Buy This, Not That: Showing Up Is More Than Half The Battle

Hey everyone! Today, we have a guest post from Sam Dogan aka. Financial Samurai. I am chilling in the Maldives and I can’t get any work done. Fortunately, Sam offered to write a guest post for Retire by 40 and sent me his new book to review. I’m about halfway through Buy This, Not That and it is the best book on Financial Independence I’ve ever read. Sam will show you how to achieve financial independence and stay there. I’ve read many books on financial independence, but they all seem a bit outdated. Buy This, Not That is 100% applicable for us today. It’s really good. Check it out if you haven’t read it yet. Sam, take it away!

One of the reasons why I like to follow Retire By 40 is because Joe and I actually have pretty similar backgrounds. He’s an Asian guy. I’m an Asian guy. He has a son. I have a son. We both retired in 2012 and we both run personal finance sites.

The main difference between us is that I consider myself a fake retiree. After all, these posts don’t write themselves! After 10 years of not having a day job, I’ve come to realize I always need to be doing something challenging. Perhaps part of it is because my wife also doesn’t have a day job and we’ve got two young kids.

Once my son was born in 2017, it seemed like my DNA kicked in where I had to step it up. There was no more leisure lifestyle as a stay at home dad who enjoyed writing online. Instead, I felt like I needed to make more active income and passive income to provide.

Without the safety net of employment, it’s been hard to completely let go. As a result, I’ve always been open to new challenges and opportunities.

The Opportunity To Write A New Personal Finance Book During COVID

When an editor at Portfolio Penguin approached me at the end of 2019 to write a book, I was intrigued. I didn’t want to write a book given our daughter was just born in December 2019. The 4th trimester is generally the hardest period to raise a child. Further, we also had a rambunctious 2.5-year-old to care for as well.

However, back in 2012-2013, I tried my best to get a literary agent with no luck. Therefore, for an editor from a reputable publishing house to offer me a book deal felt too hard to turn down. I knew if I didn’t accept the offer, I would look back with regret.

When the COVID lockdowns began in March 2020, life got real tough real quick for stay at home parents. Signing a book deal was essentially like taking on a full-time job again along with my writing on Financial Samurai. I was overwhelmed and constantly felt under pressure.

But the great thing about hard work is that it doesn’t last forever. Two and a half years later on July 19, 2022, I published, Buy This, Not That: How To Spend Your Way To Wealth And Freedom.

