Are We Spending Too Much?

Perception is reality. When two people have a different perspective, their versions of the same reality can look quite different.

Kim is the detail person with our household finances. She’s the one paying the bills and tracking our expenses. Recently, she expressed concern that we are spending too much. Our annual expenses increased by 21% in 2022 compared to 2021.

I am the big picture person in our house. I manage our tax planning and investments, including tracking portfolio inflows and outflows. Despite our portfolio value dropping by 14.2% in 2022, I had no concern about our finances, including our spending. We were net savers, adding more new dollars to our savings and investments than we took from them over the course of last year.

I shared my perspective with Kim that we are continuing to spend too little, or conversely earning more than we need. We need to reassess if we are spending our time and money in the ways we truly want. If not, we should be working less and/or spending more.

So who is right? How do you determine if you’re spending too much, or too little, after achieving financial independence? Is there a correct amount we “should” be spending?

Historical Perspective — Where is the Money Going?

When we discovered FIRE and started considering major life changes, we started closely monitoring our expenses and investment values. We wanted to better understand how much we spent and whether we had enough to cover those expenses if we were not working and earning.

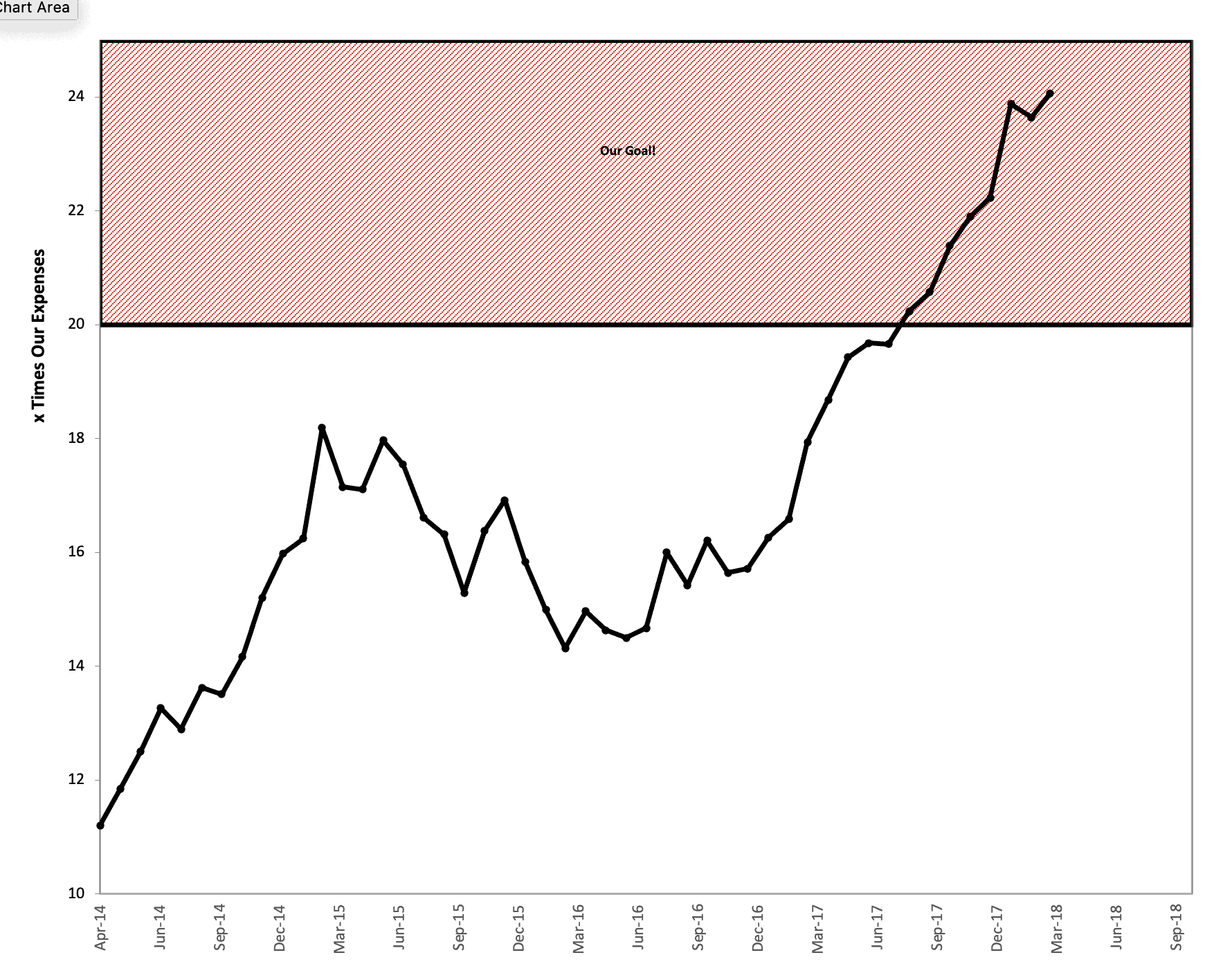

Kim created a graph plotting our monthly progress towards financial independence. She tracked our portfolio value as a multiple of our rolling average of annual spending. I shared this information monthly on my original blog as we tracked our progress.

Over the past few years, we’ve stopped monitoring our numbers so closely. Frankly, we spend very little time thinking or talking about money. I consider that a luxury. We’ve mastered the big things with our finances, so we no longer need to sweat the little things.

Out of habit, we each have continued to maintain the data every month, Kim on the spending side and me on the investing side. This data was helpful to reconcile the discrepancy in our points of view regarding how we are doing financially.

I first looked to see where our money went by comparing it to our spending from previous years. Are there any major trends that should concern us? Are there actions we should be taking?

I found that most of our increased spending could be broken down into three categories: inflation, fun, and health care expenses.

General Inflation

Inflation was all over the news in 2022. I assumed that a good portion of our increased spending was a result.

The Consumer Price Index (CPI) is the U.S. Bureau of Labor Statistics (BLS) official measure of inflation. The reported CPI for 2022 was 6.5%.

