Maximize ACA Subsidies and Minimize Health Insurance Costs in 2022

There are three main challenges to buying health insurance as an individual:

- The high cost of our medical system

- The complexity of understanding and navigating the system

- Political instability that makes long term planning virtually impossible.

Each of those dynamics changed significantly in 2021 with passage of the American Rescue Plan Act of 2021. These changes impact health insurance costs and decisions for 2022.

Open enrollment for Health Insurance Marketplace plans began November 1, 2021. It continues through January 15, 2022. You need to enroll by December 15th for coverage to begin on January 1, 2022.

For those considering purchasing health insurance through the Health Insurance Marketplace, now is the time to consider how to minimize your health insurance costs in 2022… and beyond.

Table of Contents

What’s changed with the ACA for 2021 and 2022?

Earlier this year, I wrote about the large impact that the American Rescue Plan Act of 2021 has on health insurance costs for early retirees and others buying health insurance on the Health Insurance Marketplace and utilizing ACA subsidies to make it affordable.

The law decreases cost and complexity for those buying health insurance on their own in 2022.

On the negative side, the bill highlights how unstable the system is and how challenging it is to plan for health care costs. Let’s start by reviewing what has changed and for how long.

Decreased Health Insurance Premiums for Many

Under the Affordable Care Act, the price you pay for health insurance premiums has always been a function of your household income, among other factors.

Those with the lowest incomes are eligible for Medicaid. The minimum income threshold is either 100%-138% of the Federal Poverty Level (FPL) depending on your state of residence.

Once your income exceeds this threshold, you qualify for subsidies to make insurance premiums more affordable under the Affordable Care Act (ACA). The official term for the subsidies are Premium Tax Credits (PTC). Throughout this article, I’ll use these terms interchangeably.

Eventually, those with higher incomes, exceeding 400% of FPL, did not qualify for subsidies. They had to pay the full cost of health insurance under the original ACA.

The American Rescue Plan made two significant changes. First, those who already received subsidies will now receive larger subsidies, lowering their out of pocket expenses. The maximum percentage

Second, the new law eliminated the cap of 400% of FPL which is a feature of the original ACA.

The changes in the maximum percentage of household income paid towards insurance premiums under the Original ACA and American Rescue Plan Act of 2021 are summarized in the table below.

| Income as % FPL | Original ACA | American Rescue Plan Act of 2021 |

|---|---|---|

| Up to 150% | 2.07 – 4.14% | 0% |

| 150-200% | 4.14% – 6.52% | 0% – 2% |

| 200-250% | 6.52% – 8.33% | 2.0% – 4.0% |

| 250-300% | 8.33% – 9.83% | 4.0% – 6.0% |

| 300-400% | 9.83% | 6.0% – 8.5% |

| >400% | No Cap, Subsidies Eliminated | 8.5% |

Eliminating the Subsidy Cliff Decreases Planning Complexity

Under the original ACA, subsidies were completely eliminated when household income exceeded 400% of FPL. This was frequently referred to as the subsidy cliff.

If you had an income of $X that put you right at the cliff, you qualified for generous subsidies of thousands of dollars per year. If your income increased to $X + 1 and that pushed you over the cliff, you completely lost the subsidy.

This was in effect a several thousand dollar tax on that one dollar of extra income. It made planning challenging for entrepreneurs, freelancers, people who have a substantial portion of income in the form of tips and commissions, and others with irregular and unpredictable income.

The subsidy cliff also presented challenges for early retirees who have to generate income from a mix of sources and may also be incorporating tax-gain harvesting or Roth IRA conversions to lower their future tax burden.

The elimination of the cliff makes planning simpler. If you earn an extra dollar, or even a few thousand extra dollars, over the 400% FPL threshold, your subsidy decreases and out of pocket costs increase gradually until they eventually phase out. Small planning errors are not nearly as punishing.

Subsidy Cliff Complexity Still Exists

The subsidy cliff on the lower end of the income spectrum is still in place in 2021 and 2022. You need to have a MAGI of at least 100 to 138% of the FPL (depending on your state of residence) to receive subsidies and avoid being pushed into Medicaid.

