The First Step to Choosing the Right Retirement Calculator

I was recently invited to speak at the EconoMe conference about the process of creating more accurate retirement projections. In preparing for my talk, I reviewed Darrow’s extensive work on retirement calculators on this blog.

I want to expand upon a concept he’s written about: calculator fidelity. Understanding it is the first step in choosing the right retirement calculator to meet your needs.

Calculator Fidelity

In our listing of The Best Retirement Calculators, one way Darrow allowed sorting is by “fidelity.” Here is how he described this concept:

“Credit goes to Stuart Matthews of Pralana Consulting (affiliate link) for this helpful concept. By fidelity we are referring to how well each calculator can potentially reproduce reality — the realism of its simulation.

In a nutshell, to do a better modeling job, a calculator will need to collect more data, and more accurate data, from you. So, “fidelity” is also a rough measure of increasing complexity:

- Low-Fidelity — these calculators will feature just a dozen input fields or less, and usually perform only a simple fixed rate/average return calculation. They feature ease of use, and generally will require less than 5 minutes of your time to produce answers.

- Medium-Fidelity — these calculators add additional fields, usually handling multiple accounts with different asset allocations, and arbitrary financial “events” such as irregular future income or expenses. Generally they might require 10-20 minutes of your time to produce answers.

- High-Fidelity — these calculators will add even more input fields, the ability to compare scenarios, and often Social Security and tax calculations. Generally they will require at least 30-60 minutes of your time to produce answers. And they could easily require several hours to understand all the options, and collect and input all the data to take full advantage of their capabilities. But these calculators have the potential to be most accurate, assuming you take the time to enter good data, and assuming your guesses about the future hold true.”

Different Tools for Different Purposes

I find this concept of calculator fidelity extremely helpful in understanding these tools and choosing the best one for your needs. However, it understates just how different they are, which is “best,” and thus which you should choose.

In my presentation, I used an analogy of a steak knife and a chainsaw to contrast the magnitude of difference between low and high-fidelity calculators. At their core, a steak knife or a chainsaw is a cutting device. Each serves a purpose.

If you order a nice filet mignon, a steak knife is clearly the “best” cutting tool. But if a wind storm takes down a tree in your yard, the steak knife is useless. You want the chainsaw.

This is similar to the magnitude of difference between low and high fidelity retirement calculators. They’re both calculators at their core. But they are very different tools serving different purposes.

This can best be demonstrated with a case study run on a few of the best calculators in their class.

Case Study Parameters

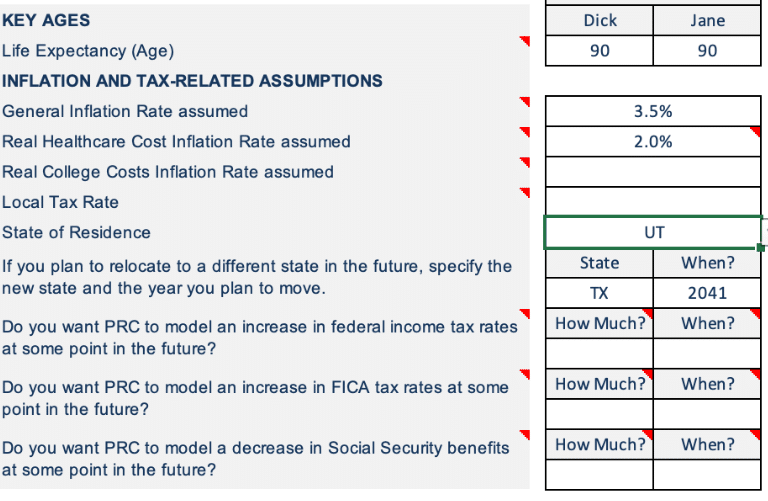

I created a relatively simple case study to showcase calculators at different fidelity levels. The parameters are as follows:

- A married 50 year old couple at or near early retirement

- Expected life expectancy is 90 years of age (i.e. 40 year retirement time frame)

- Expenses of $80,000 year

- Plus investment expenses of .25% of their portfolio value

- $2 million portfolio

- Allocation: 60% stock/ 35% bonds/ 5% cash

- Tax Allocation: 50% tax-deferred, 30% taxable, 20% Roth

- Inflation assumption of 3.5%

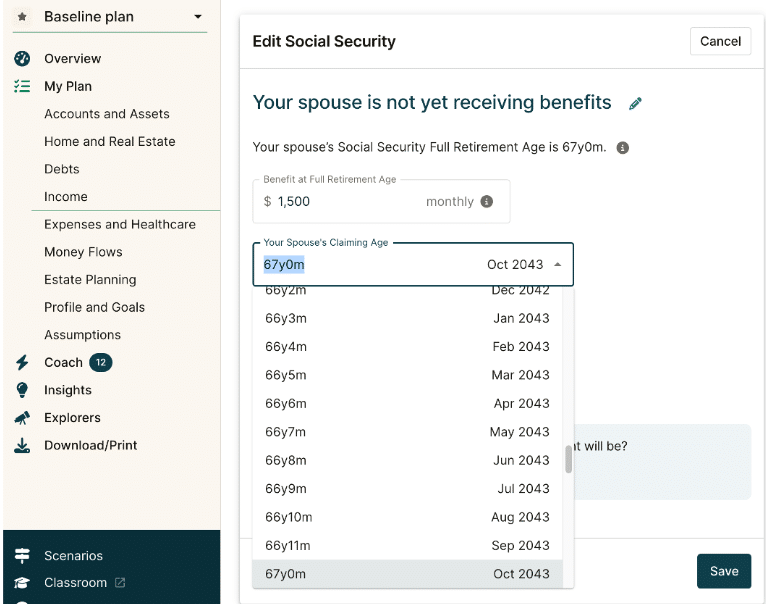

- Identical Social Security benefits of $1,500 each at their full retirement age (67 y/o)

