Retirement Planning and Your Taxes: 24 Tips for Keeping More of Your Own Money

Tax season is approaching. This is a great time to think about your future plans and how you can position yourself to reduce your tax expenditure. Retirement taxes can be surprising.

Here are 24 tips for keeping more of your money.

1. Yes, You’ll Still Pay Taxes After Retirement (And, It Might Be a Big Budget Item)

The average American pays about $10,500 a year in total income taxes — federal, state and local. Of course, many households pay a lot more and some people pay nothing at all — depending on your income level.

Ten thousand dollars is a big chunk — about 14% — of the average budget. So, if you think about it, taxes can be a bigger lever in your budget than investment returns, cutting expenses or waiting to claim Social Security for a bigger benefit check.

As such, it is worth worrying about your tax bill in retirement. However, taxes ARE lower for people who are older.

Taxes fall as you get older primarily because most retirees have less taxable income. And, there is a lot retirees can do to manipulate their income to optimize for taxes.

2. Tax Planning Should Be a Big Part of Your Retirement Plans

While taxes generally fall in retirement, they can still be a significant budget factor.

Darrow Kirkpatrick of Can I Retire Yet has done some really interesting analysis and came to the conclusion that it can often be incredibly important to do a good job of predicting taxes as part of your detailed retirement plan.

He says, “If you make a major mistake [about taxes], you could throw off your retirement calculations by a significant factor. My “One Retirement Number” article showed that for a typical couple in retirement, the effective tax rate fluctuated dramatically — between zero and 23.8% — and there was NO simple single number you could choose to give the correct answer over an entire retirement!

Other estimates suggest that for each 1% error in effective tax rate, you introduce an 8% error in your final savings balance.

It is important that you be able to predict your taxes for the next 20 or 30 years. While not perfect, the NewRetirement Planner attempts to at least calculate a credible estimate for what you will pay in taxes each year, and it is constantly being updated and maintained.

This sophisticated system:

- Automatically estimates your federal and state gross taxable income, deductions, and estimated taxes by year using the latest available tax tables and rates.

- Allows you to set different levels of income throughout retirement to approximate your tax bracket for each year. Additionally, it allows you to specify if annuity and/or pension income should be taxed (at both the federal and state levels).

- Automatically estimates how much of your Social Security income will be considered taxable based on the state you live in and your gross taxable income by year. It also considers work income penalties, as well as spousal and survivor benefits.

- Lets you specify how much of your savings are in different types of taxable and non taxable accounts and it automatically calculates the tax liability (or lack thereof) for each account, as well as tax deduction handling of contributions. And, if you live in a state that doesn’t tax retirement savings withdrawals, the NewRetirement Planner supports that, as well.

- Estimates required minimum distributions (RMDs) from retirement accounts starting at age 72 — a significant lever when it comes to tax liability in retirement.

- Allows you to choose if investment returns on after-tax savings should be treated as long-term capital gains or ordinary income.

- If you are considering a Roth conversion, the calculator will estimate the tax hit in the year of the conversion as well as the benefit down the road when you draw from the Roth account.

- If you are planning on relocating, the system factors that in and uses your new state tax rates for the years following your planned move.

For a full listing of the current tax rules in the system, which are regularly being updated, visit the Assumptions page after logging in.

