Portugal Trip Recap Plus December 2022 Early Retirement Update

Hey folks, it’s 2023! I hope everyone had a great time with friends and family over the holidays, and rang in the New Year in style!

We had a very busy December. We were vacationing in Portugal during the first week of December, and then sailed from Lisbon to the United States aboard the Norwegian Epic to get back in plenty of time to celebrate Christmas at home.

Once back home in Raleigh, we went to a couple of family gatherings to celebrate Christmas. Our New Years Eve plans got canceled due to the hosts getting sick, so we watched the ball drop at home this year.

Financially, December was a mixed month for us. Our net worth dropped by $92,000 to end the month at $2,626,000. Our income was excellent at $19,599 for last month, while our spending was incredibly low at only $1,271 for the whole month of December.

Let’s jump into the details from last month.

Income

Investment income totaled $17,860 in December. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. The majority of the quarterly dividends arrive at year-end in December. As a result, we had a gigantic amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $643 for the month. I think this is the “new normal” for blog income unless I start posting a lot more frequently.

My early retirement lifestyle consulting income (“consulting”) was $175 in December. I only booked one hour of consulting last month. I am glad the pace of my consulting side hustle slowed down while we are traveling a lot.

Tradeline sales income totaled $375 in December. This source of revenue seems to be soft right now as well, as I don’t currently have any new sales. This means January, and potentially February, will be $0 income months for tradeline sales. I ramped up my tradeline sales in 2020 and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post.

For December, my “deposit income” totaled $26. Of this total, $16 of the “deposit income” comes from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus.

The remaining $10 of “deposit income” came from a pair of $5 bonuses from our Chase credit cards. They were offering $5 cash back when you spend $5 or more at any grocery store on two different cards. Since everyone buys groceries, it was really easy to complete this grocery cash back offer.

December Youtube income totaled $118. Youtube only pays out when you exceed $100 in accumulated revenue. Recently, my Youtube earnings have been just under $100 per month on average, so it’s a nice surprise to see this revenue stream actually increase when my other income streams are shrinking.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

Closing out the income from December: a $400 bonus came from a US Bank business checking sign up bonus.

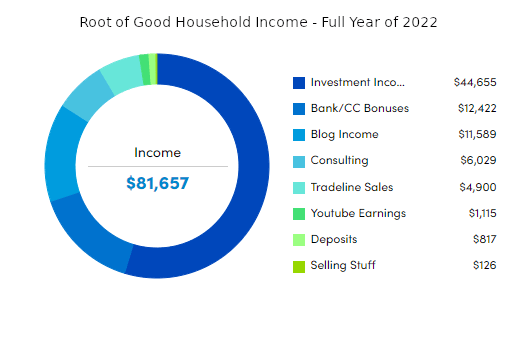

2022 Whole Year Income Summary:

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Personal Capital.

PROMOTION!

This month only, Personal Capital is giving out a free $100 Visa gift card when you sign up to use their expense tracking and portfolio management service AND have a no-obligation chat with an advisor who will take a look at your portfolio and come up with some recommendations.

Fine print: a $100 Visa® gift card for new users that participate in both an initial call and advisory recommendation with a Personal Capital advisor. New users have until February 28th, 2023 to meet with our advisors, but they must sign-up before January 31st 2023 to qualify for the reward.

Steps:

- Sign up for our free, easy-to-use financial tools. You MUST use that link to sign up for Personal Capital to qualify for the bonus. (this is the same link if you want to copy/paste: https://personalcapital.sjv.io/c/336145/1439390/13439 )

- Link bank and investment accounts of at least $250,000 (savings, investment accounts, employer-sponsored 401ks, etc.)

- Receive a free financial analysis after talking with an expert by February 28th, 2023.

- Earn a FREE $100 Visa gift card!

Free money, folks.

