Why Cutting Costs Beats Getting Rich Quick

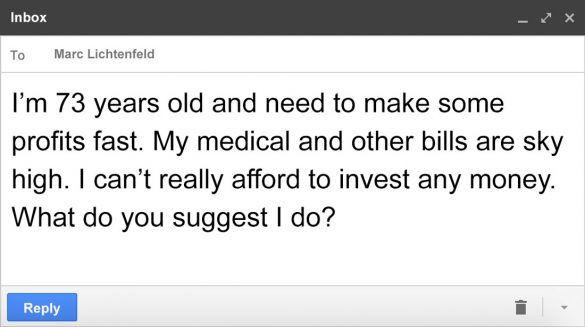

Some of the emails I receive are heartbreaking.

They typically read something like this…

It would be easy for me to say, “Sign up for one of my trading services, which are designed to generate large and fast profits on stocks and options.” But that would be the worst advice I could give. Trading stocks in the hopes of making big gains quickly should be reserved for investors who can afford to take risks because sometimes the trades don’t work out.

An investor who is desperate for profits will no doubt make decisions based on fear, which is a huge mistake. Acting on any decision that is tainted by emotion is not a smart way to trade or invest. Furthermore, it will cause a lot of stress if the investor is worried about losing money because they will continue to worry even if the trade is working.

I’d love to have a magic formula for how a person can take no money and turn it into a lot of money – without any risk. But that doesn’t exist.

That being said, there are steps one can take to ensure that the weak financial position they’re in is better in five or 10 years. Ten years may sound like a long time from now, but if someone reaches age 73 with no money, imagine how difficult it will be for them at 83.

The first thing I’d suggest for anyone in this situation is to work any way you can. That doesn’t sound too enticing, particularly if you’re older, I know. But you need some income coming in so you can start putting it away for the future. You don’t have to be a Walmart greeter either.

Love pets? Consider pet-sitting. Love kids? Babysit or tutor.

The important thing is to save and invest those funds – don’t just use them to make your life a little easier today. Whatever income you can bring in will help.

Look at where you can cut costs. Do you have a cable TV package that is not necessary? A home phone and a cellphone? Consider getting rid of the landline. That could save you hundreds of dollars a year.

Do you have insurance policies you no longer need? Life insurance should be used to replace income or cover funeral costs when you die. There aren’t many other reasons to carry life insurance.

If you do have life insurance and it’s not necessary, get rid of it. Sure, it’d be nice to leave something for your kids. But if those thousands of dollars you’d pay in premiums per year would let you breathe a little easier, or could be invested for growth and income, they’d be better off in your pocket.

Whatever extra income you can put in your pocket or costs you can save, get that money earning interest or growing. It’s hard to think about the future when today is a struggle, but it will be much worse years from now if there are no funds available and your expenses are even higher.

The worst thing you can do is enter into a risky investment when you can’t afford to lose money. If you have a little bit of cash that you’ll need soon, look for a high-yield money market account or certificate of deposit. If you have a few years before you’ll need the money, consider investing in a blue chip stock that raises its dividend every year. That way you’ll earn some income while the stock grows. But remember, even the most conservative stocks aren’t guaranteed to go higher.

Whatever you do, if you need money now, don’t do something rash or take on more risk than you can handle. That kind of action usually leads to disaster.

The specifics of the packing list for the Camino de Santiago don’t matter as much as the main idea:…

Copyright © 2024 Retiring & Happy. All rights reserved.