Planning Retirement in an Uncertain Economy: How Much Should You Adjust Your Plans?

Historically, the stock market trends upward. However, there are periods of time (some longer than others) when the market is down. Right now, markets are down and, to complicate matters, inflation is up. This combination makes for a particularly scary time to be planning retirement. If you do take the leap and quit work, do you need to adjust your plans given the current economic conditions?

Many people are finding that while their projections may have suggested a secure retirement 3 months ago, things have changed enough that their future solvency is no longer quite so assured.

You may have been maintaining a comprehensive retirement plan that showed that retirement would be smooth sailing, and suddenly, over the last couple of months, your financial outlook is murkier. Should you still retire? Do you need to reconfigure your plans? Is your plan accurate anymore?

Here are 9 tips for getting answers and navigating toward retirement in an uncertain economy:

1. Assess Your Assumptions (Think Long Term Average, Not Highs and Lows)

When you are managing a long term financial plan, you want to use a long term average for your assumptions. Assumptions are all of the variables in your plan that you can’t really control: inflation rate, rate of return, asset appreciation (or depreciation), etc…

Let’s take inflation for an example. Inflation is currently at around 7-8% or higher (depending on which index you use). However, the long term average inflation rate (from 1913 to now) is around 3.10%. And, for the last 20 years, average inflation has been 2.24%.

When running projections for your future financial security, you probably don’t want to use an 8% inflation rate. It is unlikely that inflation will stay that high for your entire retirement. However, because things are relatively uncertain right now, you might not want to use a number as low as 2 or 3%. It may be a good idea to adjust those long term averages up slightly given the uncertainty, especially if you wish to conservatively estimate your financial security.

To help reassure yourself that you can weather any financial storm, it is also a good idea to run worst case scenarios. What does your future financial security look like if stock returns remain low and inflation high?

What adjustments can you make to your plans to compensate for a worst case (or less than best case) scenario?

Many people go into retirement with a plan for withdrawing a fixed percentage from their savings every year for the rest of their life. This is referred to as a fixed percentage withdrawal and many people think of it as “the 4% rule.” (Four percent was once the recommended rule of thumb for withdrawal rate, but this recommendation is now widely questioned. And, your ideal withdrawal rate should be driven by the particulars of your financial situation, not a rule of thumb.)

That being said, numerous analyses have shown that you can now withdraw around 3% from your retirement funds a year, even when starting in a down market can sustain you if the allocation is correct – a diversified portfolio that includes cash and cash equivalents. Barron’s recommends 3.3%. (Again, your ideal percentage should be based on your financial profile.)

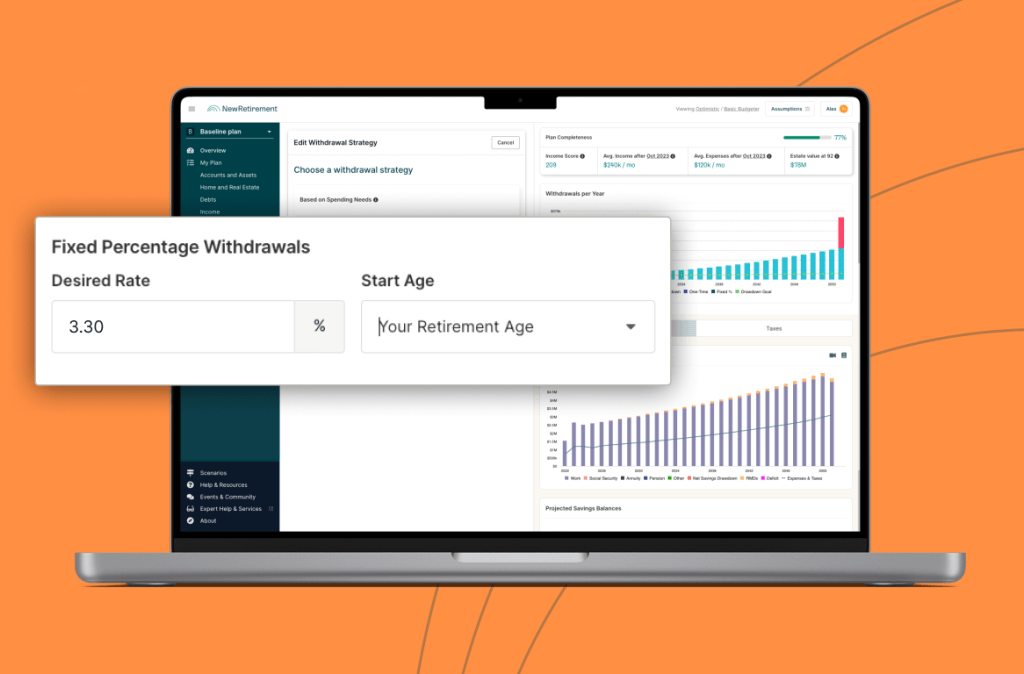

You can see what withdrawal rate works for you, given different market conditions, by using the withdrawal tool in the NewRetirement Planner.

