year.

Both require A LOT of flying…. unless you use credit card rewards. As noted above, you can accumulate Southwest rewards points rapidly by earning sign-up bonuses with several different credit cards.

Reading the Fine Print

There are two important things to understand if you want to earn a Companion Pass.

First, only points earned directly through Chase/Southwest co-branded cards help you earn the companion pass.

You can accumulate Chase Ultimate Rewards points on a number of other credit cards. These points can be transferred 1:1 to Southwest and used to fly for free. But they will not help you qualify for a Companion Pass!

Second, you need to accumulate the points (or flights) to earn a Companion Pass in a calendar year. You can then use the pass for the remainder of the year you earn it and the entire following year.

The ideal strategy would be to accumulate 125,000 qualifying points in January. Then you would have the pass for nearly two full years.

A worst case scenario if trying to earn a Companion Pass would be to earn, for example 50,000 points in December of this year and then 75,000 more next January. In this scenario, you would still have 125,000 valuable points. But you would not earn a Companion Pass.

With the current sign up bonus, there are two ways to accumulate a lot of points quickly…. and potentially earn a Companion Pass.

The Slow and Simple Path to the Companion Pass

Chase currently is offering an elevated sign up bonus on all three of their personal co-branded Southwest Cards. Annual fees on these cards range from $69-149.

You can earn up to 100,000 bonus points with any of these cards. You earn 50,000 bonus points after spending $2,000 on purchases in the first 3 months your account is open.

Then just keep using the card for all normal spending. After spending $12,000 total on purchases in the first 12 months, you then receive an additional 50,000 bonus points.

After earning both bonuses plus at least one point per dollar spent you would have at least 112,000 points (100,000 bonus points + at least 1 point for every dollar spent).

Depending on which card you choose, you earn 2-3 points for dollars spent on Southwest purchases. You get two points for every purchase made on any of these cards for hotel and car rental purchases with Rapid Rewards partners, transit and commuting (including rideshares), internet, cable, and select streaming services.

Even if you don’t earn the Companion Pass, you’ll still have over 100,000 valuable Rapid Rewards points if you hit both bonuses. Even better, this strategy is extremely simple. You simply sign up for one card and put all normal spending on it.

The only catch is making sure you don’t put $2,000 on the card before December 31 if you want both bonuses to apply towards earning the Companion Pass.

The Fast Path to the Companion Pass

There is another way to earn a Companion Pass very quickly with credit card points. It requires signing up for a personal and business credit card.

Small business owners can combine the offer on one of the personal cards with the Southwest® Rapid Rewards® Performance Business Credit Card. You earn 80,000 points after you spend $5,000 on this card in the first 3 months after opening the account. The card has an annual fee of $199.

The combined bonuses give you 130,000 points, qualifying you for the companion pass. This could be achieved quickly, giving you most of 2022 and all of 2023 to use your Companion Pass.

You could continue to use the personal card to earn an additional 50,000 points for a total bonus of 180,000 points (plus points earned directly by spending on the card). Better yet, with the Companion Pass these points can go twice as far!

*Note: Another option for small business owners is to sign up for the Southwest® Rapid Rewards® Premier Business Credit Card. This card has a lower annual fee ($99) and spending requirement ($3,000) to earn the bonus.

However, you receive 60,000 points after meeting your initial spend on the Premier card instead of the 80,000 you earn with the Performance card. So you won’t earn the Companion Pass as quickly.

Take Action

The 100,000 point offer on the personal credit cards has an advertised end date of December 7th. The current offer on the business cards does not have a definitive end date.

Remember that if your goal is to earn a Companion Pass, you don’t want to spend enough to earn the bonus until January 1st of next year. Pay attention to any spending on the card so you don’t earn the bonus too soon.

Regardless of your strategy, desires, and card options, there are great opportunities to earn points and fly for free. Get started and happy traveling!

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

Consumption smoothing is a financial planning concept developed and tested by economists. It refers to the somewhat aspirational idea…

Copyright © 2024 Retiring & Happy. All rights reserved.