Reader Story: How We Live a Nomadic Life in Retirement

I recently made a call for readers to share their stories to supplement posts by Darrow and me. First up is Margot who shares her and her husband Nick’s story.

Their path to and through retirement includes overcoming adversity in their personal and financial lives, challenging our notions about how much is “enough,” the power of flexibility and creativity, and finding the courage to live your best life in retirement.

(Disclosure/Editor’s Note: This post contains a number of links to resources Margot has found helpful. One is NewRetirement, a longtime affiliate partner of the blog. All of the other links are included for your convenience. We do not make any money if you click those links, and the inclusion of links to any of those sites does not imply that this site has vetted or endorsed them.)

Take it away Margot. . . .

What an honor to contribute a blog on this site. The resources and advice have been so helpful to me as we navigate life beyond work.

We are Margot and Nick, 70 and 75 respectively. We travel full-time. People call us nomads, vagabonds, wanderers, or “slowmads”—our preferred style is to stay in places for 1-3 months at a time. We hope to continue for at least the next 5 years, good health and attitudes allowing.

All of our belongings are in a 10×10 storage shed in Washington state. Our doctors, dentists and virtual mailbox are also there. We own no real estate or pets. We have no grandchildren and our parents have long since passed. Each of us has one child and they are on their own at the ages of 32 and 38. Our knees are still good.

We have about $750,000 in savings and investments. I took my Social Security on my own work record this month. With the assistance of plans created via NewRetirement and Schwab, we will spend to our guesstimated earthly ends. This is also called Die With Zero (the title of a very interesting book by Bill Perkins). The kids will be alright.

Where did the vagabond dream originate?

It all started in 2006 when Nick and I were matched up via It’s Just Lunch (a dating service) in Orlando, Florida. From the get-go we talked about traveling—the places we still wanted to experience.

Nick had lived in Parma, Italy as a teenager and hitchhiked Europe in his 20s. I had grown up on military bases around the world…. And, then, we started watching House Hunters International on HGTV and the dreams started to gel. At the time we were 58 and 53.

Nick was laid off from his communications position in 2010 at the age of 62. He was a graphic designer and writer—it was not his first downsizing rodeo.

So he decided to hang it up and take Social Security early. He found a high deductible Blue Cross/Blue Shield policy until Medicare kicked in. A small percentage of a family business plus Social Security kept him afloat.

Related: When to Take Social Security

Nick’s divorce and lay-offs had taken their financial toll on his savings. In 2010, he moved into my very underwater and highly mortgaged Orlando area home (thanks to a 2006 divorce, exorbitant home appraisal and the subsequent 2008 housing crisis). It was a paycheck to paycheck life.

What Kicked Us Into High Gear?

Life turned on a dime in 2011. Nick proposed; I was offered a job across the country at lower pay BUT it came with a house.

We got married on a beach in St. Thomas. We drove cross-country from Orlando to California. I persuaded the bank to allow me to do a short-sale of my Florida home. And stopped paying the mortgage, citing hardship as my salary was reduced by ⅓ at the new job. I kept up all utility, pest, and lawn maintenance for the Florida property.

Nearly 9 months later, a week BEFORE the house’s foreclosure hit a Tampa court, the short-sale settled. $180K of debt flew off my shoulders and, thanks to federal legislation, was not taxed as income. And a nice family got a great, well-maintained house at a price below what I had paid for it in 2001.

Living With Cancer (X2)

Then a hammer fell—at his Medicare exam in 2013, Nick’s PSA was 147. A tumor on his spine translated to Stage 4 (terminal) prostate cancer. Only 28% of men with his diagnosis survived for 5 years. We were still newlyweds.

A friend advised us to look at the disease through a quality of life lens. Nothing like cancer to stir the Live Your Life Live Your Life attitude! So we started dipping into my 401K and took 3-5 week vacations, thanks to my understanding bosses, to many of the places we’d dreamed about our first few years together.

After 4 years, I started to joke he’d better die or we would go broke. But, damn, he just kept on living. Miraculously, stripping his body of testosterone via drug therapy paused the cancer’s growth. And we kept draining our savings. But we knew then (and still know now) that the drugs could stop working at any time.

And then, a second hammer fell in 2019. I was diagnosed with Stage 2B breast cancer. I scheduled professional responsibilities around my treatments. Doing radiation at 7 am was chosen so I could put in a full-day’s work. I took a total of 3 sick days when I had surgery. In retrospect, what was I thinking?

Something needed to change. The stress and 60 hour+ weeks couldn’t possibly be good for me. I was working more and enjoying it less. (BTW, I had a lumpectomy and radiation and there is no current evidence of disease, thank goodness).