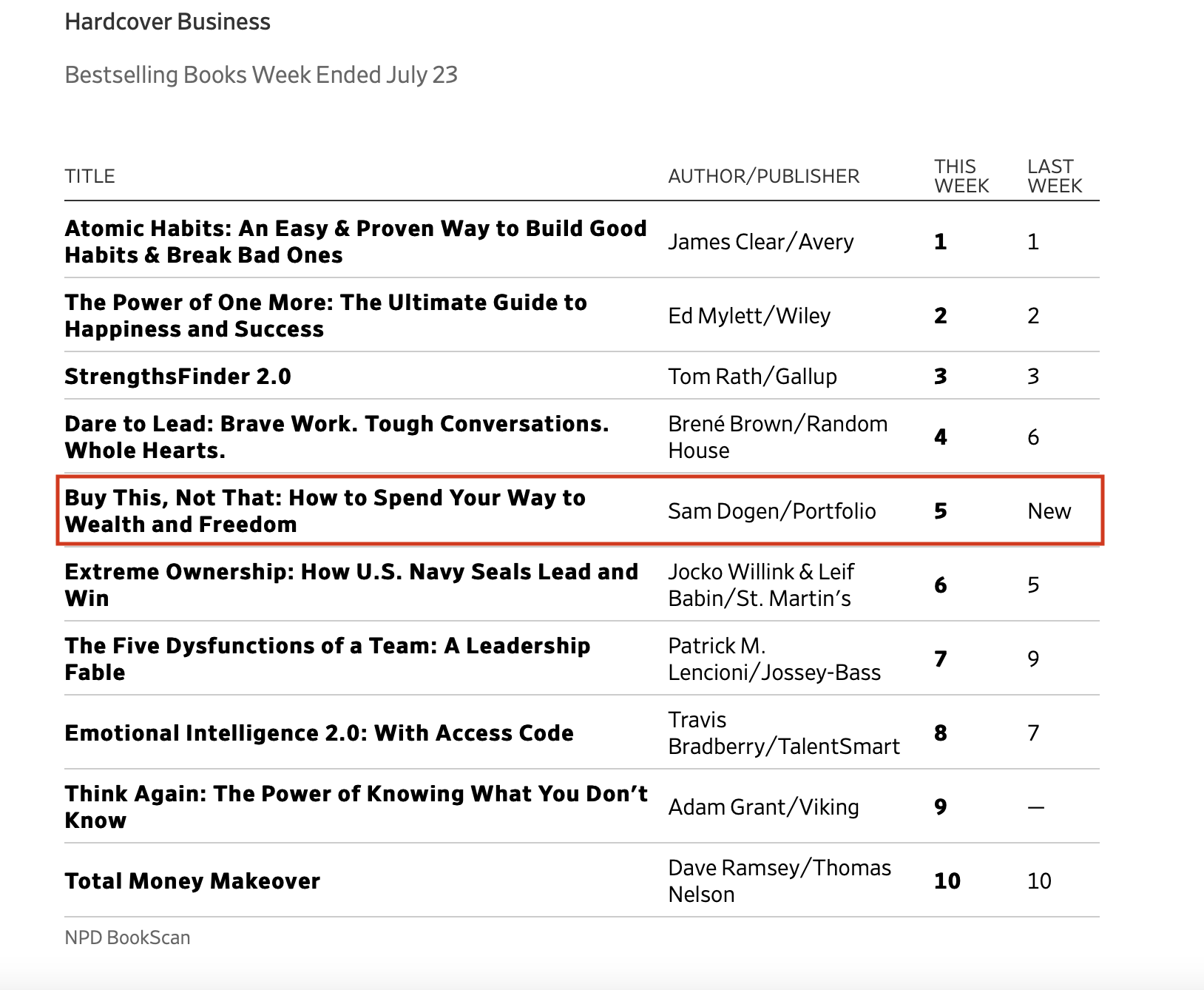

The book became an instant Wall Street Journal Bestseller and #1 Bestseller on Amazon. In a sea of established book authors, it was fun to break the status quo.

What’s unique about the book is that it not only helps you build wealth sooner, it also tackles some of life’s most common dilemmas. These include:

- Pay for private school or public school

- Join a startup or work for an established company

- Job hop or stay a loyal soldier

- Live in an expensive coastal city or move to a low-cost area

- Invest in real estate or stocks

- When to rent or buy

- When to invest in tax-advantaged versus taxable accounts

- Angel invest or don’t

- Dividend stocks or growth stocks

- Buy a fixer or a fully remodeled home

- Marry or cohabitate

- Marry for love or marry for money

- Have children early or late

- Return to work or be a stay-at-home-parent

- Combine your finances or keep separate accounts

- Get a divorce or stay married

- Seek fame or stay low key

- Buy or lease a car

- Keep The Bank Of Mom And Dad open or closed for your adult children

At the end of the day, money is only a means to an end. We want to live better lifestyles with the money we have. Instead of hoarding our wealth, we should find ways to strategically spend to live a richer and more purposeful life.

Live Life With No Regrets

Buy This, Not That isn’t only about optimizing your choices; it’s also about optimizing your attitude. Although life was harder than it had to be with the writing of the book during COVID, I have no regrets. Here is an excerpt of the book’s introduction.

I came to America with my family from Kuala Lumpur. I was born in Manila while my parents, who worked for the U.S. Foreign Service, were stationed there. We lived in Zambia, the Philippines, Virginia, Japan, Taiwan, and Malaysia, in that order, before coming to northern Virginia when I was fourteen years old. At the time, only about 6% of the population in our town looked like me. It was quite a shock going from being a part of the majority to being a minority.

I had to start over and find new friends while also navigating encounters with bullying and racism. I was also a misfit who lacked the ability to think quickly because my mind constantly bounced between English and Mandarin. My grades and SAT scores were unremarkable too.

I knew my parents weren’t rich. They drove beaters and frowned on ordering any drink other than water when we went out to eat. We lived in a modest townhouse in a grungier part of town. I never had a Nintendo. My Air Jordans were hand-me-downs from a friend and two sizes too large. We weren’t poor, but we never had more than what we truly needed.

Get On The Damn Bus

After high school, I attended William & Mary, a public university in Williamsburg, Virginia. We couldn’t afford a higher-priced school, and I wasn’t smart enough or athletic enough to get scholarships. I did well enough at William & Mary, but that’s not how I ended up getting a job at Goldman Sachs after college. The only reason I got a job at Goldman Sachs was because I got on a 6:00 a.m. bus one chilly Saturday morning.

The bus was heading from college to a career fair two hours away in Washington, D.C. Twenty other students signed up to attend, but I was the only person who showed up. After waiting over an hour for the no-shows, the bus driver took me to his company’s headquarters, swapped out the bus for a black Lincoln Town car, and personally chauffeured me to the fair. This was the first time I realized that just showing up is more than half the battle.

Seven months, six rounds, and fifty-five interviews later, I finally got the job at One New York Plaza, Goldman’s equities headquarters. All because I showed up and stuck with it.

Never in my wildest dreams did I imagine I could leave the corporate grind at age thirty-four to focus on my life’s passions. But thanks to Financial Samurai and my investing efforts, I’m now forty-five and financially free to spend time with my wife and two kids, and to work on the things I love.

One saying keeps me going whenever things are hard and I feel like making excuses: “Never fail due to a lack of effort, because effort requires no skill.” I can fail because the competition was too good, or because an unforeseen event knocked me off my feet. But if I fail because I just didn’t try hard enough, I know I’ll be filled with regret as an old man.

Grit, consistency, and confidence are the most important attributes for achieving your goals. Don’t think you need to have special skills, innate talent, or rich parents to get ahead. Who you are is good enough already.

I truly believe Buy This, Not That will be one of the best personal finance books because it goes deep into each subject matter. It also provides you the courage to make optimal decisions when faced with a big dilemma. Pick up a copy at Amazon, Barnes & Noble, or anywhere that sells books.

Thank You!

– Sam

Passive income is the key to early retirement. This year, Joe is investing in commercial real estate with CrowdStreet. They have many projects across the USA so check them out!

Joe also highly recommends Personal Capital for DIY investors. They have many useful tools that will help you reach financial independence.

Latest posts by retirebyforty (see all)

Ladies and gentlemen, I am happy to announce that it’s that time of year again! That’s right. It’s time…

Copyright © 2024 Retiring & Happy. All rights reserved.