(obligatory affiliate disclaimer: Personal Capital Advisors Corporation (“PCAC”) compensates Root of Good for new leads. Root of Good is not an investment client of PCAC. )

Expenses

Now let’s take a look at December expenses:

In total, we spent $1,271 during December which is about $2,000 less than our regularly budgeted $3,333 per month (or $40,000 per year). Groceries and travel were the two highest categories of spending in December.

Detailed breakdown of spending:

Groceries – $521:

We spent a tiny bit less than usual on groceries in December. Mrs. Root of Good and I were away from home for more than half the month. We stocked up on groceries in November before we left, so the December grocery bill was smaller than usual.

The latest inflation-related grocery price shock hit us the first few days of January when I started a new online grocery order. I started to add eggs to my shopping cart and then realized the 36-pack of eggs we bought a week earlier now comes with a two digit price tag. The price-per-dozen jumped from $2 to $5 over the course of a week at Walmart!

As a temporary workaround, we are trying the liquid egg whites and adding those to fresh eggs when making scrambled eggs. So far, so good. And the liquid egg whites, on sale, were a third of the price of the fresh eggs. Hopefully the supply chain catches up at some point and we get back to calling our eggs “eggs” instead of “chicken caviar”.

We’ve also switched to eating more meat since boneless lean trimmed chicken and pork are both much cheaper than eggs now! Economists call this act of buying one item that’s cheaper than a similar item “substitution”, but it kind of feels like a trade up, and not a trade down.

Travel – $384:

We had already paid for most of our week in Portugal and our cruise in previous months, so the travel spending in December was rather modest even though we spent more than two weeks overseas (and literally over the sea, in the case of the cruise!).

Our $384 in travel spending in Portugal (plus a tiny bit on the ship and in New York City getting home) was roughly as follows:

- attractions (Pena Palace, Quinta da Regaleia, Batalha Monastery) – $64

- ubers and public transit – $40

- restaurants – $100

- car rental for four days – $37

- gas for rental car – $50 (gas gauge was messed up so I ended up filling the car too much!)

- lodging for 1 night in Lisbon – $43

- groceries – $50

Since we were traveling off season, the lodging rates in Portugal were ridiculously low. In November, we prepaid $87 total for three nights in a 1 bedroom apartment in Nazare for example. It was admittedly a tiny apartment by American standards, but very functional for our 3 day stay. And it came with a nice rooftop terrace.

This was a great trip and didn’t cost much at all for more than two weeks of vacationing for the two of us (the kids stayed at home because they had school).

Our flight to Lisbon and our NYC to Raleigh flight were both free thanks to airline points. Lodging was very affordable as were the restaurants and groceries. The rental car was incredibly cheap too (about $10 per day for an automatic).

The only crazy spending area was gas. I ended up paying about twice as much to refuel the car because the gas gauge was broken. I tried to refill the car to 7/8ths of a tank but the gas gauge never moved higher than 6/8ths. So I ended up filling tank to “full” (an extra one quarter of a tank of gas). It’s a tiny euro car so it only holds 10-12 gallons in total, so still not a huge additional expense. I did have to argue (successfully) with the rental car staff that the car is, in fact, full of gas and therefore I should not have to pay for extra gas charges imposed by the rental company. Oh well, such is life!

Keep on reading if you want to see a full trip recap. It’s at the end of this blog post.

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now the Chase Ink business cards offer 90,000 Chase Ultimate Rewards points that can be redeemed instantly for $900 in cash. And if you have a Chase Sapphire Preferred or Chase Sapphire Reserve card, those 90,000 Ultimate Rewards points are worth $1,125 or $1,350 (respectively) towards Airbnb or other travel reservations. This is the highest offer ever on the Chase Ink Unlimited/Cash cards and may not last too much longer. Mrs. Root of Good and I each received our new Chase Ink Unlimited cards during December.

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

Utilities – $324:

The total utility spending was $324 last month.

We spent $143 for the water/sewer/trash bill.

The natural gas bill, which provides heating and hot water, totaled $94 for last month. This bill covers mostly the month of November when we ran the heat a moderate amount.