The Change or Die Point

In May, 2020, I hit a professional and personal wall. I was working my tail off addressing the challenges COVID created for my organization. There were deep and rancorous divisions of opinion about the best ways to manage the business.

I figured that I was being paid for my brain. But my advice and work were falling on deaf ears. Why was I still working?

Can I Retire?

I didn’t think I had enough money to stop working. All my retired friends—the ones with corporate jobs or jobs with pensions had $1.5-$2M saved. All the calculators said I had to have 10-20 times my income. I wasn’t anywhere close to that.

I had only started maxing out my 401K when I got my first 6-figure job in 2001. My divorce had taken a financial toll on me. And we had spent a ton on travel, thinking Nick’s death was imminent. We had run up credit card debt. My 401K sat at $350,000, and I had $80,000 in savings—hardly enough to live on. My only choice looked to be dying at my desk.

A Tragedy…. and a Blessing?

But fate and tragedy had intervened. My younger brother—a Type I diabetic—died in his sleep at the age of 63. He was always playing his blood sugars close to the bone and he never revealed a heart condition to me or our other brother. His two wives were in the rear-view mirror and he had no children. He also had 14 acres and a paid-off house.

The real estate market was a hot one and my surviving brother is a realtor. Within 18 months, we sold the house and 4 additional lots. Now, every journey starts with a toast to my late brother.

May 8, 2020 was a particularly difficult day at work. I walked the 9 steps from my office to our (attached) house and told my husband I had written my employers to negotiate a separation agreement. It was time for me to own the minutes and hours of my days. I was done with deadlines and pleasing others. The red ball came off my nose.

Nick was thrilled—he had seen how discouraged I was. No more Crabby Appleton. We opened a bottle of champagne and started to figure out how we could afford to live for 3 years before I took Social Security. We crunched numbers and made lists of countries.

A Financial (and Personal) Reboot

Thanks to the sale of family property and a good year for the stock market, we paid off all our debts and invested the rest. We now owned no real estate.

I ran the numbers again. If we kept annual expenses between 75-100K, our nest egg of $750K would—barring some unseemly tragedy— last us a lifetime. We keep a 2-3 year cash bucket (in a T-bill ladder) and don’t plan to touch investments until 2025.

I have a handful of speculative stocks in a Roth IRA that my late tech-geek brother recommended that may yet pay off (e.g. JOBY, IONQ, LVWR). This rocky market fascinates but doesn’t scare me.

Between May and August of 2020, we sold, donated and tossed most of our stuff and relocated to Washington, a tax-free state. I culled belongings and artwork by imagining what I wanted to be surrounded by in my 80s when we settle down. The storage unit is like a second-hand store where I want to buy everything in it!

A friend advised me when I quit to do absolutely nothing for the first 6 months. What did I want to say YES to? We sat in a waterfront cottage and turned our dreams of international travel into 5 years of plans.

Hitting the Road

We spent two months each in Honolulu and Croatia and three months on Lake Como in 2021.