This case was purposefully simplified for ease of data entry and clarity of demonstration. I chose a few calculators that I had used in the past, so I had some preexisting knowledge. However, I hadn’t used any of these calculators regularly for at least two years while I was focused on other issues. This allowed me to look at these tools through new eyes.

I also compare how calculators available to the general public compare to professional financial planning software I use with my planning clients.

Low Fidelity

I started by running this scenario on two low fidelity calculators:

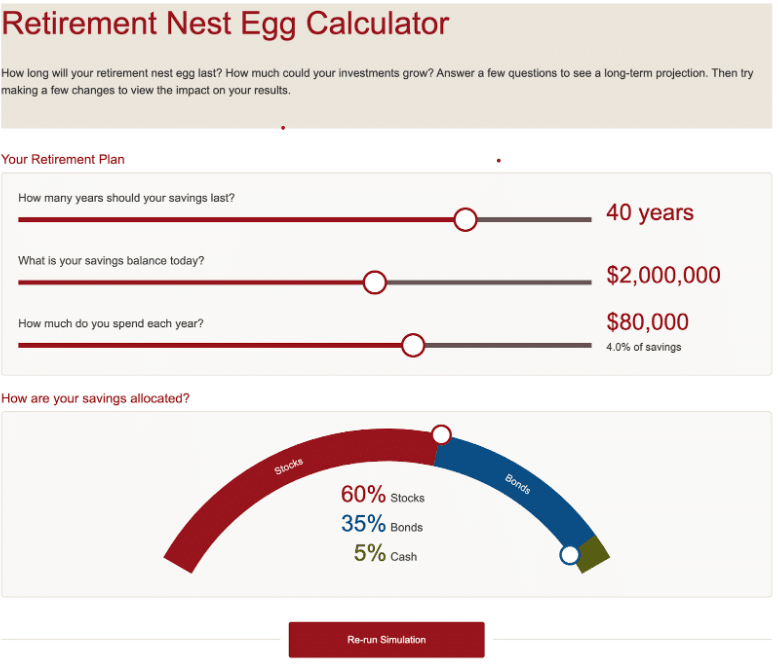

Vanguard

The Vanguard calculator offered only four inputs:

- How long savings should last

- Today’s balance

- Annual spending

- Asset allocation (percent each to stocks, bonds, and cash)

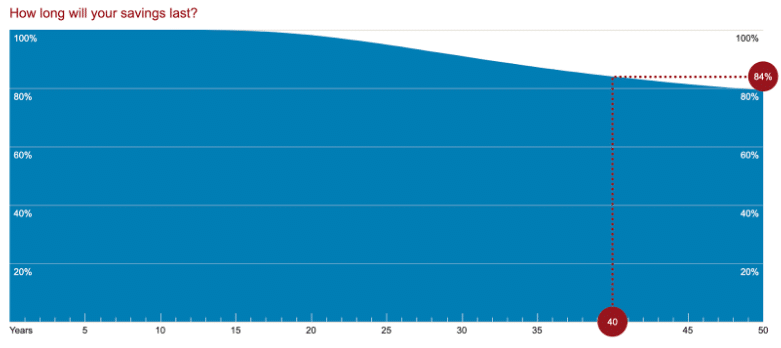

The calculator then performed a Monte Carlo analysis of 1,000 scenarios and produced two outputs in graphical form:

