Beyond Insurance: Strategies to Manage Risk

Risk management fascinates me. I shared my intuitive approach for managing risks in the insurance chapter of the Choose FI book.

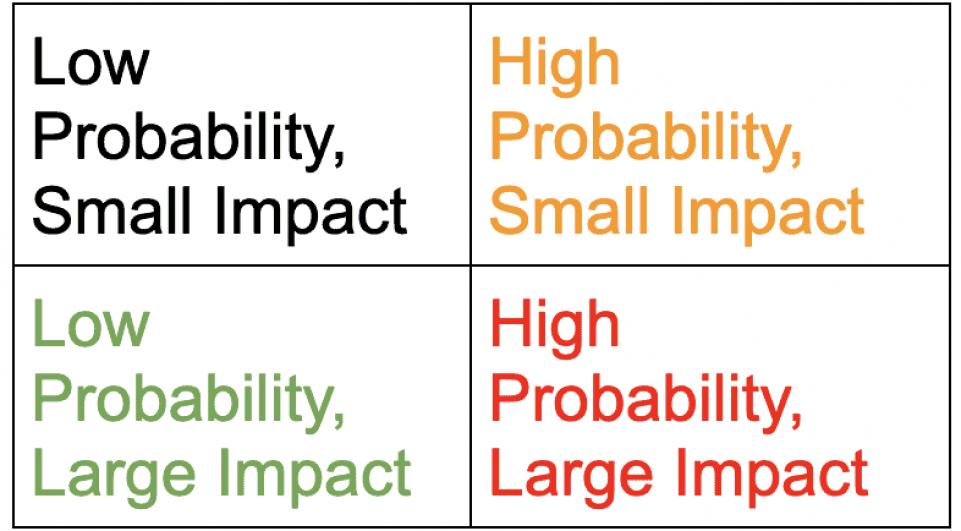

The approach I describe classifies risks into four quadrants to evaluate insurance needs. Each quadrant is based on the probability of a negative event and the impact if a negative event did occur.

I was pleasantly surprised to find the framework I had intuited was very similar to the risk management approach I recently learned in the CFP curriculum. The curriculum goes a step further. It matches different risk management strategies that correspond to each quadrant.

This framework is helpful to better manage risk. So I want to share it with you. I also layer on my own twist regarding how pursuing financial independence impacts your risk management decisions.

Understanding the Risk Quadrants

The four quadrants rank severity and probability associated with adverse events from low to high. Risk is the combined likelihood that you will experience an adverse event and the impact of that event were it to occur.

Not all negative events present the same degree of risk. So we need to have different strategies for managing them.

Magnitude of Impact Is All Relative

Before discussing the quadrants and associated risk management strategies, let’s zoom out for a moment. It is important to understand that the impact of a negative outcome is not the same for everyone.

At one extreme, a person may be drowning in debt and struggling with cash flow from week to week. Imagine this person who relies on their smart phone for work. They accidentally throw it into the washing machine with their laundry. Coming up with a couple hundred dollars to replace it could create a major hardship for this person. Buying insurance for their phone may actually be a rational decision for this person.

On the other hand, someone with a multi-million dollar net worth and adequate liquidity may elect a high deductible health insurance plan with max out-of-pocket expenses of $14,000+/year for a family. While unpleasant, in the grand scheme of things the financial impact of hitting this maximum in any given year would likely be minimal.

As you think about risks you face and what quadrant they belong in, take time to consider the impact of a negative event for you. If you are far along in your financial journey, appreciate the peace of mind this may give you.

Conversely, if you are just starting out, understand that there are benefits to building wealth and gaining financial strength long before you are financially independent and able to retire. Your financial strength and resiliency increases progressively along the journey to financial independence.

Related: The Stages of Financial Independence

Low Probability, Small Impact: Retain the Risk

In the first quadrant, you find risks that are not likely to occur. They will have little financial impact in the unlikely event that they do.

This is the easiest scenario to manage. You can simply retain these risks.

This is the default position and requires no action from you. Do nothing and deal with small financial impacts in the unlikely event that these adverse events occur.

High Probability, Small Impact: Retain or Reduce the Risk

In the next quadrant are events that have a high probability of occurring, but small financial impact if they occur. Because the impact is small, you can choose the default position, do nothing, and retain the risk.

Any one event is not going to break you. However, because these events have a high probability of occurrence, they can be a nuisance and they add up over time.

Mitigating the impacts of these events with insurance is not optimal. The high frequency which with they occur makes them expensive to insure, relative to the damage incurred if a negative event occurred.

A better strategy is to find ways to reduce your risk. Doing preventative maintenance is one strategy to reduce your risk exposure.