The level depends on whether you live in a state that expanded Medicaid. Avoiding Medicaid is desirable for many people, because Medicaid is not accepted by many health care providers and institutions.

It is also important to not make the mistake of signing up for a Marketplace plan rather than Medicaid if you don’t have enough income to reach this lower threshold, because you will not qualify for ACA subsidies.

Most early retirees could generate income by doing Roth IRA conversions. Just be aware of this and do it before the end of the calendar year.

Highlighting Political Instability

The American Rescue Plan also highlights the instability and unpredictability of the health insurance marketplace. Marrying health insurance premiums to tax subsidies is problematic.

Our health and thus health care needs are unpredictable. Anyone who has had any need to utilize the system knows that health care costs are extremely high and rarely transparent in the United States. Adding to the challenge, health care costs consistently increase faster than the general inflation rate.

These issues make planning for health care expenses challenging, even without incorporating tax planning into the equation. Adding in the tax planning component can make for a nightmare!

Tax laws can and do change frequently. The American Rescue Plan is a perfect example of why planning for health care costs for the long term is impossible.

This law is in effect for 2021 and 2022. The law didn’t go into effect until March 11 of this year. That’s about 3-4 months after most Americans made their health insurance decisions for 2021, as we’re doing right now for 2022.

You may still be able to incorporate some of the strategies discussed in this blog post to limit your 2021 costs. But there was no opportunity to plan in advance.

What will happen after 2022? Your guess is as good as mine. If nothing changes, we’ll revert back to the original ACA rules.

Certain aspects, particularly eliminating the subsidy cliff, make sense and simplify the process of buying insurance. But as we’ll see below, common sense and simplicity are in low supply with the ACA. So I’m not banking on these changes becoming permanent.

Buying a Health Insurance Plan on Healthcare.gov

Buying insurance through healthcare.gov (or your state’s marketplace) guarantees access to health insurance similar to what we traditionally have had through our employers. There is a lot I don’t like about our current healthcare system. That said, I find comfort in familiarity.

One of the most read articles on this site explores the many imperfect health insurance options that American early retirees have available. I’ve also done a deep dive into the best alternative for our family, Health Care Sharing Ministries.

I’ve concluded that buying traditional health insurance through the Marketplace utilizing available premium tax credits is the best solution for our family if we can’t get insurance through an employer. An ACA compliant plan allows us to have contractually binding health insurance that should protect us in a worst case scenario.

Our challenge is determining how to obtain the best coverage in the most affordable way.

Using a Health Insurance Calculator to Assist Planning

I’m a big fan of the Kaiser Family Foundation’s Health Insurance Marketplace Calculator. It is helpful in a number of ways when planning for short and long-term health insurance costs.

It shows what your estimated health insurance premiums will cost for a Silver Level plan with and without subsidies. Both are useful pieces of information.

The size of your Premium Tax Credit determines your actual costs for health insurance. Calculating this is helpful in planning for the upcoming year.

Knowing the full unsubsidized cost of health insurance is useful when considering what your insurance would cost if the law changes and/or your income exceeds the limits which allow you to qualify for subsidies. This prepares you for worst case scenarios.

Using the calculator is also helpful for planning purposes. It shows what factors influence your health insurance costs, some of which you may be able to control.

What Factors Influence Your Marketplace Health Insurance Subsidies and Costs?

Factors that influence costs for marketplace health insurance plans include:

- Income,

- Geographic location,

- Whether health insurance coverage is available at your or your spouse’s job,

- Number of people in your household (adults and children),

- Ages of people who will be covered,

- Whether those covered use tobacco,

- Whether you’ve received unemployment compensation in 2021.

We’ll explore each in more detail below.

The Impact of Income on Health Insurance Costs

Your Modified Adjusted Gross Income (MAGI) determines your Premium Tax Credit and thus your out of pocket costs for health insurance. This variable is particularly important for planning purposes for early retirees.

That’s because we early retirees often have considerable control over how we generate the income needed to meet our spending needs.

This is in contrast to entrepreneurs, freelancers, and others without employer sponsored health insurance. Controlling income may be more difficult and less predictable in those circumstances.

Income also stands in contrast to other factors that determine premium costs, because we have little to no control over many of those variables. Because it is so important to understand how income affects health insurance premium costs, we’ll go into more detail below.