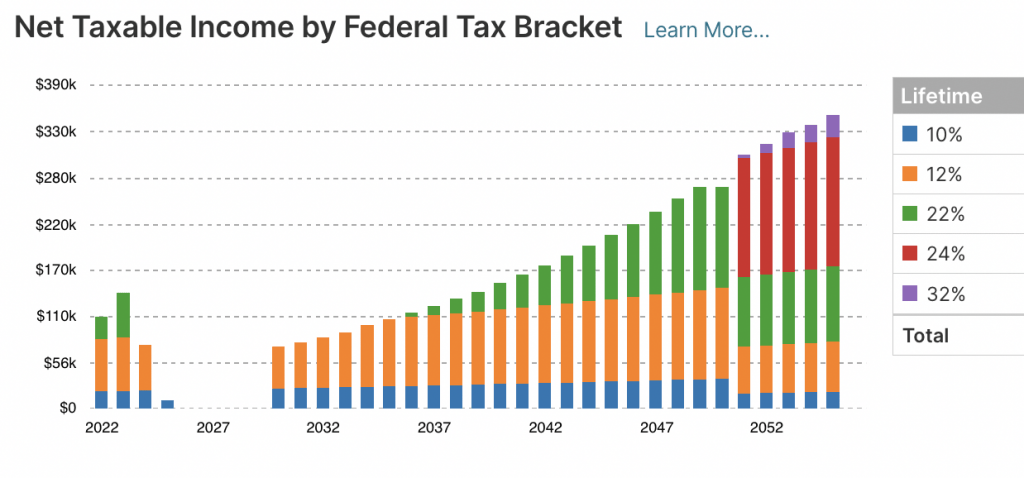

Subscribers to NewRetirement’s PlannerPlus can see 8 detailed charts showing your annual projected estimates for:

- Income taxes (State and federal broken down by federal income tax, state income tax, federal capital gains tax, FICA, and other state taxes)

- Gross taxable income (State and federal by source: work, passive, pension, withdrawals, RMDs, Social Security and realized gains)

- Tax deductions (State and federal tax advantaged savings contributions and standard deductions)

- Net taxable income by state and federal tax brackets

3. Prepare Yourself: Taxes in Retirement Are More Visible

When you are working, income taxes are often taken out of your paycheck. It is an almost invisible expense.

However, when you are retired, taxes are something that you more actively pay, making the bill’s sting more annoying and obvious.

4. Know Your Retirement Tax Rates

In retirement, you may have to estimate your tax bracket. Overestimating and underestimating can both cause problems, so it might be a good idea to seek help from a financial advisor or accountant when estimating. It’s important to understand that even if you know your tax bracket, you might not know how much you will ultimately end up paying in taxes. Estimating your bracket should at least give you some idea of your projected expense.

First, add up your retirement income and determine at what age you will start receiving distributions from your various retirement savings vehicles. Remember that not all your retirement sources will be taxed the same way. For example, a portion of your retirement income might be taxed at a lower rate until you start receiving higher distributions, or some of your income might not be taxable at all.

It’s also crucial to know your tax bracket for estimating how much you’ll pay in capital gains tax on the sale of any investments subject to the tax.

To calculate your estimated tax payments, you can use the worksheet with Form 1040 ES. Estimated tax payments are due each year on April 15th, June 15th, September 15th, and January 15th of the following year.

NOTE: The NewRetirement Planner automates tax estimates and forecasts. Create an account now and learn more about your retirement taxes.

If you are lucky enough to retire early, you’ll want to be careful about withdrawing from your retirement accounts. Traditional retirement savings vehicles like 401(k)s and IRAs enforce a 10% penalty for any withdrawals made before 59.5.

However, there are a few ways around the rules. You may want to learn more about the 72(t) and the rule of 55 – ways to make penalty-free withdrawals from your retirement accounts BEFORE you turn 59.5.

6. Stay Flexible

At this point in your life, you will most likely have several different account types, which may include a brokerage account, a traditional tax-deferred account like an Independent Retirement Account (IRA) or a 401(k), and a Roth IRA in which you can withdraw tax-free, explains Pamela Kornblatt, president of Tax Strategist, LTD, based in New York City.

“Conventional wisdom holds that you should start by drawing on the taxable assets and then move next to the tax deferred vehicles, saving the Roth, which is tax-free, for last,” Kornblatt says. “However it may not necessarily be advantageous to strictly follow this order, and it is in fact ideal to keep assets in each type of account to be able to tap into them throughout your lifetime.”

It’s a good idea to make sure you maintain assets in each of the three types of accounts, Kornblatt explains. “This allows for added flexibility to both help lower your overall tax burden and also spread taxes out over time so you don’t have to pay them all out at once,” she says.

You can see how withdrawals from different accounts are being taxed in the Tax Insights charting in the NewRetirement Planner.