Having a cavity, or even a root canal, is unlikely to break anyone reading this blog. Still, why not invest a few pennies and a minute or two a day to floss and drastically reduce the financial risk (and pain!) of this event.

Other examples are taking care of your appliances and electronics, automobile, and other higher end consumer needs to help them last longer, function better, and keep you safe.

Low Probability, Large Impact: Transfer the Risk

Risks that have a low probability of occurrence and a large financial impact when they do create the perfect scenario in which insurance products should be used. In this case, you transfer risks you can’t afford, or don’t want, to accept onto an insurance company.

The probability of these events occurring are small. That’s why insurance companies are able to profitably sell policies that protect against these large risks at affordable cost. These policies prevent financial ruin while providing peace of mind.

Examples that fit well in this category are homeowner’s insurance that protects you if your house burns down, umbrella liability insurance that protects you from a lawsuit that exceeds your homeowner’s or automobile policy, and term life insurance for a parent who is young and healthy.

The likelihood of adverse events occurring that would cause these policies to pay is relatively small. However, the impacts could range from the high six-figure to seven-figure range if they did occur, substantially impacting all but the most wealthy among us. Choosing to buy these policies is generally an easy decision.

Related: How Much Umbrella Insurance Do I Need?

High Probability, Large Impact: Avoid and/or Reduce the Risk

The final category is the hardest to manage. The large impact these events can have makes them a serious threat. The high probability of occurrence makes them expensive or even impossible to insure. So it is advised to avoid or reduce the risk.

A perfect example in the mountains are avalanches. I have zero tolerance for accepting the risk of getting caught in an avalanche because of the severity of the consequences. So on days when there is avalanche risk, I simply avoid uncontrolled avalanche terrain by skiing terrain not steep enough to slide, skiing in avalanche controlled terrain at a resort, or staying home. This takes my risk of getting caught in an avalanche essentially to zero. Easy!

In the world of personal finance, avoiding and reducing risk isn’t so easy. It’s likely each of us will incur substantial medical expenses at some point. Age related physical and cognitive decline will make long-term care needs a reality for many of us.

Completely avoiding these risks, while ideal, is not possible. Reducing the risk is wise. We can and should eat well, exercise regularly, improve sleep, and reduce stress. However, those strategies are not foolproof….and at times are naive.

Because these scenarios are so challenging, they require a combination of risk avoidance (when possible), risk reduction (preventative measures), risk transfer (insurance) and risk retention (self-insuring, higher deductibles, copays, and coinsurance, extended elimination periods, etc.)

Related: When Should You Self-Insure?

Risk and Insurance

I’ve always been fascinated by the concept of risk. I share an interest in outdoor adventure with Darrow. Those themes drew me to this blog as a reader after I read a guest post he wrote comparing big wall climbing with wealth building.

Years later, I came onto Darrow’s radar after I expressed my appreciation for his approach to risk management when I reviewed his second book. His nuanced consideration of risk and reward stood in stark contrast to the oversimplified way many people view things as “safe” or “risky.”

Many people are drawn to the promise of safety. Others will capitalize on the natural desire to be safe by selling the idea of safety for their financial benefit. In reality, safety is mostly an illusion.

Insurance products are effective ways to manage risk in specific scenarios as noted above. However, insurance products are often oversold by playing on our biggest fears and promising to alleviate them.

It is important to remember that insurance companies are businesses, not charities. In order to stay in business, an insurance company must collect more in premiums than they pay out in benefits plus the overhead costs to administer and sell the policies plus enough to provide an adequate return to investors.

Any insurance policy you buy is, in aggregate, making a losing bet.

That is not a criticism of insurance companies or a suggestion that we should never buy insurance. It is simple math. Understanding the math, you don’t want to buy more insurance than you need.

You also do not want to “save” money by paying lower premiums to an underfunded insurance company that will not be in business and thus not be able to pay out when you need them.

Related: How Strong Is Your Insurance Company?

Risk and Financial Independence

Reducing financial risks you face with less needs for insurance products is a great, and not often enough discussed, benefit of pursuing financial independence. Over time, you shift events from the large impact quadrants to the small impact quadrants, reducing your insurance needs. Shift your strategies over time to reflect this change.

As you gain financial strength, you can progressively eliminate more and greater “losing bets” as the impacts of losses decrease. Redirect that money to making more “winning bets” to further increase your financial strength and improve your lifestyle.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

In a world where financial habits vary widely, the spending behaviors of the wealthy stand out as particularly intriguing.…

Copyright © 2024 Retiring & Happy. All rights reserved.