First, it is important to understand what other factors impact your insurance premiums.

Geographic Location

There is variability in the cost of health insurance plans based on your geographic location.

One factor to consider is whether you live in a state that expanded Medicaid. If you’re not sure, find the status of your state here. Alternatively, enter your current location and any other locations you may be considering into the calculator to see if it impacts your health insurance costs.

In states that did not expand Medicaid, your income needs to be at least 100% of FPL to qualify for insurance subsidies. You must have income greater than 138% of FPL in states that expanded Medicaid.

Another consideration is differences for residents of one of the non-contiguous states. Note that Alaska and Hawaii FPL numbers have been adjusted upward due to higher cost of living.

Also note, the number and quality of insurance options available differs greatly by geographic area. This will not be evident until you begin shopping for health insurance plans in your particular area.

Health Insurance Available Through an Employer

An important variable in the cost of your health insurance is whether you or your spouse have health insurance offered through an employer. If so, you generally won’t qualify for any subsidy and will pay the full cost of a health insurance plan purchased through the Marketplace.

There are rare exceptions if coverage provided by an employer does not meet minimum standards for coverage or affordability. You can read full details of these exceptions here.

Number of People in Your Household

The number of people in your household is defined as a tax filer, their spouse, and dependents. The more people in a household, given a fixed household income, the higher your Premium Tax Credit and lower your out of pocket cost will be.

This can be counterintuitive. You may assume that the more people you insure, the higher your health insurance expenses will be. That is true when looking at the full, unsubsidized costs.

However, subsidies are based on your income as a multiple of FPL. Because it is generally more expensive to house, clothe, and feed more people, a larger household would have higher expenses. A given household income wouldn’t go as far in a household with more people.

Consider two households with the same income. The larger household will get a greater Premium Tax Credit and thus pay a lower share of the health insurance costs. A smaller household would qualify for less subsidies, and thus pay a greater share of health insurance costs.

This is important to consider if you will be adding (birth, adoption, marriage, etc.) or subtracting (death, divorce, children aging out, etc.) people from your household. The number of people in your household will substantially impact health care costs, assuming household income remains constant.

Ages of people who will be covered

Age is a factor that makes it especially important to optimize your ACA subsidies as we get older. We tend to use more healthcare services as we age. Thus, health insurance premiums increase considerably as we get older.

As an example, premiums for our family of 3 would have a full unsubsidized premium cost of $15,877 based on Kim’s and my ages, in our mid-40’s.

I experimented with increasing the adult ages to 60 in the health insurance calculator and leaving all else equal. The full cost of an unsubsidized plan jumped to $25,546.

However, our out of pocket costs for health insurance premiums for Marketplace plans are based on a percentage of our income. So our out of pocket costs for premiums are exactly the same in either scenario, regardless of our age.

Our subsidy in this example increases by nearly $10,000/year by entering a higher age! This demonstrates why it is more important to be able to optimize your Premium Tax Credit as you age.

Use of Tobacco

Using tobacco is another factor that impacts your health insurance costs. The calculator doesn’t indicate how much more tobacco users will pay. It simply states: “You may pay more if your insurer charges a higher rate for tobacco use. In most states, insurers can charge a tobacco surcharge of up to 50% of your total premium before the tax credit. The tax credit cannot be applied to the tobacco surcharge.”

I can think of many reasons that are better than saving money on health insurance to stop using tobacco. Increased risk of cancers, lung disease, heart disease, and stroke jump front of mind. The direct financial benefits of not buying tobacco products and paying the high taxes on them are others. But if paying a lower health insurance premium pushes you over the edge to quit, all the better!

Eliminating discrimination based on pre-existing conditions is one of the most politically popular provisions of the ACA. I find it odd that tobacco use is the one behavioral factor that is, for whatever reason, so stigmatized that it can cause you to pay a higher health insurance premium. For 2022 planning purposes, this is all you need to know.

When planning for the long term, it will be important to see whether this remains the case. Or will other behaviors and lifestyle related conditions that may impact your costs be incentivized or punished via health insurance subsidies and premiums? Stay tuned.