7. Retirement May Be a Good Time to Consult a Tax Expert

The process of trying to figure out where to take funds out of to minimize the impact of taxes is pretty complicated, especially when you throw in Social Security taxes and income from other sources, in some situations. You might need an expert on the topic, Kornblatt points out.

“Every person has a unique tax situation and an advisor can customize an approach to ensure you have enough money to live on in as tax efficient a way as possible,” she says.

NewRetirement offers consultations with a Certified Financial Planner ®. You’ll collaborate with advisor on your NewRetirement Plan with their deep expertise. Schedule a discovery meeting today.

8. You Will Probably Continue to File Taxes with a 1040 and…

Most people file their taxes by using Form 1040. For most retirees, this will stay the same after you retire. The main difference is that you attach Form SSA-1099 to report Social Security benefits. And, if you have a pension, you will use Form 1099-R.

You will also need to report work income, annuities and savings withdrawals.

9. Pay Quarterly to Stay on Top of Retirement Taxes

When you work, taxes are typically withdrawn from every paycheck. These withdrawals help ensure that you do not owe too much or too little in April.

You can request similar withholdings for your pension, Social Security, annuity and other retirement income sources using forms W-4, W-4P and W-4V.

However, if you are not doing automatic with holdings on taxable income, you will probably need to make quarterly tax payments.

The IRS has a very detailed publication that outlines Tax Withholding and Estimated Tax. Or use Form 1040-ES to estimate your payments.

10. Understand the Penalties for Collecting Social Security and Working at the Same Time

Social Security work penalties are not technically a tax, but often thought of as one.

Working as long as possible is a tried and true way to give you are more secure retirement. However, there are definite implications for collecting Social Security and working at the same time.

- If you have reached your “full retirement age,” then you keep all of your Social Security benefits — no matter how much you earn.

- If you are younger than your full retirement age and earn more than certain amounts, then your Social Security benefits will be reduced.

The NewRetirement Planner automatically calculates work penalties if you are planning on starting Social Security before full retirement age. You can learn more from the Social Security Administration, “How Work Affects Your Benefits.”

11. Working for Yourself? Try This

Many retirees start their own businesses. If this is you, did you know that you can deduct the premiums you pay for Medicare Part B and Part D plus the costs of supplemental Medicare or Medicare Advantage?

12. Have Income? Make it Nontaxable!

If you are not yet retired, you certainly have income from work. Already retired? You may have taxable income from withdrawals, passive investments and more.

No matter your retirement status, retirement tax planning often means keeping your taxable income under certain thresholds. To do this, you can take “deductions.” Deductions are a way to turn taxable income into nontaxable income.

Here are a few ways to make your retirement income nontaxable:

So long as your income is below a certain threshold, any money you put into a 401k, 403b or IRA (a traditional IRA, not a Roth IRA) will not be taxed.

Catch up contributions are the IRS’s way of making it easier for savers age 50 and up to tuck away enough retirement savings.

You probably already know that there’s a limit to how much you’re allowed to save in tax-advantaged retirement account such as IRAs and 401(k)s. Well, once you reach age 50, you’re allowed to make additional “catch up” contributions over and above those annual contribution limits.

Funding healthcare is expensive. However, you can make your spending a little more efficient by utilizing an HSA. Money you put in an HSA is deductible up to $3,650 for individuals and $7,300 for families in 2022 – plus an additional $1,000 if you are over 55. Besides the savings being non taxable, distributions from the HSA are also tax free when they are used to pay medical expenses.

If you itemize your deductions, then the interest you pay on some debts — mortgages, student loans and more — is deductible.

Like debt, state and local taxes can be deducted if you itemize.

Charitable contributions of up to 50% of your adjusted gross income are also deductible if you itemize and give to a qualified charity. Your donation can be in the form of money or property.

NOTE: For users of the free Retirement Planner, income taxes are modeled using a blended state and federal rate. For PlannerPlus subscribers, the income tax model is more accurate, detailed and transparent. You can:

- See annual estimates for federal, state and capital gains taxes

- Review annual taxable income and realized capital gains

- Specify itemized deductions and property taxes.