- How Long Your Savings Will Last

- Projected Savings Balance

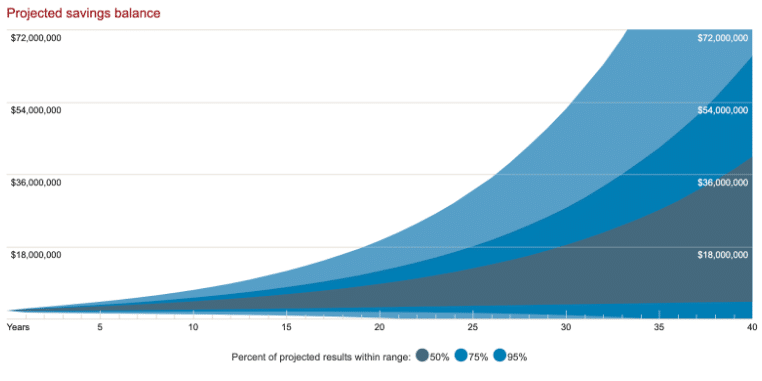

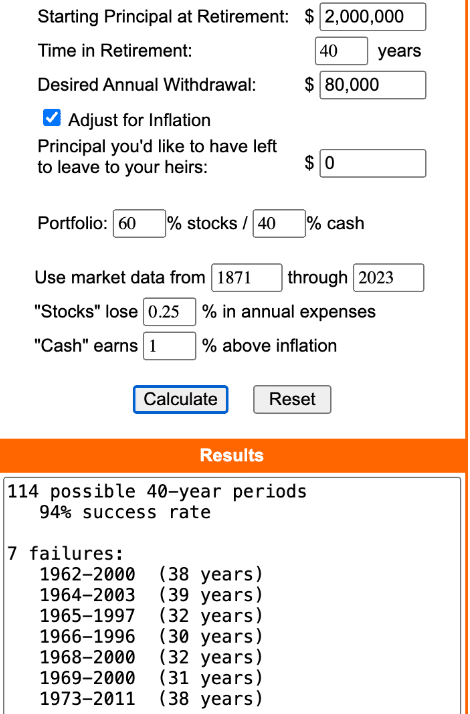

Moneychimp

Moneychimp’s retirement calculator offered a similarly simple to use and easy to understand interface.

Inputs include:

- Starting principal

- Time in retirement

- Desired annual spend (with ability to adjust for inflation)

- Desired terminal account balance

- Asset allocation (% stocks and cash with ability to model cash returns as % above inflation)

- Investment expenses

Moneychimp’s calculations are based on historical stock returns combined with a user chosen real (above inflation) rate of “cash” return.

Inputs and outputs were able to be captured in a single screenshot. This calculator also includes a nice explanation of methods and some tips to help interpret the data.

Low-Fidelity Cons

Clearly, low-fidelity calculators have limitations. Neither was able to account for even a single input for Social Security. Vanguard couldn’t account for investment fees in my simple case.

Neither consider if someone is on track to retire, account for different retirement dates for spouses, or are able to model irregular income or expenses (sale of a home, purchase of vehicles, working part-time for 5 years of retirement, etc.). There is no accounting for taxes.

Low-Fidelity Pros

That does not mean these tools are without value. Their simplicity makes it easy to get started. I spent less than 5 minutes with each one between landing on the web page and getting useful output.

This can be immensely helpful for someone who is just starting and trying to get a grasp on the key variables that determine success or failure in retirement calculations. The impact of small changes that flow through and compound over a multi-decade plan are not intuitive for most people.

You can test variables quickly:

- What if your burn rate was a half a percent lower? Or higher?

- Do 1% advisor fees added to your portfolio really matter?

- How does a more (or less) stock heavy allocation impact outcomes?

- What if my retirement lasts 30 years instead of 40? Or 50?

Because the calculations are quick, simple, and crude, it is clear that you don’t want to make major life altering decisions based on one, or even several of these low-fidelity calculators. But they can be helpful for someone in the early stages of planning to get in the ballpark and get a feel for retirement calculations without becoming overwhelmed. For the right person at the right time, low fidelity calculators are an excellent tool.

Medium Fidelity

Next, I ran my scenario through two medium fidelity calculators:

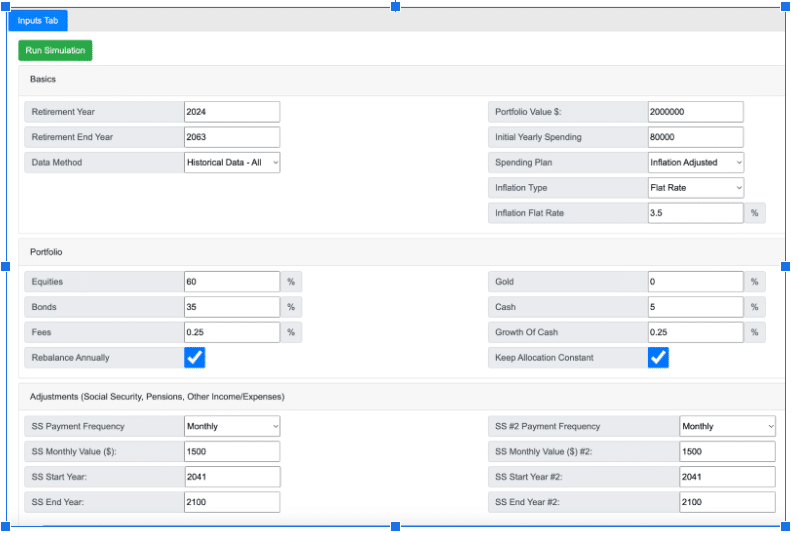

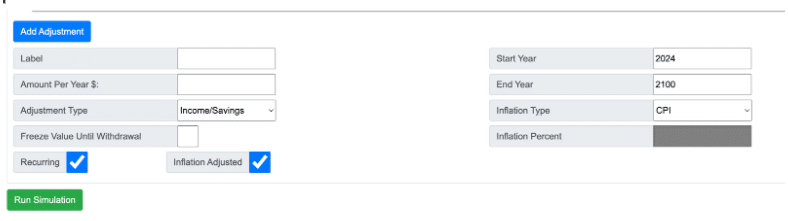

cFIREsim

cFIREsim easily handled all of the variables in my simple scenario except one. It couldn’t account for different taxation of tax-deferred, taxable, and Roth accounts. In addition to taking on the rest of the variables, it had the capacity to handle considerably more modeling complexity.