Unemployment Benefits

The final factor that the calculator considers is whether you’ve received unemployment compensation at any point in 2021.

Under the American Rescue Plan Act of 2021, if you received unemployment benefits at any point in 2021, you then qualify for a free (fully subsidized) Silver plan through the Marketplace. It doesn’t matter how much income you earned for the year.

As of now, this provision is for 2021 only. It does not apply to 2022 planning decisions.

How Income Impacts Your ACA Subsidies

The factor which you have the most control over to maximize your ACA subsidies and limit your out of pocket expenses is income. It’s important to first understand what counts as income as it relates to obtaining Premium Tax Credits.

What Constitutes Income For ACA Subsidies?

Your subsidies, and thus your personal health care expenses for a given year, will be based on your household income in that year. So 2022 subsidies and your share of expenses will be based on your income in 2022.

You will have to estimate this. If your estimate is off, you’ll have to pay the difference or receive a refund after the fact.

Your 2021 income will probably be a good enough approximation to start planning if your expectation is that your situation isn’t going to change much.

If you are retiring, cutting back work, transitioning to self-employment, or making other changes that will substantially increase or decrease your income, you’ll make your best guess at what income in the following year will be.

It is also important to understand that subsidies are based on total household income, even if not everyone in the household needs to buy insurance through the Marketplace.

Consider a household of three where only one spouse works. The working spouse has insurance through their employer, but coverage is not extended to their family. The worker’s income counts against the subsidy the remaining spouse and child can qualify for.

Finally, you need to understand what counts as income which impacts premium subsidies and out of pocket premium costs. For the purposes of this discussion, income is your Modified Adjusted Gross Income (MAGI).

Calculating MAGI for ACA subsidies

I’ve written about how to calculate your Adjusted Gross Income (AGI) and Modified Adjusted Gross Income (MAGI). If you are not familiar with these terms and how to calculate these numbers, start there.

Once you generally understand these calculations, you’ll have to factor in how a few specific factors related to health insurance decisions will alter these calculations.

Finally, after getting your AGI, learn how to adjust it to arrive at your MAGI. This number determines your Premium Tax Credit and out of pocket insurance premium costs.

Determining Eligibility for a Health Savings Account (HSA)

Contributing to a HSA provides an “above the line” deduction that lowers your AGI, and thus MAGI. Lowering your MAGI will increase the subsidy you qualify for. This in turn lowers your out of pocket expense for health insurance premiums.

Since 2017, we’ve obtained our health insurance through my wife’s employer. Each year, we have chosen a high-deductible health plan. Part of our reasoning for doing so was having the ability to contribute to an HSA.

Related: Using a HSA to Save for Retirement

We assumed we would choose similar coverage and continue contributing to an HSA annually when purchasing a Marketplace plan. We assumed the determining factor of whether a plan was a high-deductible health plan was… the size of the deductible.

I created an account to explore specific insurance plan options offered through the Marketplace at Healthcare.gov. I began by exploring plans with similar features to those we currently have. The closest equivalent to our current coverage is a Silver Level plan.

To my surprise, Utah has no silver level plans that are HSA compatible. We need to choose a Bronze Level plan that has considerably higher deductibles and coinsurance amounts than we’re accustomed to. Otherwise, we lose the ability to contribute to an HSA and get this valuable deduction.

You can find the qualifications for a high-deductible health plan in IRS publication 969. Alternatively, when shopping plans on the Marketplace you can sort them by whether they are HSA compatible.

Take home: Don’t assume you will be able to contribute to an HSA and claim that deduction when projecting income until you explore the plans available in your area. You may not find an HSA compatible plan to your liking.

Circular Logic for Self-Employed Deductions

Buying your own health insurance provides another valuable above the line deduction that reduces AGI for the self-employed. However, it quickly becomes apparent that this also adds complexity to your calculation.

Self-employed health insurance costs are deductible. The deduction lowers AGI. A lower AGI leads to receiving a larger tax credit. A larger tax credit means lower health insurance costs for you.

These lower costs reduce your deduction. The lower deductible amount increases AGI. A higher AGI results in reduced tax credit. The smaller subsidy results in higher insurance premium costs.

After going in circles with this, I was certain I didn’t understand something. I reached out to CPA Mike Piper to clarify.