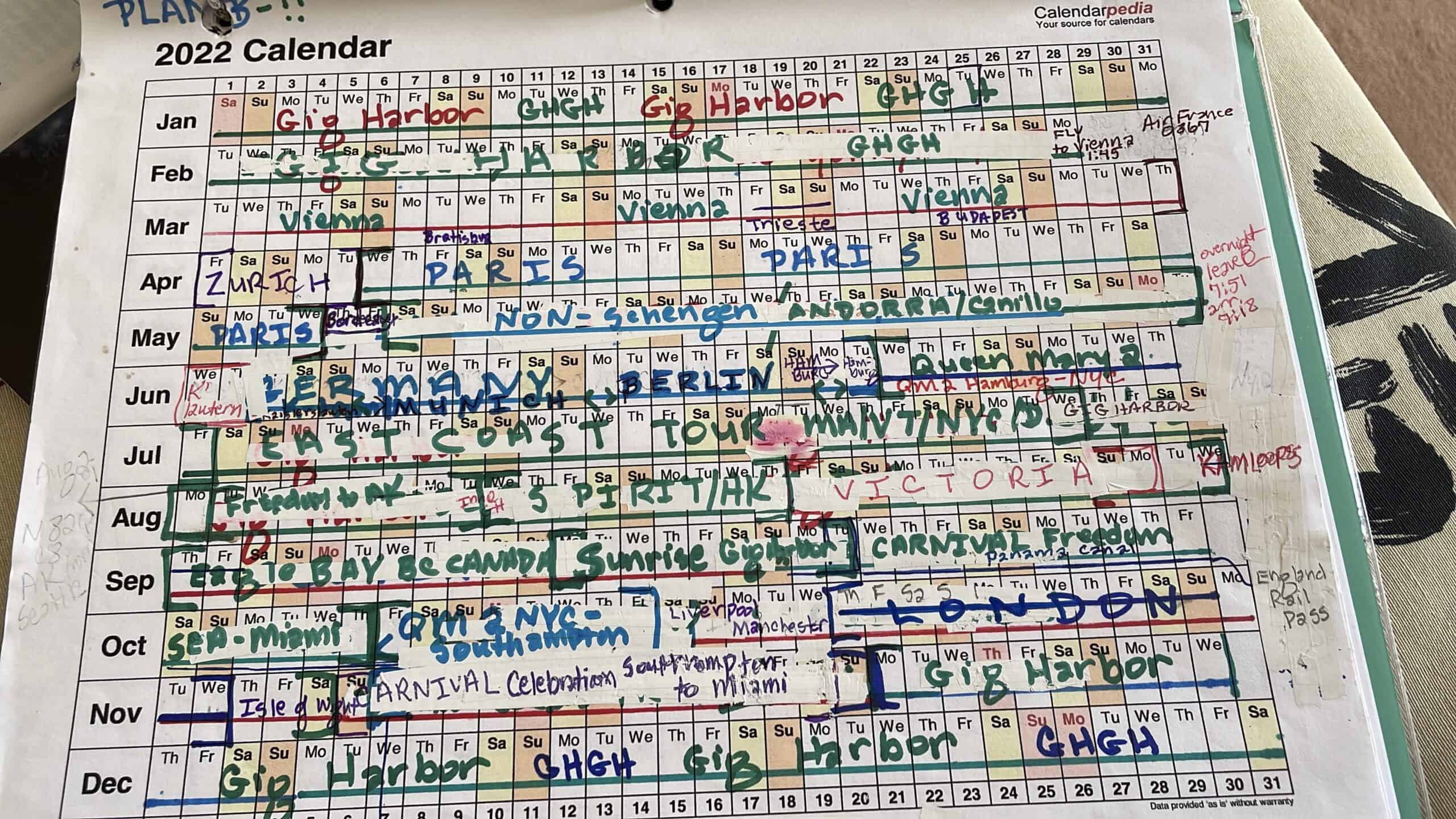

In 2022 we slept in 57 beds—a month each in Vienna, Paris, Germany and Andorra, a month-long road-trip through western Canada and another road-trip from Maine to South Carolina to see relatives and friends. We’ve taken 5 post-COVID cruises with 12 more booked through 2025.

We flew to Bonaire in February for a month, then jumped to Aruba before a 21-day trans-Atlantic cruise to Barcelona where we are now. We’ll head to a beach house near Valencia for another month before heading to England, Norway and Scotland.

2024’s plan is Sydney, Auckland, Perth, Bali and a world cruise.

2025 will be the year of South America: Lima, Cuenca, Santiago, Montevideo and Sao Paolo and then Lisbon, Tenerife, Isla de La Palma, Funchal and Porto are in the consideration set.

We integrate 6-8 weeks of pet-sitting annually to offset the increasing prices of short-term rentals. We both have had pets our entire lives and we miss the cuddles.

Via TrustedHouseSitters.com, we’ve had 2-3 week sits in Vancouver, B.C., Washington State and England. We have 5 weeks scheduled for Australian Shepherds in England and a cat on the outskirts of London.

As its name implies, this international (and very searchable) fee-based membership site and app is based on trust. People who need care for their pets while traveling post all the details and invite applications, usually 1 week to 3 months out.

Generally via video conference, we interview with our prospective hosts. No money changes hands. An added bonus is eating all perishable food in the fridge and visiting new places.

Nomad Finances

We are NOT on vacation—we just live our lives in a series of different neighborhoods and cultures. Our core budget is $60K a year plus an additional $40K for splurgey travel for five more years. The transition from accumulation to spending has NOT been a problem for us. Social Security now covers 70% of our expenses:

- Accommodations: $30K (short-term rentals and hotels)

- Food: $15K (we like the occasional Michelin-starred experience but mostly cook “at home”)

- Cruises: $25K (generally, interior cabins. As a blackjack player, I also get dozens of offers for “comped” cruises. We cruise an ocean rather than fly over it whenever possible).

- Transportation: $10K (trains, planes and automobiles)

- Charitable giving: $8K (I’ve always given financial voice to my heart by giving at least 10% of my income to causes I care about).

- Clothing, mail, entertainment, etc. $5K

- Insurance, medical & taxes, phone: $7K

We expect our post-nomad expenses—in our so called “no-go” years to be around 60K, covered by our Social Security, using dividends and RMDs for shorter stints of travel.

Won’t You Get Bored?