Surely we are better than average I naively assumed. I’m a “personal finance expert.”

Yet, the numbers told a different story. Our personal rate of inflation for the year was 21% and I wasn’t even aware! How was that even possible?

Groceries

One area where our personal rate of inflation was much higher than the CPI was groceries. Inflation in food prices, reported by the BLS at 10.4%, exceeded the general CPI. Our personal inflation in grocery spending was 19% year over year. Ouch!

This is somewhat concerning because groceries make up nearly 20% of our total household spending. We enjoy cooking and eat the vast majority of our meals at home.

We don’t have any desire to change the way we eat. So there’s not much for us to do here other than take note of what we are spending and figure out how to pay these expenses moving forward.

Property taxes

Another area where our personal rate of inflation far exceeded the CPI was property taxes. Our property taxes increased by another 28% in 2022 compared to 2021. They have now more than doubled since we purchased our house in summer 2017.

Fortunately, we bought far less house than we could “afford” and we live in an area with relatively low property taxes. Even with the increase, our property taxes represent only 4% of our total annual spending, so luckily it is not a major concern as we love where we live.

This rapid increase in property taxes is notable. We moved here from an area with little property value appreciation, and subsequently stable property taxes. In our new area, real estate prices are increasing rapidly.

Appreciating real estate prices are generally looked upon favorably by people who see their net worth rising. However, this is a phenomenon realized only on paper or a computer screen.

There is little benefit of your home value going up, other than being able to borrow against it, until it comes time to sell. Even then, it is no benefit if you need to buy another home and all the other properties are increasing at the same rate. You only benefit if your property value has gone up and you can buy something that has not increased as much.

Related: Using Domestic Geoarbitrage to Retire Sooner

In contrast, the cost of increasing property taxes is real. We feel those costs every year when that bill comes due.

Utilities, Gas, and Insurance

Most conversations about inflation assume that your personal costs are reflective of the general CPI. This was mostly the case for our insurance, utilities, car, and home maintenance with three notable exceptions.

Our gasoline expenses increased by 48% year over year. At first glance that number is eye popping. However, we’ve built a lifestyle that involves very little driving.

Our 2022 number represents just 2% of our annual spending. I anticipate with gas prices coming back down, it will be closer to 1% of our spending again this year.