Select edit withdrawal strategy on the Money Flows page, then you:

- Set your desired withdrawal rate and start age for withdrawals.

- The plan will draw down your assets based upon the portfolio balance in the year selected by your desired percent.

- The drawdown will include an annual increase by the rate of inflation you’ve modeled.

- Try different rates

- Assess your net worth at longevity and cash flow to find a withdrawal rate that makes sense for the assumptions you are projecting.

Explore 18 different retirement income strategies.

Ideally, when you retire, you have 1-5 years of money in a cash account so that you don’t have tap investments when they are down. Cash allows you to fund expenses without liquidating assets in down years.

Recently on the private NewRetirement Facebook Group, Meg asked for advice about how to overcome all the worry she felt about the prospect of withdrawing funds and retiring in fraught economic times. She got a lot of wise advice.

David (and many others) applauded Meg for having emergency cash available so that she didn’t have to take withdrawals. He wrote, “People get worried at the opportunity cost of having five years in cash but I view it as a gain since you are avoiding losses so it ends up being the same thing as a gain.”

He continued, “Bottom line, in retirement, as long as you have a good five years to live on, you have set yourself up.”

Ideally, you are able to live on cash until the market recovers at which point, you can sell stocks at a profit and replenish your cash accounts. And, stay prepared for uncertainty.

Having cash available to avoid selling investments at a loss is part of a bucket strategy.

Brad described his bucket strategy: “If you are 100% in stocks when you are retired you are going to have to sell when the markets are off their top some times and loose out on possible future profits. If you are ok with that then that works for you. I use my bucket system. Bucket 1 is 12-36 months in cash. Bucket 2 is my bonds for long term down time in the stock market such as now. So, I pull from this bucket to replace my cash. Bucket 3 is my stocks which I skim profits from when they are high to refill bucket number 1.”

Not everyone has the financial planning insight to hold cash. If this is you, don’t rush to liquidate investments at a loss quite yet.

Here are some emergency money alternatives to consider. However, if you own your home, your best bet may be to consider tapping your home equity.

Your home is probably your most valuable asset, especially with home values at all time highs right now in many areas of the country.

A home equity line of credit is a loan where you are borrowing against any equity you have built up in your home.

Tapping your home equity through a home equity line of credit may be the most efficient loan available to you especially if you have a fair amount of equity in your home, only require a small loan, have a decent credit rating and will be able to pay it back.

Use the NewRetirement Planner to assess the pros and cons of tapping your home equity. Run scenarios that compare a home equity loan to selling investments at a loss.

Henry recommended, “If you are using cash and will have little or low other income this year, have you considered converting some of the pre-tax IRA to Roth? The tax rate on the converted amount would be low, or even zero depending on other income and amount converted. “

David agrees, he wrote: “I tell people the secret to success in retirement is that I will never a down year. What I mean is this, when the market goes up, you sell at the top knowing that are living at the high so you have no losses. When the market goes down, you move your portfolio from your pre-tax acounts into your Roth and then the gains get shifted from your IRA / 401k to Roth and then you don’t have any taxes to worry about for your future withdrawals.”

Learn more about Roth conversions. Or, explore mistakes people often make with Roth.

A lifetime annuity is an insurance product that guarantees income. When you purchase an annuity, you are exchanging a lump sum of money for a monthly paycheck for a specified period of time or for your lifetime.

Annuities are good for people who value guaranteed income over the possibility of financial gain.

Explore the pros and cons of annuities. Or, see how much income you can buy with the lifetime annuity calculator. Better yet, try out an annuity in the context of your overall financial plan: model an annuity in the NewRetirement Planner.

If you are worried about your future financial security, make sure that you have the proper asset allocation to sustain you through whatever the future holds. Understanding what could happen and organizing your assets to accommodate different scenarios is a sure way to feeling peace of mind about your money.

You need a well diversified portfolio and a solid income plan.

The NewRetirement Planner can help you get organized and see opportunities. Many people also benefit from professional financial advice, especially when it comes to asset allocation. NewRetirement offers collaboration with a fee-only fiduciary Certified Financial Planner®. Sign up for a free discovery session to discuss your needs.

The NewRetirement Planner puts financial wellness in your hands.

Study after study has shown that when you build and maintain a holistic financial plan, you make better decisions, develop positive financial habits, and experience better financial outcomes.

If you want to retire now or in 30 years, these tools will help you discover strategies to achieve your goals and the peace of mind you need to live the life you want.

Lawrence wrote, “The economy is beyond your control. Can’t be consumed by it and worry otherwise you might cut your retirement short. Do your best and enjoy it.”

Darol reminded people to set a plan and then focus on what is important to you. He wrote, “What is the PURPOSE of your wealth? What is the purpose of your money? It is a hard question to answer.”

Explore:

The specifics of the packing list for the Camino de Santiago don’t matter as much as the main idea:…

Copyright © 2024 Retiring & Happy. All rights reserved.