He assured me my understanding of the law was correct and pointed me to an excellent resource from the Harry Sit’s Finance Buff blog. It provides IRS Guidance On Circular Reference in ACA Premium Subsidy and Deduction and explains how to resolve it.

If you are self-employed, take time to understand how to calculate this deduction correctly to legally minimize premium costs.

Modifying AGI to Determine Premium Tax Credits

Once you have an acceptable estimate of your AGI, you need to modify it to get to your final income number that will determine your Premium Tax Credit. Find the calculations to determine MAGI for the purposes of health insurance subsidies on the IRS Instructions for Form 8962.

This is an estimate. We’re trying to determine our costs for health insurance in 2022, based on projections of income made in late 2021. We won’t ultimately know our final costs until spring of 2023 when we file our tax returns and have our actual MAGI.

This is the best we can do for now. So we use the estimated MAGI that we calculated to estimate our Premium Tax Credit.

Estimating Your Premium Tax Credit

You can determine your estimated Premium Tax Credit by filling out an application at HealthCare.gov. However, be careful before jumping to this step.

Before you start shopping on the Marketplace, play with an AGI calculator to experiment with manipulating your income. Then plug different income numbers into the KFF Health Insurance Marketplace Calculator to fine tune your planning, until you are confident in your estimate.

I started on the Marketplace website and completed an application. I wanted to change one income number to see the impact of contributing to a 401(k). Doing so required going through the entire application again, which took nearly ten minutes.

After going back and working with the other calculators, I found the estimated subsidy from the KFF calculator was within $4 of my results on HealthCare.gov. In addition to being precise and accurate, the KFF calculator provided a more user-friendly experience when experimenting with different income scenarios.