Virtually all of our driving is for recreational activities. In spring and late fall when we aren’t driving to ski, paddleboard, or mountain bike, we may not fill the tank of our one car for an entire month. We drive so little, gas prices just don’t matter much for us.

The lifestyle we’ve built makes us essentially immune to even drastic changes in gas prices. This is another demonstration of how your personal rate of inflation can differ greatly from the CPI.

Our bundled home/car/umbrella insurance premiums increased 13% last year on the heels of an 8% increase the year before, despite having no claims or traffic violations in either year. These costs are under 3% of our total spending, so I have been lazy in shopping for better rates.

Similarly our bundled cable and internet increased by 12% this year despite no corresponding increase in service. Seeing the seemingly egregious increases makes me realize I could probably do a better job managing both of these expenses moving forward.

Fun

The second category where we spent substantially more last year was on personal enjoyment.

In 2022, our spending on outdoor adventure gear and activities increased by 120%. This spending represented 13% of our annual household spending for the year.

Our travel expenses went up by 14% in 2022. These expenses made up another 13% of our annual spending.

Outdoor Gear/ Activities

We made substantial gear additions and upgrades last year. Our major purchases included a new set of powder skis and bindings for me, an uphill ski set-up for Kim (skis, bindings, boots, skins, and avalanche safety gear), and a full-suspension mountain bike for Kim. These are all likely one off purchases that should last us at least 5 years and have little additional ongoing maintenance costs.

Our ski passes increased more than usual last year. This was in part to make up for a price freeze the year before due to uncertainty around the pandemic. Our daughter also aged into a more expensive season pass price bracket.

Still season passes are an incredible value for our ski crazy family. Our average daily cost per person is under $15 compared to the daily pass rate of $135 for a single weekday and $175 for a weekend day pass at our local resort.

Kim and I also joined our local climbing gym in November. This therefore wasn’t a big expense in 2022, but it will further increase our spending in this category by about $170/month or $2,000/year going forward if we stay with it.

Travel

I was frankly shocked by how much we spent on travel in both 2021 and 2022. We paid for no non-business flights (other than a mandatory nominal security fee of $5.60 on every flight booked with travel rewards) or hotel rooms in either year due to my efforts earning credit card travel bonuses and using up travel credits accumulated during the pandemic. Our travel spending also didn’t include my trips to speak at a CampFI event last July or the Bogleheads Conference in October, as I wrote those off as business expenses.

Still our travel expenses represented 13% of our 2022 annual spending, and increased by 14% compared to the year before.

Upon further review, the vast majority of the travel expenses from 2021 were incurred in our month-long cross country trip in a rented camper van. Likewise, a large portion of our 2022 spending was prepaid expenses for another upcoming campervan trip in 2023.

Seeing exactly where our travel expenses went made me more comfortable that our spending is under control, and we are getting a ton of value for the travel dollars we did spend considering in 2022 we took:

- Three family cross-country flights and another solo trip for me to visit family.

- A family flight to Phoenix and rental car to hike the Grand Canyon and spend time in Sedona and Phoenix.

- A family flight to Las Vegas and rental car for a trip that included a few outdoor adventures in surrounding areas and several days and nights on the Vegas strip.

- A train trip from Pennsylvania to NYC with several hotel nights in Times Square during the holiday season.

Health Care

The other area where our spending increased at a rate greater than the general inflation rate is health care expenses. When planning for retirement spending there are two components to be concerned with, health insurance premiums and out-of-pocket costs for care. Both increased substantially for us in 2022.

Our health insurance premiums increased by 11.4% in 2022. They made up 6% of our annual spending. This was disappointing to see because the primary reason Kim continues to work the amount she does is to qualify for this benefit.

A bigger concern is that this high-deductible plan leaves us with substantial out-of-pocket expenses when we actually have medical expenses as we did in 2022. Our out of pocket expenses increased by 77% from 2021.

The combination of our health insurance premiums and out-of-pocket expenses accounted for 15.7% of our annual spending in 2022.

We take a little peace of mind knowing that most of our 2022 expenses were attributable to some issues Kim is addressing. We anticipate these particular expenses will come back down as she improves. My daughter and I have so far been blessed with good health.