The electric bill totaled $88 last month.

Gas – $35:

A half tank of gas for $35. Our daughter is in college and topped off the tank while we were out of town (with our credit card).

Healthcare/Medical/Dental – $9:

Our current 2023 health insurance costs $18 per month, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$45,000 per year Adjusted Gross Income. We didn’t have to pay the premium in December (for coverage during January) because we paid it in November.

We signed up for 2023 dental insurance plans and paid one $9 premium in December. I chose a very basic plan for $9 per month for me that covers most preventive care but no fillings. Mrs. Root of Good has a different set of dental needs than I do so we kept the more comprehensive $20 per month plan for her (same as 2022’s plan). Mrs. Root of Good’s next dental insurance bill comes due during January since we prepaid in November for the first month of coverage.

By buying insurance, we should save a couple hundred dollars on my dental care. For Mrs. Root of Good, we will still save a few dollars compared to paying cash for the preventive dentist visits throughout the year.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

Full Year Spending Summary for all of 2022

Our spending totaled $29,449 for all of 2022. This annual spending is about $10,000 less than what we budgeted for in our $40,000 annual early retirement budget.

Looking back, I can’t really believe the numbers. I feel like we live a $100,000 per year lifestyle but somehow it only costs us $30,000 to $40,000 per year. We literally spent less than the poverty line once again in 2022. However this doesn’t feel like poverty!

Travel topped the list of expenses for 2022 at roughly half of our total spending. That isn’t too surprising since we spent three months abroad in 2022. We spent two months in Europe and another month spread across several cruises of five to ten days each.

2023 travel spending might be a bit lower mainly because we have over $10,000 in Airbnb gift cards that we got for free in 2022 by cashing in some Chase Ultimate Rewards points. And our $2,600 10 night family cruise during Christmas 2023 was also free thanks to Chase Ultimate Rewards points (redeemed through our Chase Sapphire Reserve card).

Our other annual expenses were pretty normal with groceries, utilities, insurance, and taxes being the top categories of “non-discretionary” spending. That’s just the cost of a basic lifestyle in the United States in a mortgage free home.

The Education costs for 2022 totaled $481 and most of that was the cost of college books for two of our kids that are in college. These expenses are actually reimbursed from their 529 accounts so it’s not eating into our taxable brokerage account balances. In fact, education was a net money-maker for our household since our oldest daughter got a nice financial aid award that covered books, community college tuition, and some living expenses.

2023 education expenses should be fairly modest thanks to the 529 accounts and financial aid. In 2024, I expect college costs to creep up as one or both of our daughters will be at four year state universities where the tuition is higher than the $0 tuition at the community college.

Other big spending for 2023 will be a used car. We failed in our attempts to acquire one during 2022 but that’s okay. The market appears to be cooling off a bit, since I am finally seeing a few cars under $10,000 that aren’t complete pieces of junk.

Monthly Expense Summary for 2022:

- January – $1,193

- February – $2,535

- March – $5,356

- April – $1,321

- May – $2,972

- June – $3,782

- July – $2,947

- August – $1,398

- September – $2,527

- October – $1,565

- November – $2,586

- December – $1,271

Summary of annual spending from all years of early retirement:

Net Worth: $2,626,000 (-$92,000)

Another rocky month in the stock market. Seeing six figure gains or losses (or close to it, in the case of December) is fairly routine now. This past year serves as a good reminder that the stock market is a great place to get excellent long term returns but sometimes a poor place to get good short term returns.

Stocks and bonds got crushed in 2022. Equities were down 16-20% for the major US and international index funds. Bonds didn’t fare much better, with the Vanguard Total Bond Market Index Fund down 13% in 2022!

The one silver lining in 2022 is that value stocks held up much better than growth stocks. The Large Cap Value and Small Cap Value funds at Vanguard were down only 2% and 9% respectively in 2022. I have a strong tilt toward value stocks so I didn’t have as bad of a year as many other folks did (but the previous decade wasn’t as kind to us value investors!).