“Boredom is the inability to pick up on subtle vibrations.”

–Colin Wilson

People wonder if we get bored. Never, ever! There are so many books to read and people to watch. We walk. Nick brings his watercolors or guitar.

We meet new friends and try new foods and learn new train and bus systems. We pack lighter and lighter—we now travel with two roller-bags and two back-packs.

Health “Care” vs. Health Insurance

And what about healthcare? We plan at least 2 months in Washington every year for medical and dental appointments and follow-ups.

Medicare will cover an emergency overseas. And we also have Med-Jet for emergency hospital-to-hospital air evacuations. We also buy the cruise/air carrier insurance. AND, for longer land stints, we get coverage via a quote from insuremytrip.com.

We are considering an annual travel policy but, at our ages, the choices are limited and expensive. Many nomad friends report excellent care overseas at very reasonable prices.

We are intentional about every step we take. We are more fearful of falls than COVID. A shower mat travels with us wherever we go. We avoid the dangerous habit of being 17 years old in our heads. The “3 points of contact” rule is mandatory (i.e. if there is a railing, we USE it). Also “one thing at a time”. We often caution each other about steps, uneven cobblestones and low beams.

We find accommodations via VRBO.com, Airbnb and expat FB pages. Short-term hotel stays are easy to book last minute via Hotwire. We play the points game with credit cards to avoid paying cash for air transportation.

Related: Travel More and Spend Less With Credit Card Travel Rewards

We belong to a GREAT FB page for nomads of all ages called Go With Less where information and tips are traded generously.

The Power of Flexibility and Creativity

Everywhere we go, everyone we meet is curious and sometimes envious about how we live. And wonder if they could do it. Over dinner last week, one of our new companions said they weren’t sure they had the guts to live like we do.

My response? All it takes is the willingness to be untethered. We are easy-to-please people with newly found flexibility about what life (and train strikes) throw at us.

And what happens when you can no longer travel at this pace?

Our endgame is to find an apartment in the little Washington State town where our storage shed is. And get a dog. And maybe cats, too.

The liberation of owning nothing is exhilarating. This way of being in the world is more fun than I ever imagined. Not working is more rewarding than I ever imagined.

Live your life. Live your life.

Chris’ Take Home Points

Man Plans, God Laughs

Many of you, like me, are planners. If we’re being honest a more accurate description would be control freaks. Reading through parts of Margot and Nick’s story made my heart race and palms sweat a little as I bet it did some of yours. To name just a few examples….

- Nick “hanging it up” after a layoff, despite not having his finances in order,

- Margot shortselling her house at the last moment before foreclosure,

- Holding “speculative stock” positions into retirement,

- Both Nick and Margot meeting what is many of our greatest personal and financial fears head on, receiving serious medical diagnoses.

And yet they not only manage life, but live a life of adventure most of us even with perfect health and far larger portfolios would be afraid to pursue.

Margot suffered the loss of her brother. She grieved his passing. Then, rather than dwelling on losing him or feeling uneasy about the money he left her, she made the active decision to focus on the blessing of receiving an inheritance, being grateful for what she received, and using it to live life even more fully from that point forward.

Reading this story will not make me stop being a planner, and I hope that is not what you take from it either. However, it will serve as a reminder for me, and hopefully you, that there are many things we don’t control. Inevitably things will happen, both good and bad (and sometimes both at once!), that are not in our plans.

Our success and failure in life and retirement are not ultimately determined by those things that happen to us, but in how we deal with and move forward from them.

The Role of Flexibility and Knowing When You Have “Enough”

A major factor in Nick and Margot’s ability to move forward is their ability to be flexible and creative. A likely factor for their creativity and unconventional approach is the idea that necessity is the mother of invention.

Many of us obsess about whether we have enough, and in the process end up with more than enough. Sometimes we end up with far more than enough.

There is a body of research showing most retirees will never draw down their retirement portfolios. This is a common pattern I observe in readers I’ve spoken to and supersavers I do planning work with.

Margot and Nick have low fixed costs (no home, no car, few possessions). They are able to find creative ways to lower housing, transportation, and travel costs (house/pet sitting, comped cruises, credit card travel rewards, flexibility, etc.).

They live a life of travel and adventure that people with far larger net worths only dream of. Charitable giving is also a priority.

Kudos to them for making this work and using the resources they have to build the life they want to live!

If you would like to share your story to help others learn from it, send me an email at chris@caniretireyet.com.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Personal Capital account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. Now he draws on his experience to write about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. You can reach him at chris@caniretireyet.com.]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

In a world where financial habits vary widely, the spending behaviors of the wealthy stand out as particularly intriguing.…

Copyright © 2024 Retiring & Happy. All rights reserved.