Create an account or log in today for a detailed and reliable view of your retirement finances — now and well into the future.

13. Even Social Security Can Be Taxed

Social Security benefits are taxed only if your income exceeds a certain threshold.

Income for federal taxes is defined as half your Social Security benefits, plus all other taxable income and some nontaxable income including municipal bond interest.

You also need to know your state’s rules on taxing Social Security benefits if you live in one of the 13 states that do (Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia).

Let NewRetirement show you your projected tax burden for this year and evermore.

14. Consider Bundling Medical and Charitable Deductions into Certain Years

Because the threshold for deductions on medical expenses and charitable donations is higher, you may want to consider bundling those expenses into certain years and only claiming them every two or three years.

For example:

By grouping as many medical expenses as possible in a single year, you can maximize the deduction you get for those expenses. In 2022 you can only deduct expenses which exceed 7.5% of your 2021 adjusted gross income.

If you’ve already had some significant healthcare expenses for the year, see if you can move medical expenses that you’d normally take next year to the end of this one. For example, if you have a dentist appointment in January, move it to mid-December instead.

If you recently purchased long term care insurance, you may be able to deduct the premiums. The older you are, the more you can deduct. In 2022, the deductions range from $450 for those under 40 to $5,640 if you are over 70.

Instead of making annual charitable gifts, give 2, 3, or even 5 years’ worth of donations in a single year, then take a few years off.

Focusing all of your donations in a single year increases the value of deductions beyond threshold for a single year, and then take the larger standard deduction in the “skip” years.

A Donor-Advised Fund (DAF) may be an option if you are bundling charitable expenses. Per Fidelity, “A DAF may allow for tax-deductible contributions of cash or appreciated assets in a given year, but then control the timing of the distributions to charity in future years.” This is probably a strategy you will want to discuss with a financial advisor.

15. Watch Out for Lump Sum Benefits

If you are planning on getting a lump sum payment from a pension or other source, you could be facing a big tax headache. The company paying your benefit is required — by law — to withhold 20% of the money for taxes. (You can likely recover the taxes, but it is complicated and the lump sum distribution can trigger all kind of annoyances and the very real possibility of penalties.)

You may be able to avoid the problem if you ask your employer to deposit your pension directly into a rollover IRA. The check can not be made out to you, it must be transferred directly into the IRA account.

16. Monitor Medicare Surtax for High Earners

A Medicare surtax will apply to the lesser of net investment income or the excess of modified adjusted gross income over $200,000 for single taxpayers and $250,000 for married couples filing jointly.

So, it may be worth keeping your income levels below these thresholds.

NOTE: The NewRetirement Planner factors in these additional costs, when applicable.

17. Your Retirement Savings and Taxes

When you finally leave the workforce for good, you may start relying on your savings for your income. Depending on what kind of savings or investment accounts you have, your tax obligations may vary.

- If you’ve invested in an Individual Retirement Account (IRA), your savings are tax deferred, but you will have to pay once you start taking distributions — when you withdraw the money.

- If you have money in a Roth IRA, then you paid taxes when you invested the money and all withdrawals are tax free.

18. Are You Older than 70 and Still Working? Do a Reverse Rollover…

A reverse rollover — transferring funds from an IRA into your company 401k or 403b program — is an interesting tax strategy if you:

- Have money in an IRA account that will be subject to Required Minimum Distributions

- Do not NEED or want to withdraw funds from your IRA accounts

- Have access to a 401k or 403b program where you are currently working

Learn more about other ways to reduce the impact of Required Minimum Distributions.

19. Strategize for a Roth IRA

It can be a bit of a game to figure out how to save the most money on taxes with regards to IRAs, 401ks and Roth IRAs.

There are multiple strategic decisions to make:

You have options for saving your money. You can avoid taxes up front and save in a traditional IRA or 401k, paying taxes when you withdraw funds (when you may be in a lower tax bracket). Or, you can pay taxes now, but avoid paying taxes on your gains if you save in a Roth account.