The thing no one is talking about is real returns. Not only did equity and bond investors lose double digits in nominal terms, they also lost 7% to inflation in 2022! In real terms, an investor in 100% VTSAX (Vanguard Total Stock Market Index) would be down 26.6% in real terms. Ouch. Not a fun year.

Of course the first week of 2023 has been very kind to stock market investors so far. I still don’t know if we are in a recession, or about to be, or if we managed this “soft landing” that I hear about in the news. It definitely doesn’t feel recession-y yet, but I don’t know if the job market and economy are as overheated as they were a year ago.

My investment approach is the same as always: do nothing, and let an equity-heavy portfolio generate long term returns well above inflation over the next several decades.

For the curious, our net worth reported above includes our home value (which is fully paid off). However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

More Thoughts on our December trip to Portugal and Transatlantic Cruise

The week in Portugal plus 9 days on the transatlantic cruise back home was our first big trip away from home without the kids since the pandemic started three years ago. We went on a couple of cruises out of Charleston in 2022, but that didn’t feel the same since you really don’t do as much exploring and sightseeing on a cruise, given the limited time you’re actually in port.

It was nice to get away for a bit and do some travel with just Mrs. Root of Good and I. We had a busy three days in Sintra, just outside of Lisbon.

Over the course of two days, we toured the Pena Palace and the Quinta da Regaleia.

After leaving Sinta, we took the commuter train back to Lisbon. Once in Lisbon, we picked up a car for four days and headed to the coast to Nazare.

Nazare is known for having the largest waves in the world, sometimes exceeding 80 feet. While we were there we “only” saw waves approximately 25 feet tall (about five surfers high). We enjoyed exploring the cliffside and beach in Nazare where the big waves are. We visited the Forno de Orca Cave but we could only look into it from above since the entrance was flooded during high tide.

On the way to and from Nazare, we drove through the countryside and skipped the toll roads. Of course we saved $40 or so in tolls and rental car toll pass charges. But the main goal was to take the scenic route through the countryside.

We stopped in the town of Obidos on the way north to Nazare. The town was surprisingly packed, perhaps thanks to the Christmas market and temporary ice skating rink in the village square. We spent most of our day in Obidos walking the castle walls surrounding the town.

For lunch, we packed some fruit, bread, cheese, and presunto (the Portuguese cured ham that is basically prosciutto). After spending the morning walking the perimeter of town along the wall, it was nice to break for a picnic in the castle forecourt overlooking the town of Obidos.

Then on the return trip from Nazare back to the south to Lisbon, we took a 30 minute detour to visit the town of Batalha and the Batalha Monastery.

Further south along the road to Lisbon, we enjoyed lunch in a roadside diner in Rio Maior. After lunch we visited the saltworks or “Salinas de Rio Maior”.

Once in Lisbon, we settled into our hotel for the night not too far from the cruise ship and enjoyed takeout Chinese food and sushi from our balcony.

Then the next morning we slept in late, got up, and hopped aboard the Norwegian Epic for our 10 day, nine night journey back to New York City. The ship’s itinerary included two ports of call at the Azores and in Bermuda. Unfortunately, a river pilot’s strike delayed our departure from the Port of Lisbon for ten hours so we had to cancel the stop at the Azores.

Then we were facing an almost-tropical storm in the Atlantic, so our ship steered more southward to avoid the brunt of the storm. We were still facing hurricane category 2 apparent winds of 96 mph at the peak (at least what I observed from the onboard weather station). I now know what it feels like to sit in a hot tub 15 decks up on a ship with rain pelting the back of my head with hurricane force strength. Check that off the bucket list!

The strong headwinds cut our ship’s speed in half for several days so we were well behind schedule as we approached Bermuda. The captain made the call to cancel the Bermuda stop as well due to how far behind schedule we were.

We had relatively calm seas on the Bermuda to NYC stretch of the trip, and eventually we made it to New York City on time. In the end, we spent 9 full days at sea and didn’t see land till we woke up in New York.

