What people ought to know about the different kinds of personal finance blogs

259 total views

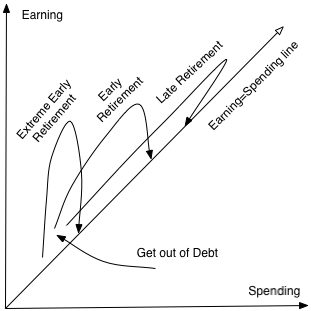

Personal finance blogs primarily fall in three major categories. First, there are the “getting out of debt” blogs. Second, there are the “just got out of college” personal finance blogs. Third, there are the “career track” personal finance blogs. Of course there are more categories such as retirement blogs or I-won-the-lottery blogs, but these are the biggest.

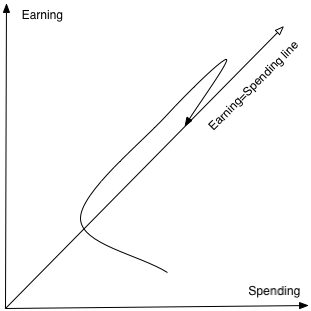

Drawn below is a graph depicting this triad.

A person in this diagram may start in debt or at the spending=earning line. As earnings go up savings are gradually increased to 15% at which point they are held constant. As earnings keep going up spending is adjusted accordingly. After 30 or 40 years, the person retires with a modest drop in spending (no cafeteria lunch and no commute).This path is how most people think when it comes to personal finance. Other paths may sound strange or even impossible.Here are some other paths. That hopefully puts everything in perspective.

Originally posted 2008-02-28 07:18:59.

This article was originally published by Earlyretirementextreme.com. Read the original article here.

Ladies and gentlemen, I am happy to announce that it’s that time of year again! That’s right. It’s time…

Copyright © 2024 Retiring & Happy. All rights reserved.