However, Kim and I are both aging. We have at least another decade with a child. Our lifestyle involves regular outdoor adventure activities for all three of us and our daughter’s youth sports.

Odds are 2022 will not be the only year in which at least one of us requires care for injury or illness. Unfortunately, with out of control health care costs, it takes very little care to hit our high out-of-pocket maximum payment. This will be an area in which we continue to pay close attention in our financial planning.

Spending Too Much?

After reviewing our spending, I take comfort knowing that a large chunk of our increased spending was attributable to the fun category. If necessary, we could reel that in substantially while still maintaining an amazing quality of living.

However, I enjoy being able to spend with little concern and I really don’t want to have to reel that spending in. Lifestyle inflation is real for all of us. Kim is right that I need to be more aware of our spending.

Also, seeing how little control we have over general inflation and health care spending is concerning. Reviewing our spending was helpful for me to see things from her perspective. What could she learn from looking at our spending from my perspective?

Safe Withdrawal Rate Perspective

My perspective on our spending originated from the same place as Kim’s. As we tracked our net worth as a multiple of our spending, I felt we had reached a point where we are, more or less, financially independent.

In the FIRE community, we talk a lot about “the 4% rule” as a starting point to determine how much you can safely spend in retirement annually. I prefer to think in terms of Darrow’s more qualitative “Retirement Flexibility Scale for Choosing Your Safe Withdrawal Rate” which he described on the blog years ago.

In reality, we can never know exactly what our safe withdrawal rate is until after the fact. We do know if we only spend income produced by a broadly diversified portfolio, let’s call that 2% in the low yield world of 2022, you can not run out of money because you are not touching principal.

In 2022, we spent far less than that. We actually were net savers over the course of the year! Stated another way we had a negative withdrawal rate. The new money added to our savings and investments was greater than the amount we took out over the course of the year.

Spending Too Little?

Based on that, I felt we could easily spend more or earn less. This was my basis for initially having little concern over our spending.

Kim expressed concern that if we did need to rely on our portfolio, we were not really financially independent. Our 2022 spending would have represented 4.06% of our 2022 beginning balance and 4.73% of our diminished year end balance.

From that perspective, she is correct. Our 2022 spending is a bit higher than either of us would be comfortable with if we had to live exclusively off of our portfolio.

However, we have substantial flexibility on both the spending and earning sides of the equation. A traditional retirement where neither of us have any earned income is not impending.

Seeing how much we are spending and where it is going brought me closer to Kim’s point of view. For her, seeing that the amount we took from our taxable savings and investments to meet spending needs was less than what we added (401(k), HSA, and Roth contributions) over the course of the year helped to alleviate some of her concerns.

All of this clarified that we need to do a better job of communicating about money, but it didn’t definitively answer our initial questions.

Are we spending too much (or too little)? Is there an amount we “should” be spending?

So we kept talking and looked at things from a third perspective.

Values Perspective

In my book, I discussed the concept of being a “valuist.” I defined the term as a person who aligns his or her spending with their personal values.

This is something Kim and I have traditionally done a good job with. We maybe got so good at it that we started to take it for granted, leading to our lack of communication about money. So I suggested we get more intentional.

I asked her to reflect on the past year. I did the same. We each asked ourselves three questions which we then discussed.

What spending did we particularly derive value from in the past year?

What did we regret spending money on in the past year?

What did we regret not spending money on in the past year?

It was comforting as we discussed this topic that all three of our lists mirrored one another almost identically. Neither of us have any major regrets about how or how much money we spent. Even more comforting was that the list of things we are happy we spent on far outweigh any regrets.

Spending That Added Value

In particular we both agree that our travels, spending on outdoor gear and adventures, and investment in health added substantial value to our lives.

Our vacations gave us time to bond as a family, away from the distractions of everyday life. We continue to expose our daughter to cultural, educational and physically challenging experiences in nature that shape her physically, mentally, and emotionally.

We also traveled more than usual the past two years to spend time with family. In particular, I made it a focus to spend as much time as possible with my parents. My mom has been struggling with a series of health issues that make traveling to see us impossible, and makes even normal daily activities a struggle. My dad has been faithfully serving as her primary caretaker. This is an opportunity to give back to them.