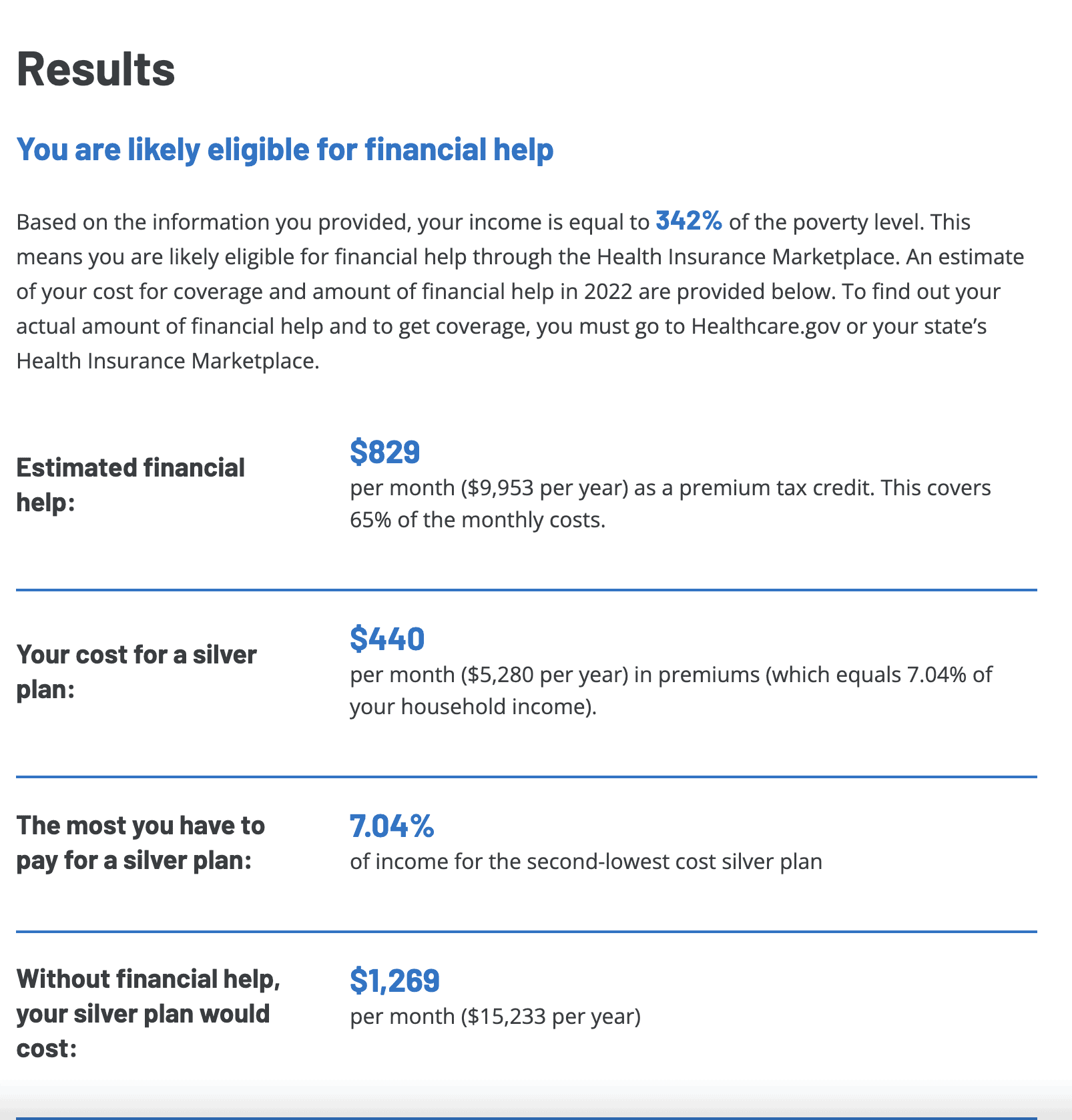

The screenshot below shows our outcomes from the KFF calculator.

How Do Premium Tax Credits Work?

Based on our best assumptions for our 2022 income, combined with our household size, geographic location, and our ages, we qualify for a monthly subsidy of about $830/month. The KFF calculator shows that with this premium tax credit, we would pay about $440 for a Silver Level health insurance premium.

You do not have to choose a Silver Level plan. Your premium tax credit is the same regardless of the plan you choose.

If we were to choose a higher cost Silver level or Gold level plan, our subsidy would remain the same, but our out of pocket costs for premiums would be higher than shown on the calculator.

Conversely, if we choose a lower cost Bronze level plan, our premium cost would be lower. Our out of pocket cost could potentially be $0 if we choose a plan with a price tag equal to or less than our $830 monthly subsidy. If you choose a plan with premium costs less than your PTC, you do not get any additional tax refund.

Choosing a Plan

When looking to minimize health care costs, health insurance premiums are only part of the equation. You need to consider your total cost of insurance premiums plus your share of any costs for care.

I’ve focused a lot on the challenges of predicting income and thus costs of health insurance premiums. Predicting health care needs and costs is even harder.

You need to determine both your best and worst case scenario to help manage risk.

What Is Your Minimum Health Care Cost?

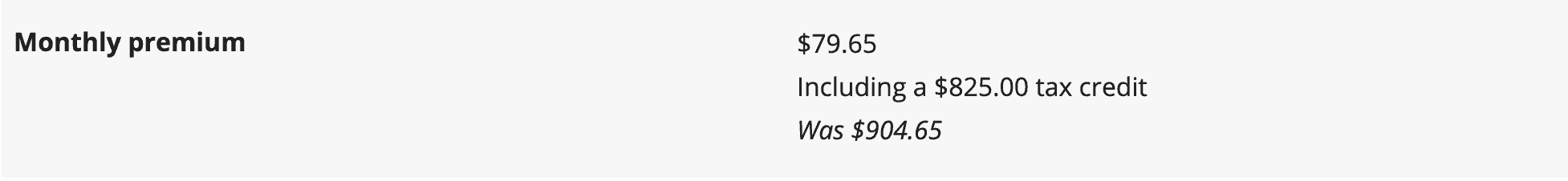

The best plan for our family based on a combination of having our current health care providers in network, cost, and HSA compatibility has an unsubsidized premium cost of about $905/month. With our premium tax credit applied, we would pay only about $80/month with the Marketplace plan.

In a best case scenario where we don’t need any health care evaluation or treatments, we would pay about $960. Preventative care is covered with all Marketplace plans.