This was our first transatlantic cruise and probably won’t be our last. There were a few days of rough seas that tossed the boat around plus a few days of very nice weather in the latter half of the cruise. Other more experienced passengers told us that this was one of the rougher crossings they have been on, and it didn’t seem so bad to me.

I liked what another passenger said about this cruise:

Even with all the storms we’ve been through, crossing the Atlantic on this ship is way more luxurious than flying from Europe to America in first class on a plane. Assuming you have the time to spare.

I couldn’t agree more. It might have been nine days at sea with the disappointing loss of both of our port stops. But we were well fed, well entertained, and well rested the whole time. We were fortunate to have a balcony room where we enjoyed views of the sea for nine days straight. Our computer was full of downloaded Netflix shows and movies and games. Our phones full of books and games. And the nightly shows and music kept us busy as well.

Considering the cost of the cruise was about $400 per person, it didn’t cost a lot more than a one way flight from Europe to the United States. And it definitely proved more comfortable!

Life update and Exciting News!

A few days after this post goes live, we will be setting out again on another cruise. This time we will spend ten days cruising the Caribbean with ports of call at five different islands. I’m looking forward to the warmer weather since it’s been a bit chilly here in Raleigh on some days.

After we get back from the cruise, we have nothing planned for February through May and it feels glorious right now. Maybe we get bored and end up going somewhere. Or maybe we just rest and relax at home before a busy summer, fall and winter 2023-24 travel season. Lots of possibilities…

The big trip we have planned this fall will take us to Ecuador for a couple of weeks. Over the Christmas holidays, I got an inquiry from Cheryl Reed, the organizer of the Chautauqua FIRE retreats that are held in Ecuador each year. She invited me to come down there and give a speech at the next FI Chautauqua to a group of 20-30 FIRE-seekers.

I agreed to speak, so I’ll be down there in Ecuador in late September through early October. Here’s the FI Chautauqua website if you are interested in joining us down there.

Key details: The Chautauqua (which means “talks”) will be held September 30 to October 7, 2023 and will begin and end in Quito, Ecuador. Free transfers are provided from the Quito airport to the hotel in Ibarra, Ecuador where we will spend the week together.

The speakers are Karsten from Early Retirement Now, Justin from Root of Good (me), Cheryl Reed from Above the Clouds Ecuador and Fritz from The Retirement Manifesto. The other two FIRE bloggers are very sharp folks and I’m looking forward to seeing them. I had the pleasure of hanging out with Karsten (aka Big ERN) at CampFI Midatlantic a few years ago and was impressed with his knowledge of all things finance and FIRE (he is a PhD economist, after all).

Prices for the event are $1,850 per person for couples ($3,700 total), and $2,200 for one person in a single room. Almost everything is included such as transportation, tours, meals, and lodging. The main thing you have to pay extra for is your airfare to Ecuador and alcohol at the hotel or at bars/restaurants when we’re out adventuring. But I’ve been assured that beers are only $2-3 each at the hotel so not exactly budget-breakers at that price.

Past guests overwhelmingly say they had a great time. So this Chautauqua seems like a good opportunity for someone interested in FIRE and needing that personal connection to get things going, or keep things on the path to FIRE. The organizer said the event typically sells out within a few weeks, so do not delay if you are interested in attending.

If you’re interested in joining us in Ecuador, the FI Chautauqua website has more info. Also, drop me a line in the comments because I’m curious who’s going!

Well folks, that’s it for me for this month. See you soon!

Did you have a good holiday break? I bet you’re ready for spring to arrive!

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* – It’s the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it’s FREE?

- Interactive Brokers $1,000 bonus* – Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* – We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* – Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

* Affiliate links. If you click on a link and do business with these companies, we may earn a small commission.

Editor’s Note: Today’s guest column on the potential for a “business bonanza” in 2025 comes from Manward Press Chief…

Copyright © 2025 Retiring & Happy. All rights reserved.