How Low Can Your Bond Values Go?

Bonds serve as a ballast to offset the volatility of stocks, particularly when stock values are falling. Since the start of the year, that’s exactly what stocks have done. So how are bonds holding up?

Vanguard’s Total Bond Market Index Fund (VBTLX) is a popular core bond holding for many, including me. As of May 6, this fund was already down 10.54% for the year. It lost nearly 4% in April alone, and nearly another 1% the first week of May.

The Federal Reserve is expected to continue hiking rates to fight inflation, meaning more losses for bond holders could be on the horizon.

Rising interest rates are driving the value of existing bonds lower. But what factors determine how much bond values drop when interest rates rise? How much more can bonds continue to lose?

Understanding Bond Duration and Interest Rate Risk

The relationship between interest rates and bond prices can be complicated. It’s easy to get lost in the weeds and be overwhelmed.

I’m going to start with the key information that everyone managing your own portfolio should grasp in order to adequately understand and manage your risk. This includes understanding the concept of bond duration.

If you are willing to invest a little bit of time to go deeper, it is wise to understand a few key mathematical factors that influence duration.

If at any point the math gets to be more than you are interested in, skip to the end. I’ll discuss a few specific features that make certain bonds especially susceptible to interest rate risk while others completely sidestep this risk.

What Is Bond Duration?

Investopedia defines bond duration as “a measure of how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows.” What exactly does that mean?

In more practical terms, bond duration can be thought of as a measure of how sensitive a bond’s price is to changes in interest rates. A rule of thumb regarding duration is for every 1% change in interest rates, a bond’s value will change by approximately 1% for every year of duration.

So if a bond has a duration of 3 years and interest rates go up by 1%, then the bond’s value would decrease by approximately 3%. If a bond has a duration of 9 years and prevailing rates drop by .5%, the bond would increase in value by approximately 4.5%.

The longer a bond’s duration the greater a bond’s interest rate risk if rates rise. The flip side of this risk is the potential for reward. A bond with a longer duration has more upside for price appreciation if interest rates fall.

Bond Duration In Practice

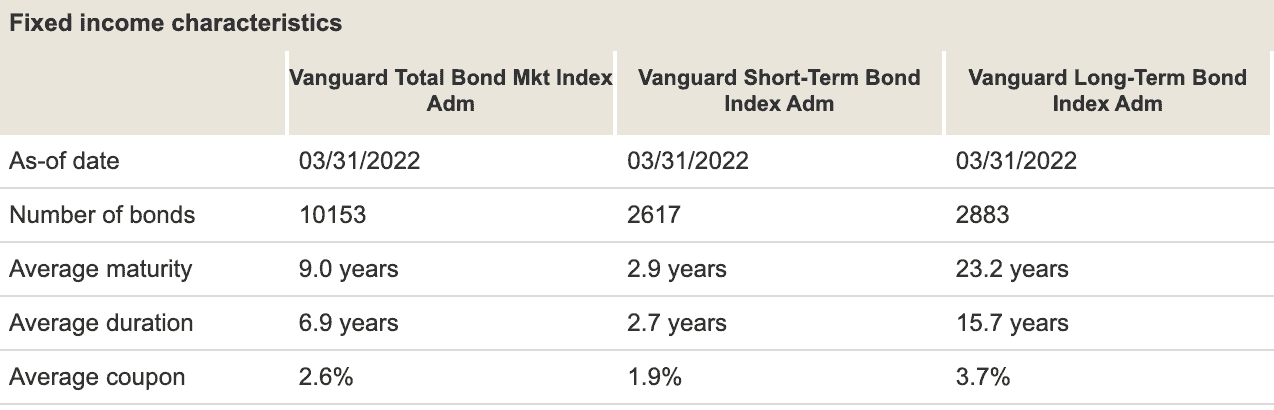

As an example, let’s look at Vanguard’s Total Bond Market Index Fund (VBTLX), a popular core bond holding. Compare that to the Vanguard Short-Term Bond Index Fund (VBIRX) and the Vanguard Long-Term Bond Index Fund (VBLAX) , funds of similar quality bonds but with shorter and longer durations.

