How the Inflation Reduction Act Impacts Medicare Part D

The Inflation Reduction Act of 2022 is a law aimed to combat inflation and lower healthcare costs for millions of Americans. This Act offers provisions to help fight the national deficit, promote clean domestic energy, and, notably, reimagine the Medicare Part D program by cutting the cost of prescription drugs.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

On August 16, 2022, the Act was signed into law by President Joe Biden. Once fully implemented, the Inflation Reduction Act will tremendously impact seniors participating in Medicare Part D plans.

How Does the Inflation Reduction Act Impact Medicare Part D Costs?

The Inflation Reduction Act aims to help reduce overall drug costs on Medicare Part D plans by using three main tactics.

- Allow Medicare to negotiate the cost of high-price drugs

- Create an annual maximum Medicare Part D out-of-pocket cap of $2,000

- Cap insulin costs at $35 per month for Medicare part D enrollees

Once implemented, each of these cost-saving tactics will help seniors on Medicare save millions of dollars each year in out-of-pocket spending.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part D Drug Negotiations

The Inflation Reduction Act of 2022 allows Medicare to negotiate the cost of expensive prescription drugs it covers. Due to the Medicare Modernization Act of 2003, Medicare could not negotiate costs with pharmaceutical companies.

The Inflation Reduction Act allows the Health and Human Services (HHS) secretary to negotiate drug prices on behalf of Medicare for up to ten prescription drugs by 2026 and an additional 15 drugs per year until 2028. Then, the HHS secretary may negotiate the prices for up to 20 drugs per year in 2029 and beyond.

There will be limitations on drug types that the HHS secretary can negotiate. However, the Act also provides a penalty for drug companies choosing to increase costs for Medicare-covered medications over the annual inflation rate.

To put this in perspective, in 2020, the prices for over half of all drugs covered by Medicare rose at a rate higher than inflation. The Inflation Reduction Act hopes to stop unnecessary drug price increases.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part D Maximum Out-of-Pocket Cap

Medicare Part D plans utilize drug phases that determine your out-of-pocket cost for prescription drugs. You progress through each phase by meeting a certain threshold in drug expenses.

Once you meet one benchmark, you move to the next phase, and so on.

The catastrophic coverage threshold for a Medicare Part D plan includes the total amount you spend out-of-pocket during each phase plus the manufacturer discount during the coverage gap phase (donut hole).

The Inflation Reduction Act will end the 5% catastrophic coverage coinsurance by 2024 and introduce a $2,000 maximum out-of-pocket limit on Medicare Part D plans by 2025. Essentially, the Act would eliminate catastrophic coverage and the donut hole.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part D Insulin Cap

One of the most prominent issues impacting seniors today is the high cost of insulin through Medicare Part D plans. When proposing the bill, lawmakers set their focus on lowering the cost of this life-saving drug. Millions of Medicare Part D enrollees depend on insulin to survive each day.

According to a Yale University study, nearly 25% of all Medicare Part D insulin users ration their insulin below the recommended dosage to cut costs. The Inflation Reduction Act creates a monthly cost cap of $35 for insulin. This means a month’s supply of insulin covered by Medicare Part D will become a fraction of the current cost for many beneficiaries.

In addition to providing an insulin cost cap, the Inflation Reduction Act will eliminate cost-sharing for vaccines Medicare Part D plans cover, and expand low-income subsidy eligibility by 2024.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Next Steps for the Inflation Reduction Act of 2022