The inputs I needed were all captured on one screenshot (when undefined by my case, I went with calculator defaults):

This tool also can model irregular income, saving, and spending events:

cFIREsim provides concise graphical and tabular outputs. In my case, I selected modeling historical returns. As you can see, the right side of the outputs were pointless for my simple scenario, demonstrating the ability of this tool to handle more complex modeling.

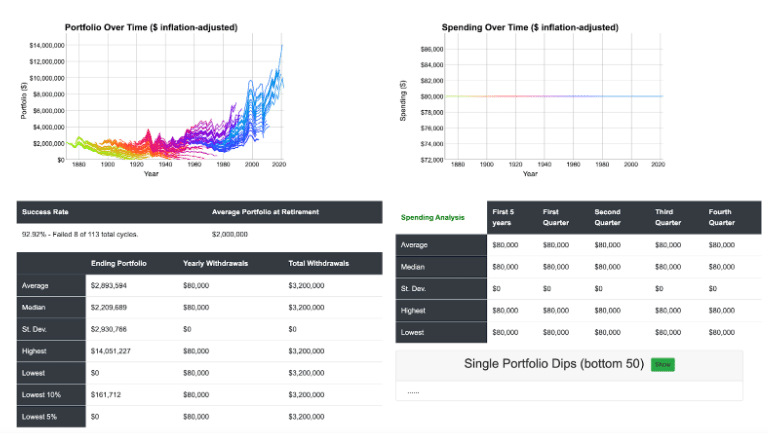

Financial Mentor

This medium fidelity tool also handled most of the variables from my simple case. Like cFIREsim, it had the capacity to handle considerably more modeling complexity than my simple case study presented. However, it also didn’t account for taxation of different account types. This particular tool also doesn’t have a prompt to account for investment expenses.

The Financial Mentor calculator runs projections based on a steady rate of return throughout the calculations, resulting in a different look and feel with the outputs. This particular calculator also provides tabular output (not shown) with year by year beginning and ending balances as well as the account growth, additions, and spending that lead from one to the other.

Medium Fidelity Cons

The biggest weakness of this class of calculators is the inability to offer much assistance to the user regarding taxes. The Financial Mentor tool explicitly requires you to estimate a tax-rate which runs through your entire scenario. It does provide a default. However it may considerably over or underestimate your tax burden through your life cycle.

Taxes are addressed by cFIREsim in this single sentence in a tutorial on the site: “Important Note: You should budget for some amount of “taxes” in your spending. cFIREsim does not take into account taxes in any way.” No further guidance is provided.

Darrow has written why taxes are one retirement number you can’t afford to get wrong. I’ve shown how wildly people can misestimate their retirement tax rate and how much it can vary from year to year based on your individual circumstances. After reading those two posts, you’ll get a sense of the importance of this variable and why you want to do better than guessing at it.

The other weakness common to medium fidelity tools is that in keeping the inputs simple, it is not always intuitive how one variable will impact others. For example, you can model selling a home by entering the proceeds as non-recurring income.

But will you then pay rent? If buying, will you pay cash or get a mortgage? Will you move to a new state with a different tax code? You have to remember to account for these variables and others on your own without intuitive prompts.

Medium Fidelity Pros

These tools both offer considerable increases in functionality, control, and customization of variables, and ability to model more complex scenarios compared to low fidelity calculators. At the same time, the inputs and outputs are simple enough that they are not overwhelming. I was able to enter my inputs and get useful output from each in about 10 minutes apiece.

These calculators allow for quick if/then scenario analysis of the same variables that low fidelity calculators do. Calculators in this class may also model factors such as:

- Irregular large purchases (car purchase, bucket list trips, home remodels, etc.)

- Irregular income (part-time retirement work, selling an asset, staggered retirement dates for a couple, etc.)

- Real estate strategies (upsizing, downsizing, rental income, etc.)

- Changing asset allocations over time.

Medium fidelity tools offer a large step up in functionality and valuable insights that you can’t get from a low fidelity tool. That functionality comes without the biggest drawback of high fidelity calculators….complexity.