VBTLX has an average duration of 6.9 years. VBIRX has an average duration of 2.7 years. VBLAX has an average duration of 15.7 years.

How did these funds perform over the first quarter of 2021 when interest rates were rising? As of May 6, the Total Bond Market Index Fund is down 10.54% year-to-date. Over the same time frame, the Short-Term Fund is down a little less than half as much, 4.63%. The Long-Term Fund, with the longest duration of the three, is down 21.11% for the year.

Using Duration to Assess and Manage Risk

Understanding duration, you can assess the risk of your bond investments. VBTLX has an average duration of 6.9 years. So for every additional 1% interest rates rise, you can expect to lose about 7% on an investment in this particular fund.

It is important to remember that over time, lower yielding bonds in the portfolio will be flushed out and replaced with new higher yielding bonds. As they do, the risk to reward profile for bonds will improve.

New bonds will compensate you with more yield. As yields rise, so does the potential for them to go back down, offering you potential future price appreciation.

Even if you are certain interest rates will continue going up or will start going back down, that information is of little value if you don’t also know the timing, rate, and magnitude of the changes.

Predicting the direction, amount, and timing of interest rate changes is incredibly hard. To control your risk, keep duration less than or equal to the time until you will need to sell your bond investments.

Mathematical Factors That Influence Duration

That is the basic bond duration information anyone investing in bonds should understand. To gain a deeper understanding, we need to explore a few mathematical concepts that impact bond duration.

These concepts will help to clarify factors that determine how bond prices are related to interest rate changes. This informs the amount of interest rate risk present with a bond investment.

Inverse Relationship Between Interest Rates and Bond Prices

Interest rates and bond prices are inversely correlated. This means when prevailing interest rates go up, existing bond prices decrease. When rates drop, existing bonds become more valuable. I covered this recently when discussing how rising interest rates impact bond investments.

To quickly recap, imagine purchasing a $1,000 bond with a coupon rate of 2%. If you hold the bond to maturity, you will receive $20 of annual payments until the bond matures. At that point, your $1,000 principal will be returned along with your final payment.

Now, imagine interest rates increase to 3%. Investors could buy a new $1,000 bond and receive $30 of interest annually instead of the $20 you are receiving. If you had to sell your bond, you would have to do so at some discount to the $1,000 face value. Otherwise, there would be no incentive to purchase your old lower yielding bond.

Conversely, if rates dropped to only 1%, someone purchasing a new bond would be paid only $10 interest annually. They would covet your bond yielding 2%. As such, it would be worth some premium above the $1,000 face value if you chose to sell it.

The Length of Time Until A Bond Matures Impacts Sensitivity to Price Changes

The shorter the life of the bond, the less a change in interest rates impacts the price. This relationship is not linear. The size of the bond’s discount or premium will decrease at an increasing rate as its life gets shorter.

Return to our example above of a $1,000 bond yielding 2%. Let’s add the assumption that the bond has a maturity of 10 years at the time it is purchased.

If rates on new bonds increased to 3% a few months after buying the bond, you would be stuck with your bond paying only 2% for the remainder of the 9 plus years.

Now imagine prevailing rates stayed at 2% for most of the life of the bond, then went up to 3% a few months before the bond matured. You would have been receiving prevailing rates for over nine years. You would only be “missing out” on the potential higher interest on your final payment. At that time, your principal would be returned and you could reinvest it at higher rates.

In either event, rising interest rates are not good for existing bond holders. But in the first of these extreme examples you would be much worse off. This would be reflected by a much bigger hit to your bond’s price.

Inverse Relationship Between Coupon Rate and Duration

If the coupon rate of a bond is higher, its sensitivity to a change in rates will be less. Conversely, if a bond has a low coupon rate, it will be more sensitive to a change in interest rates.

Consider it this way. If a bond is paying 10% interest, and rates go up or down by .5% that represents only a 5% difference between your coupon rate and prevailing rates.

Compare this to a bond yielding 1%. The same .5% change in interest rates represents a 50% difference between your bond and the prevailing rates. The price of the lower yielding bond would be impacted more significantly by this equivalent change in rates.

Over the past decade interest rates have been low by historical standards. The response to the COVID pandemic drove them to all time lows. These low starting yields left bonds extremely sensitive when rates started increasing.

