How Much Money Do You Need to Retire?

A common question among readers of this blog is “How Much Money Do I Need to Retire?”. In fact, for many people that is the question they are trying to answer when they ask “Can I Retire Yet?”.

Bill Bengen was a financial planner trying to answer that question for his clients. He published research in the Journal of Financial Planning in October 1994 that revolutionized retirement planning. Bengen’s research showed that 4% is the maximum safe withdrawal rate (SWR) when initiating withdrawals from a retirement portfolio.

In the three decades since, this has been an area of ongoing research and debate. Is 4% too high or too low of a SWR? How does SWR research apply to longer time frames for those pursuing early retirement?

These are important questions as we plan for retirement. But is all of the ongoing research and debate making us lose sight of a more important question?

Finding the Right Safe Withdrawal Rate

Current research continues to focus on determining what the safe withdrawal rate is given prevailing conditions. The consensus among leading researchers, at least through the end of 2021 when we had a combination of abnormally high stock valuations and low interest rates, was that a 4% withdrawal rate was not sustainable. It was likely too high.

Examples from this camp include leading retirement researcher Wade Pfau. His voice was among the first I heard challenging the 4% rule based on his research using non-US stock and bond returns. He became more vocal in his objections as interest rates fell and stock values grew.

Karsten Jeske has been a critic of the 4% rule for those pursuing FIRE. He’s shown that longevity risk increases when you apply this rule to longer retirement time horizons. A study published by Morningstar opined that even for traditional retirees, 4% was likely too aggressive given conditions in 2021.

However, not everyone agrees with these sentiments. A vocal dissenter is Bill Bengen, the same person who introduced the 4% rule decades earlier. In an interview with Michael Kitces, Bengen emphasized that in his original research he was looking for the absolute worst case scenario. He opined 4% is likely far too conservative most of the time. He has not wavered in that position, even in the face of recent high inflation and challenging market conditions.

It is worth stepping back to ask an important question. Why is so much time and energy spent researching and debating safe withdrawal rates?

Related: My Retirement Flexibility Scale for Choosing Your Safe Withdrawal Rate

Solve For X

The idea behind safe withdrawal rates is that they enable you to know how much you can safely spend from a retirement portfolio. Safety is defined as having little to no chance of outliving your portfolio.

Simply multiply your initial portfolio value by the safe withdrawal rate to determine your initial annual withdrawal. In equation form it looks like this:

Initial Portfolio Value X SWR = Initial Annual Spend

From this three variable equation, if you know any two of the variables you can determine the third. So determining how much money you need to retire, is a matter of shifting the equation around like this:

Required Initial Portfolio Value = Initial Annual Spend/SWR

If you can determine both your annual spending and the SWR with confidence, then you can determine how much money you need to retire.

How much money do I need to retire? This profoundly important question can be boiled down to simple math. You just plug in those two known variables and solve for X.

Solve For “You”

Here lies the problem with this entire approach. We have intelligent individuals with professional credentials, PhDs, and teams of researchers going through immense amounts of data. The idea behind their research is that the hard part is figuring out the relationship between market returns, interest rates, and inflation to determine the correct SWR.

This assumes we know who we are and what our wants and needs are now. It also assumes that our wants and needs will stay, or at least cost, the same over the course of our retirement, adjusted only to match the general rate of inflation. For traditional retirees, that time frame may be 30 years or more. For a FIRE type of retiree, we may be talking about 50+ years!