High Fidelity

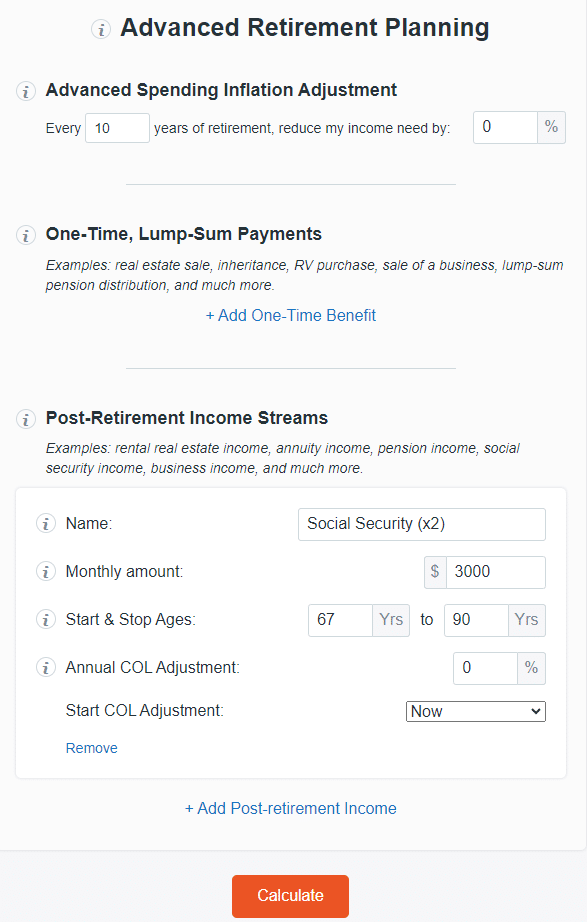

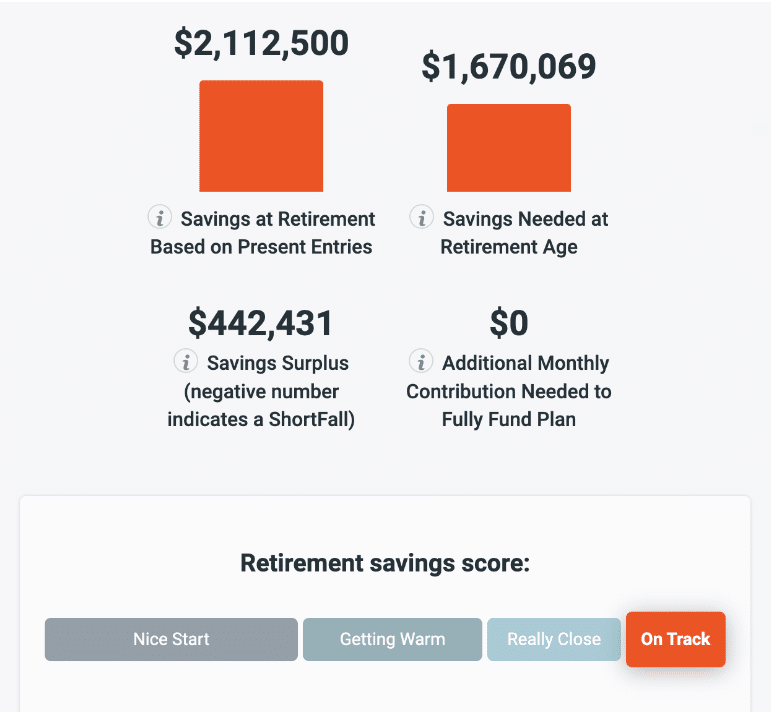

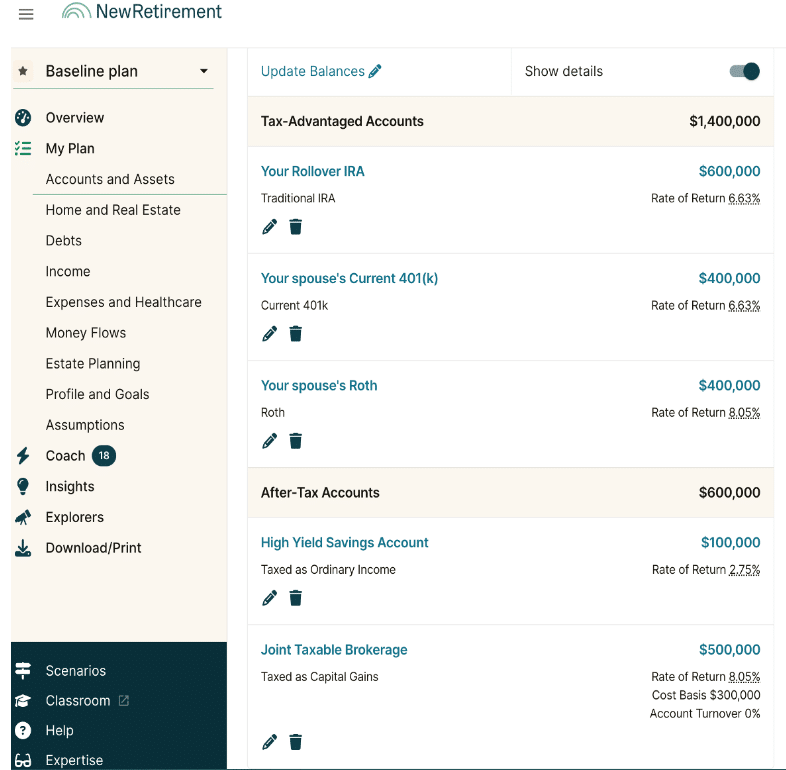

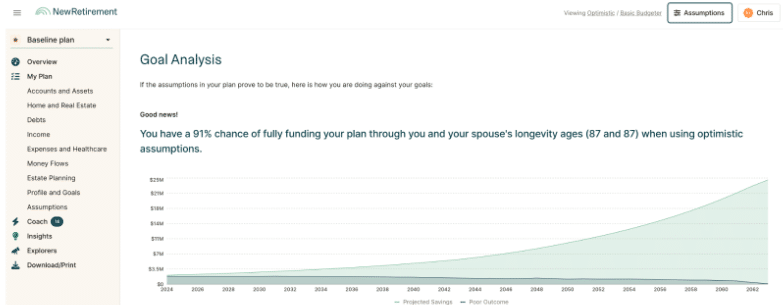