I spent a few weeks in Pennsylvania with them in February. All three of us spent a few weeks there in the summer as well as Thanksgiving week. Kim noticed on the latter trip how much they were both struggling, my mom physically and my dad emotionally. She came up with an idea to return just a month later to surprise them with a Christmas visit.

The expression on their faces when we showed up unannounced from 2,000 miles away on Christmas day made it worth every penny and ounce of energy spent.

Kim is very generous with spending on others. She has a hard time spending on herself. So it was rewarding for me to hear her acknowledge how much she valued spending on healthcare needs to take better care of herself and for outdoor gear that allowed her to treat herself. She initially resisted these spending decisions until I pushed her to make them.

Where We Regret Spending

While most of our spending added value to our lives, two areas stuck out for us where we regret our spending: our bundled home/auto/umbrella insurance and cable/internet bills. Fortunately, neither of these make up a substantial portion of our expenditures.

There in may lie the problem we struggle with. On one hand, we crave financial simplicity and value our time. Neither of us want to put in the effort of making phone calls, sitting on hold, etc. for decisions that don’t really move the needle financially for us.

On the other hand, something rubs us the wrong way with both of these expenses. We don’t believe you should treat people unfairly simply because you can get away with it.

We also know that we have obtained our financial position by not being lazy or frivolous with our money. Knowingly spending more money than we should on these services just doesn’t feel good to either of us.

The fact that both of us brought up these expenses as regrets tells me it is time to do something about them. I am currently shopping both of these services. I’ll share if our intuition is correct and we can find the same or better service for less.

Where We Regret Not Spending

Similarly, neither of us had any serious regrets. However, our one regret was the same.

After spending a few days with our families over the holidays, we took a train to New York City. We went with little agenda. After spending a few nights in Times Square, we were going to move to a hotel near Laguardia for our last night for an early flight the following morning.

One thing we considered doing before leaving Manhattan was taking our Christmas crazed ten year old to Radio City Music Hall to see the Christmas Spectacular with the Rockettes. It was sold out, but we were told to go to the ticket window an hour before the show as tickets occasionally become available. We agreed that if we could get three balcony tickets for the matinee ($65 each) we would see the show before leaving town.

When we got to the window, only two tickets were available in the whole theatre. While talking to the attendant, three floor tickets ($180 each) together opened up, and we needed to decide fast. We turned them down.

We justified our decision by the fact that we needed to get back to our first hotel to get our luggage, get a subway out of the city, and desire to do so before it got dark and Times Square was even crazier.

All these things were true…. regardless of ticket price.

Also true, is that we aren’t city people. We live in Utah. We may never go back to New York City. That was absolutely the only time we could ever have that specific experience with our daughter. Money was the deciding factor.

Take Home Messages

At the end of the day, there is no absolute right answer as to how much you should spend. Like all things with personal finance, this is personal.

There are spending rates that are not sustainable. We are clearly not there.

It is also possible to cross over from being frugal to being cheap and regularly depriving yourself of things you want and can afford. We’re clearly not there either.

A theme of this blog is financial simplicity. I’ve expressed my desire to live on financial autopilot. My goal is to spend the minimal amount of time worrying about money so I can maximize the things in life that truly matter.

Our disagreement about our spending and this analysis that grew out of it showed me the importance of maintaining some vigilance. It is great to be in a place where money is not a day-to-day concern. However, getting too lax with financial habits and systems can set you up for trouble.

Those financial habits and systems are especially important if you have a partner in this journey. It is remarkable to me that after a quick look at the numbers and a few conversations, we went from two drastically different perspectives to being back on the same page and with a plan to move forward. If you have a partner, these need to be ongoing discussions.

Finally, it is important to understand that we are constantly changing over time. Periodically, we need to reflect on the role money plays in our lives. Financial habits and attitudes that served you in one phase of life may hinder you in other phases.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

FIRE can be daunting when you’re starting out. When you’re young, you want to enjoy life and have fun.…

Copyright © 2024 Retiring & Happy. All rights reserved.