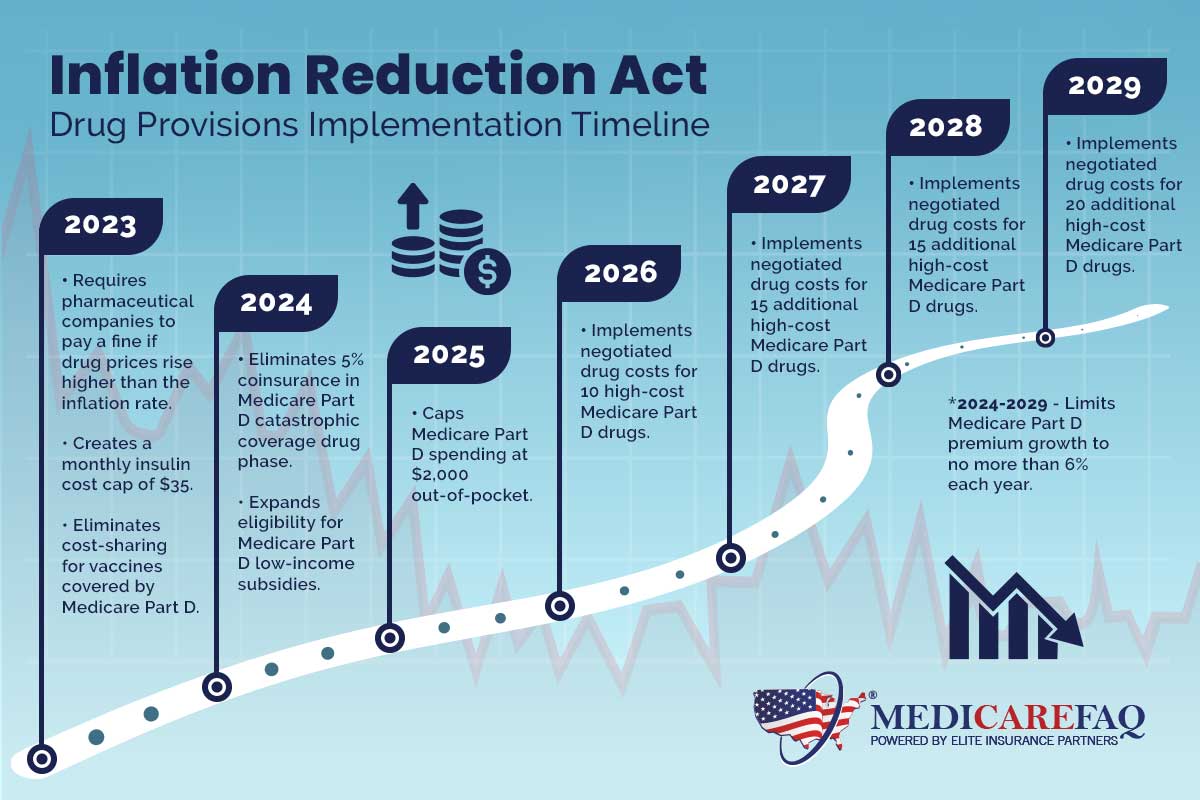

On August 16, 2022, the Inflation Reduction Act was signed into law. The next steps are to implement the law based on the timeline below.

Please review the implementation timeline for Medicare Part D provisions below:

- 2023 –Requires pharmaceutical companies to pay a fine if drug prices rise higher than the inflation rate, creates a monthly insulin cost cap at $35, and eliminates cost-sharing for vaccines covered by Medicare Part D.

- 2024 – Eliminates 5% coinsurance in Medicare Part D catastrophic coverage drug phase and expands Medicare Part D low-income subsidies eligibility.

- 2025 – Caps Medicare Part D spending at $2,000 out-of-pocket.

- 2026 – Implements negotiated drug costs for 10 high-cost Medicare Part D drugs.

- 2027 – Implements negotiated drug costs for 15 additional high-cost Medicare Part D drugs.

- 2028 – Implements negotiated drug costs for 15 additional high-cost Medicare Part D drugs.

- 2029 – Implements negotiated drug costs for 20 additional high-cost Medicare Part D drugs.

- 2024-2029 – Limits Medicare Part D premium growth to no more than 6% yearly.

Today, I bring you a guest post from a couple of nomadic retirees, Tom Swan and Georganna Hawley. They’ve…

Copyright © 2024 Retiring & Happy. All rights reserved.