- Money in a traditional 401k or IRA grows tax deferred, meaning that you pay taxes on the money when you withdraw the funds (and no taxes at all when you invest the money).

- Money in a Roth account grows tax free. Contributions to this account are made with after-tax earnings, but you owe zero taxes when you withdraw the funds — no matter how much the account has grown. (Another difference is that Roth IRAs do not have Required Minimum Distributions (RMD), although Roth 401ks do.)

If you have savings in a traditional retirement account, you may want to strategically convert some of that money into a Roth account.

A Roth conversion is when you take money from your traditional IRA or 401k and convert it into a Roth account. The downside is that you must pay taxes on the money you convert. The good news? All future growth in the Roth account can be withdrawn tax free.

Knowing when to do a conversion can be confusing. You need to calculate current and future tax brackets, rates of return, withdrawal needs, and more…

Explore 5 circumstances where a Roth conversion might be a good idea.

Or, try the Roth Conversion Explorer. The Explorer is Part of NewRetirement’s PlannerPlus. The tool helps eliminate the guess work of if and when you should do conversions. The Explorer will use your plan and run thousands of scenarios to identify personalized strategies for you to convert your retirement money.

20. Taxes After Retirement: Plan for Required Minimum Distributions

According to the IRS, a required minimum distribution is the minimum amount you must withdraw from your tax advantaged savings accounts each year.

You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA or other retirement plan account when you reach age 72 (Unless you turned 70 1/2 in 2019 or earlier. In that case, withdrawals started at 70 1/2.). Roth IRAs do not require withdrawals until after the death of the owner.

You must also make minimum withdrawals from your 401k by age 72 (unless you turned 70 1/2 in 2019 or earlier) or when you retire.

If you do not make these withdrawals, the IRS will assess a rather large penalty of 50% of the amount that should have been withdrawn.

The IRS has more information on Required Minimum Distributions (RMDs).

The NewRetirement Planner automatically makes these withdrawals in your plan and will remind you when it is time for you to do it in real life.

21. Thinking of Relocating? Consider the Best States to Retire in for Taxes!

Most of the wisdom shared above is most relevant to federal taxes. However, state taxes can take a big bite out of your retirement nest egg as well.

If you are considering relocating for retirement, you might as well look at states that have the most favorable tax rates for retirees. These 10 locations are the best states to retire in for taxes.

The NewRetirement Planner estimates your states taxes based on where you live — now and in the future.

22. Don’t Forget Estate Taxes

Federal estate taxes are really only a concern of the very rich. Estate taxes don’t kick in until your estate is worth more than $11 million (twice that for married couples).

However, state estate taxes can be concerning, depending on where you live. Learn more about estate taxes.

23. Try Tax Loss Harvesting

If you sell investments that aren’t tucked away in a tax-advantaged retirement account, you’ll have to pay capital gains taxes on the profits you made from those investments. However, if you sold any investments at a loss during the same year, you can wipe out those gains for tax purposes and avoid paying the related taxes.

This approach is known as tax loss harvesting.

Tax loss harvesting allows you to get rid of your loser investments while profiting a little from the transaction. In fact, if you have more losses than gains, you can use the extra losses to erase up to $3,000 of other taxable income (including the distributions from your traditional IRAs).

24. Taxes Are Critical, But Your Overall Retirement Plan is More Important

Taxes can be a burden, but they are just one of hundreds of expenses we all contend with.

Having a well documented overall retirement plan is probably more important to your overall financial well being than the details of taxes. The NewRetirement Retirement Planner lets you plan for retirement from now till your forever. You can set different levels of income, different levels of expenses, explore using home equity to help fund retirement and so much more.

This Retirement Planner is easy to use and gives you control over hundreds of different levers so you can discover a retirement plan that suits your desired lifestyle and means.

Ladies and gentlemen, I am happy to announce that it’s that time of year again! That’s right. It’s time…

Copyright © 2024 Retiring & Happy. All rights reserved.