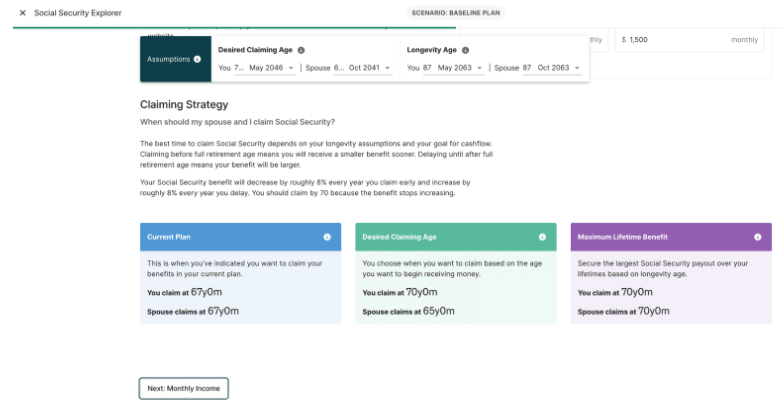

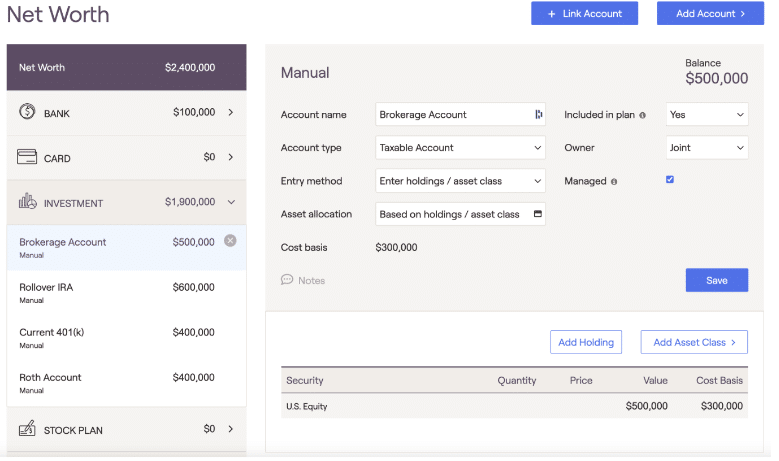

Finally, I ran my case study through our affiliated high fidelity calculators, NewRetirement PlannerPlus and Pralana Gold.