Related: Retiring With Extreme Low Interest Rates

Bond Convexity

We’ve established that a decrease in interest rates will lead to a rise in bond prices. An increase in interest rates causes an existing bond’s value to fall. But the prices do not change by an equal amount.

A bond’s price will increase by a greater amount for a given decrease in interest rates than it would fall given an equivalent increase in interest rates. This leads to what is known as bond price convexity.

This is simply a mathematical truth that I’m sharing for the sake of completeness in covering the factors that impact bond price. There isn’t a whole lot to do with this piece of information. Just understand this math quirk always works to a bond investor’s advantage.

Abnormal Interest Rate Risk

We’ve discussed the impact of changing interest rates on bond prices in general. But not all bonds are created equal.

Bonds With Increased Interest Rate Risk

Some bonds are callable, meaning that the borrower can pay back the debt early if they choose to do so. The most common example in which you are likely to invest, directly or indirectly, is mortgage backed securities (MBS).

MBS are securities backed by pools of mortgages bundled together and sold to investors. They make up a substantial portion of investible debt. As such they are a substantial portion of many bond funds.

Some investors seek even more exposure to MBS when their yields look particularly attractive. However, most mortgages can be paid off early.

When rates are going down, people are more likely to refinance at better terms. As the lender (i.e. the bond holder), this effectively shortens your duration at a time you would most benefit by having a long duration.

When rates are rising, fewer people will pay their mortgage off early. This essentially increases your duration, sticking you with lower yields for longer. You would benefit from a shorter duration so you could get your money back sooner and reinvest at new higher prevailing rates.

It is important to be aware of this feature when considering your interest rate risk. If you want to limit interest rate risk, it is better to limit exposure to debt that is callable.

Bonds With No Interest Rate Risk

On the other extreme, some bonds are not marketable. This means they can not be sold on a secondary market.

As such, they have no interest rate risk if rates rise. On the flip side, they also have no upside for price appreciation if interest rates fall.

An example that is getting a lot of press at the moment is I Bonds. I Bonds must be purchased directly through Treasury Direct, and they must be redeemed in the same manner for their face value.

Related: I Bonds vs. TIPS

So How Much More Will We Lose With Bonds?

This is the million dollar question that investors want to know. Unfortunately, no one can give you the answer without a crystal ball that can see how high rates will go and when they will stop rising. Given what we know about duration, we can make a reasonable estimate of the risks we are exposed to based on some assumptions.

Since the beginning of the year, rates have risen sharply. As of May 6th, the 5-year treasuries are paying 3.06%. A 10-year treasury yields 3.12%. This represents an increase of approximately 2% on the 10-year and 2.5% on the 5-year in just four months.

The median yield on a 5 year treasury is 3.43% and the mean is 3.74% historically. So let’s call it 3.5% on average.

The median yield on a 10 year treasury is 3.81% and the mean is 4.50% historically. So let’s call it a little over 4% on average.

It seems reasonable to assume rates will reach these historical averages. If so, we’re looking at an additional 1+/-% increase in rates multiplied by the duration on your bonds to get a reasonable expectation of additional losses.

If this assumption on rate hikes holds true and you have bonds with a shorter duration, that’s not great. It is tolerable for most investors.

The all-time high rate on 5-year treasury is 8.77%. The 10-year has been as high as 15.32%. If we got anywhere near that interest rate environment and/or you hold bonds of longer durations, there is a potential for much greater losses.

It’s important to stay humble. We must acknowledge there is always the possibility that things improve more quickly than anticipated. Rates could stabilize or even start going back down more quickly than currently anticipated by many.

Proceed With Caution

Unfortunately, no one knows how this ends. Be wary of anyone who says they do.

Understanding duration is valuable to help manage the risk that bonds in your portfolio are exposed to. Plan accordingly. Don’t take risks you can’t afford to lose with your investments, particularly with this portion of your portfolio that most people rely on for safety.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

Editor’s Note: Chief Income Strategist Marc Lichtenfeld’s longtime followers know how much he relies on technical analysis – that…

Copyright © 2024 Retiring & Happy. All rights reserved.