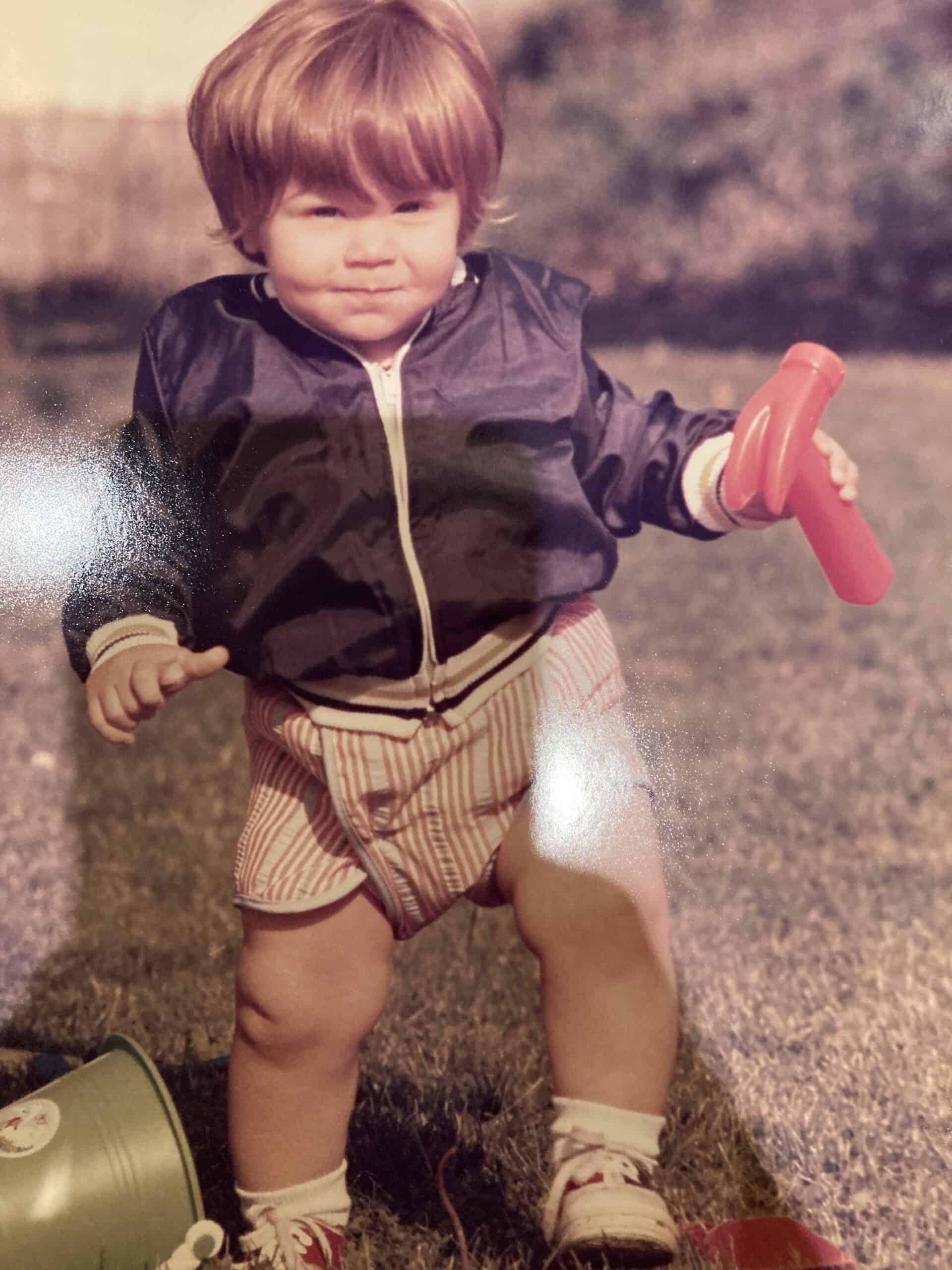

When I think about my own retirement, I like to consider this handsome little fellow.

That is a picture of me at two years of age. I am now 46 years old. That is a difference of 44 years.

When I run simulations in one of my favorite retirement calculators, I always assume I will live at least until age 90. That is another 44 years.

As I look at that picture, I know it is me. That little guy and I share the same name, birthdate, Social Security number, and DNA.

Yet, even beyond the physical growth and aging, I don’t see that person having much in common with the me of today. Why would I assume that who I am won’t change at least as much in the ensuing four plus decades?

This got me thinking and reading about how we change as we age.

Life’s Two Halves

There is a body of literature exploring this topic. A number of books break our lives into two halves. These books have common themes. One is that it is almost as though we are entirely different people in the first and second halves of life.