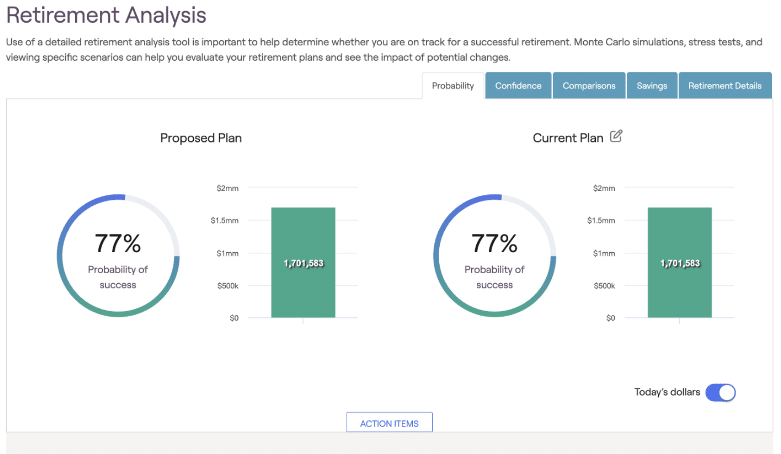

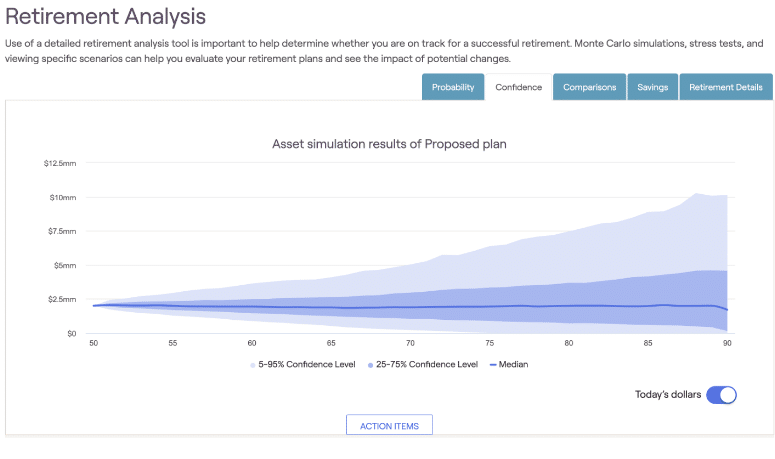

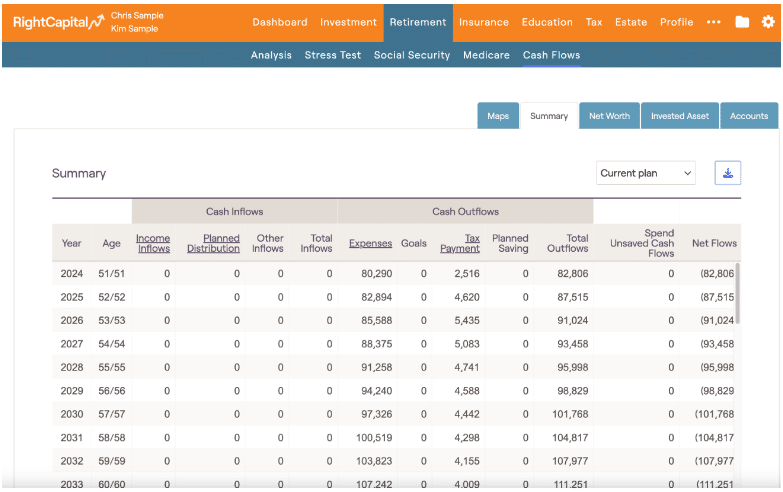

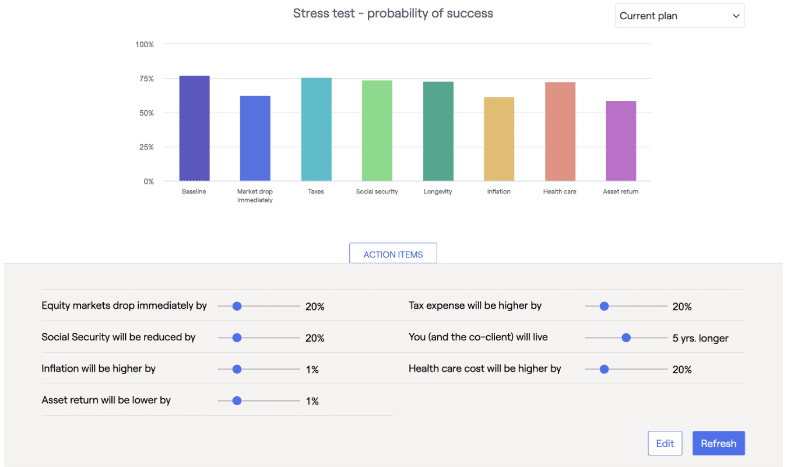

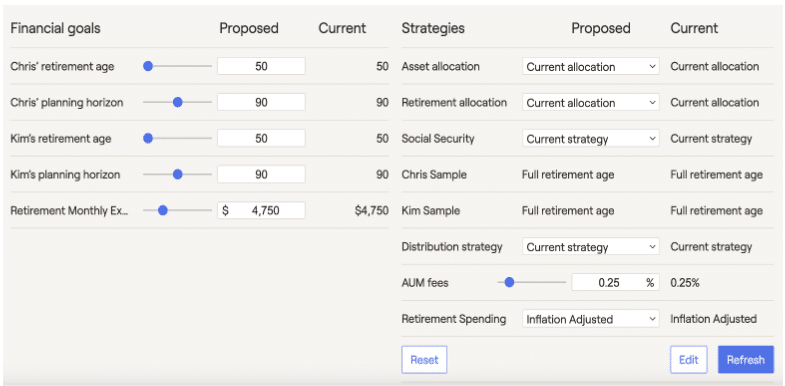

I also ran the scenario in RightCapital, the professional planning software I use with financial planning clients.

My hope is that you can get a sense of the similar functionality between these high fidelity calculators and professional software. You will also quickly see the demands on the user when using these high fidelity calculators compared to lower fidelity tools.