This compares favorably to the $300/month or $3,600 we would pay as our share of premiums for a high deductible plan through Kim’s employer. We would need to incur about $2,600 in health care expenses, which is rare for our household, just to get back to even.

What Is Your Maximal Health Care Cost?

Paying a lower insurance premium is nice. But the whole purpose of having insurance is to protect your downside in a worst case scenario. How does this Marketplace plan compare to the insurance we currently have?

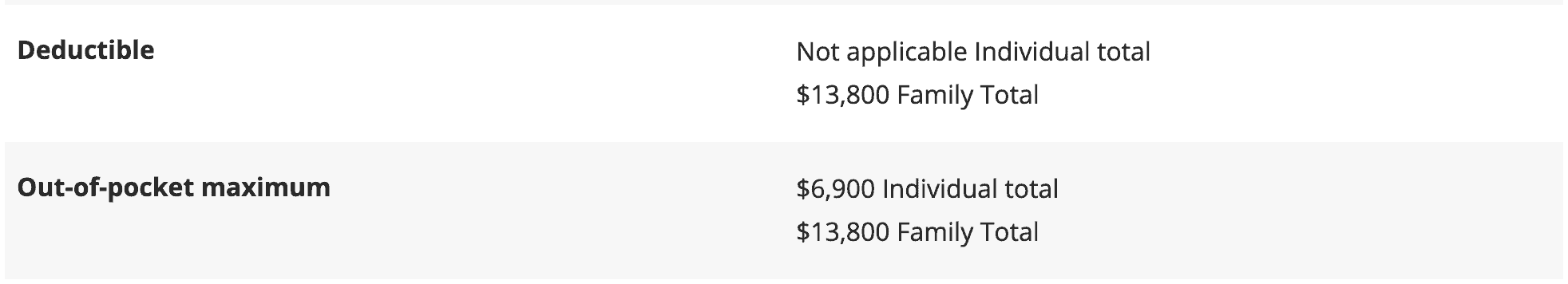

The out of pocket maximum for our family is $13,800 with the Marketplace plan. The plan we currently are covered under has an out of pocket maximum of $8,000 for our family.

However, when factoring the worst case scenario you have to factor in the total cost of insurance premiums and out-of-pocket costs.

The total premium plus maximum out-of-pocket expenses are $14,760 for our family with the Marketplace plan. The worst case scenario under our current coverage from Kim’s employer is $11,600 for our family.

The Challenge of Buying Individual Health Insurance

Our situation demonstrates the challenge of buying affordable individual health insurance. It requires a combination of tax planning, risk management, making healthy lifestyle decisions, staying up to date on ever changing rules and regulations, and at the end of the day… luck.

The difference between the cost of subsidized insurance and the full cost of insurance demonstrates the variability that any early retiree needs to plan for in case subsidies are discontinued or the system substantially changes. This only becomes more important as we age and health care costs and the likelihood of needing care increases.

I frequently share articles or write about non-conventional approaches to retirement such as semi-retirement, mini-retirements, one spouse retiring first, or investing in alternative asset classes like real estate or retirement businesses that may produce more retirement income than traditional paper assets.

These approaches allow starting down the road toward early retirement sooner, with more income, more life options, and less financial risk. However, having a higher income produces unique challenges to obtaining affordable medical insurance.

Unfortunately, no one has a crystal ball. So we have to make our best decision year to year. Hopefully this framework will help you minimize your health insurance costs in 2022.

Beyond that? Check back this time next year…

Chime In

How are you dealing with the challenges and risks of obtaining health insurance? Is health insurance keeping you trapped in a job when you would otherwise retire, work less, start a business, or choose another career?

I am always impressed by the level of knowledge, experience, and creativity shared by readers of this blog and look forward to reading your ideas, insights, and solutions in the comments.

I understand political instability and risk is part of the challenge when planning for health insurance. Name calling and ideological rants are not helpful to anyone trying to develop a plan to transition to retirement sooner.

Please refrain from making this a political conversation. There are thousands of other places on the internet for those seeking that. I reserve the right to delete or edit comments that don’t comply with this request. Thank you.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

In a world where financial habits vary widely, the spending behaviors of the wealthy stand out as particularly intriguing.…

Copyright © 2024 Retiring & Happy. All rights reserved.