The first half of life is driven by ego. We pursue worldly signs of success, accumulating status, titles, power, money, and possessions. We need to break away from our original families and forge our own identities.

The second half of life is characterized by a search for deeper meaning. Common themes of the second half are an increased focus on relationships, service to others, and purpose. This stage of life is characterized by maturity and wisdom.

It is important to understand that the word halves is used conceptually. We all know young people who seem mature beyond their years. Others never do the inner work required to make this transition and seem perpetually trapped in the first half.

As I learned about this concept, I couldn’t help but see the connection to conversations I’ve had with others in the pursuit of financial independence. There tends to be a rejection of the first half of life ideals and an embracing of those associated with the second half.

These topics deserve more of our time and attention. If you are interested in diving deeper I recommend three books to get started:

We’re Constantly Changing

While there is overlap between the concepts of life’s two halves and the pursuit of financial independence, they don’t match perfectly. You certainly don’t magically become a “second half of life” person once you hit a number on a spreadsheet or leave your job.

Many times we embrace the second half of life concepts after a major life event, be it positive or traumatic. Often we become disillusioned with what society suggests we should value. These events don’t necessarily coincide with our financial position at that time.

We may start embracing second half of life concepts, but still have to devote much of our life to working a job to pay the bills. Or we may accept second half of life principles long after achieving financial independence…. or never embrace them at all.

Another challenge is that for most of us there isn’t a clear line of demarcation between the first half and second half of life. Instead, we are constantly growing, changing, learning, and evolving throughout our lives.

Some of you may feel certain that you have put a lot of thought into what is important to you and have aligned your life with that. Maybe you have.

Even if you have found happiness and contentment now, things around us change. They include but are not limited to:

- Health/ Aging

- Relationships

- Neighborhoods, states, and even nations

- Laws

- Economic environments

This summer, I had the opportunity to discuss my personal evolution at a CampFI event. My life’s direction has taken several radical shifts, none of which I would have predicted. Understanding that the future is unknown impacts how we plan for it.

You can watch an edited version of the talk here:

What to Do?

We are all changing as we go through life. This adds an additional element of uncertainty to retirement planning.

This personal aspect of the calculus doesn’t get the same attention from researchers that the hard numbers that drive safe withdrawal rates do. That doesn’t mean that predicting who we will become, what we will want, and what future versions of our lives will cost is any less challenging than predicting future market returns, interest rates, or inflation.

We all want certainty. Unfortunately, I can’t provide any.

I can provide some observations from reflections on my own life and conversations with many other people. I can also share an exercise and mental framework I’ve found helpful in my own planning.

Understand What Matters

I have observed persistent patterns across periods of radical changes in my own life, talking to others of diverse backgrounds, and studying what adds meaning to people’s lives. There is a consistent pattern of what is important, in order from most to least:

- Relationships

- Experiences

- Things

Plan accordingly.

Get Personal

As you try to “solve for you” it is important to reflect on who you are. While I’ve changed significantly throughout my life, upon reflection I’ve been able to identify a few constants across time. Here are a few prompts to help you do the same.

I am most happy when I’m….

I feel most fulfilled when I’m….

My answers were:

- Doing hard things

- Outdoors

- With people I love

- In service to others

Once you identify the specific things that are most important to you, think about how that may manifest in the future and build the time and financial capacity into your plans to accommodate them.

Be Humble and Flexible

Predicting the future is impossible. Acknowledge this fact and make it a part of your planning.

At each step of my journey, I have been grateful that I have been able to change, grow, and take advantage of new opportunities as they presented themself. This was a direct result of my growing financial freedom and the personal freedom it provided.

As I approached financial independence and early retirement, I was careful to take a path that continued to allow for future growth and that could accommodate an unknowable future.

Related: Redefining Retirement

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

In this New Retirement Podcast episode, host Steve Chen and guest Dr. Jordan Hutchison, Vice President of Technology for…

Copyright © 2024 Retiring & Happy. All rights reserved.