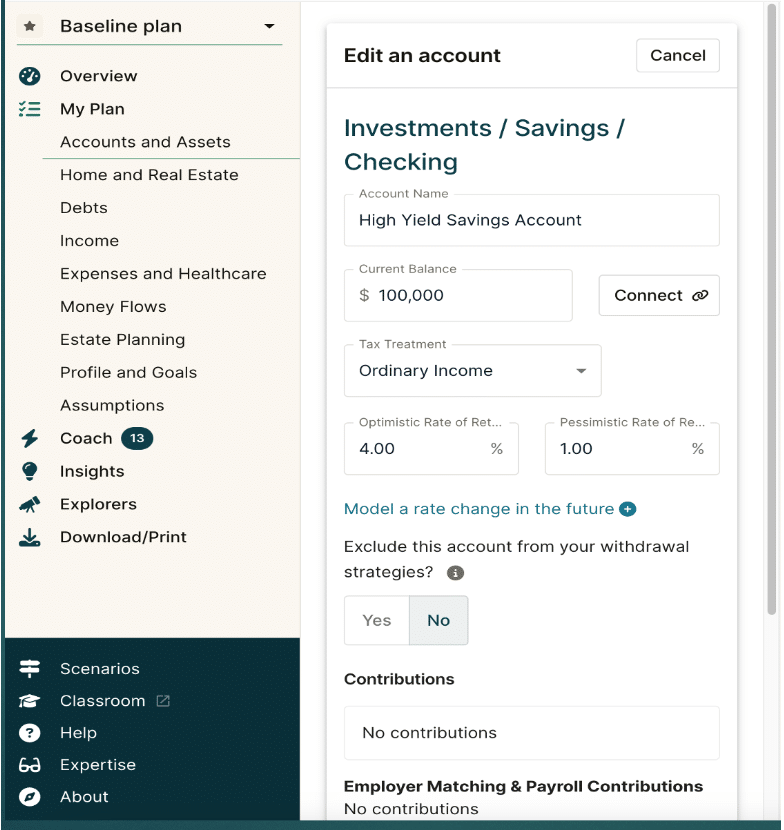

NewRetirement First Inputs

From the word go, the difference between these high fidelity tools and lower fidelity calculators is apparent. The first input in NewRetirement was to start adding accounts. The simple act of entering my cash required knowing the tax treatment of this holding and entering optimistic and pessimistic rates of return. It also requires understanding whether I am to enter nominal (what you see on your statements) vs. real (inflation adjusted) returns.

This single, seemingly simple, input took me longer to enter than running my scenario from start to finish on a low fidelity calculator.

I then had to enter each account separately and estimate both an optimistic and pessimistic rate of return based on the allocation of that particular account as well as selecting the appropriate tax treatment and cost basis based on the holdings in taxable accounts.

Related: The Benefits and Drawbacks of Taxable Accounts

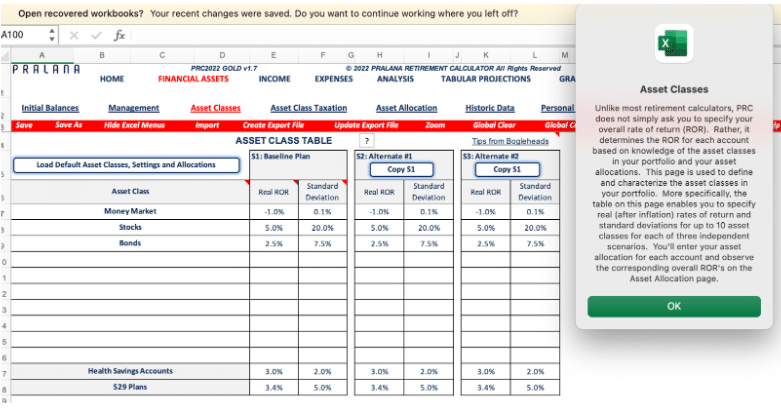

Pralana First Inputs

Pralana Gold similarly allows detailed inputs. Pralana not only allows you to create your own inflation assumption, it gets you thinking about different rates of inflation (healthcare and education) and allows different assumptions on for each on the first input page. It not only allows you to model Social Security and tax projections, it asks whether you want to model changes in rates and benefits in the future.

Like NewRetirement, Pralana requires you to choose the rate of return on different asset classes. In this case, your inputs are in real (inflation adjusted) terms.

All of this is clearly explained and resources are offered to assist you. Even so, this is a considerable demand on a new user of the tool, and may quickly be overwhelming for someone just familiarizing themselves with retirement calculations.

Other High Fidelity Inputs

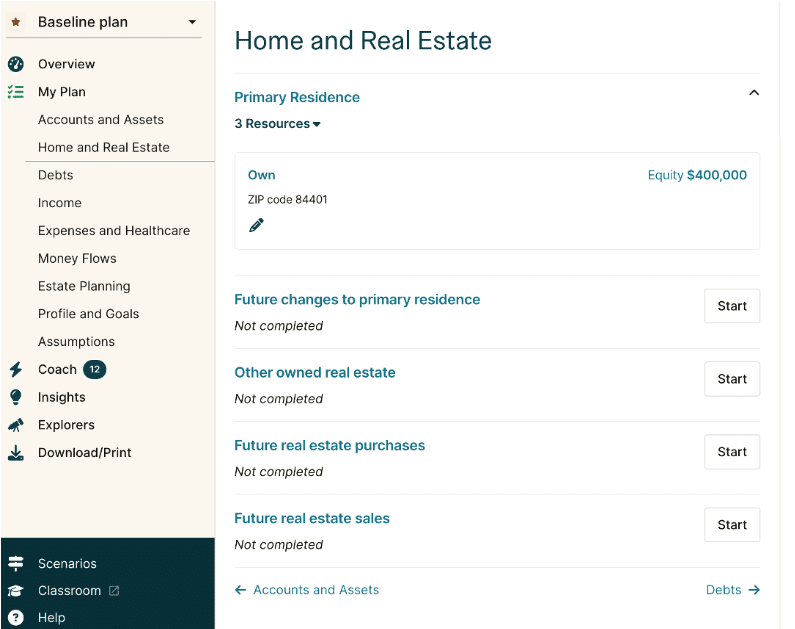

I’ll highlight a few other inputs, utilizing NewRetirement PlannerPlus, because the user interface provides for better screenshots to share. The number of inputs and outputs available on either tool are far too many to go over every one in this blog post. I’ll highlight just a few.

Note: We do have in depth reviews of both Pralana Gold and NewRetirement PlannerPlus on the site.

These tools allow modeling real estate changes (downsizing, relocating to a different state, switching from owner to renter or vice versa, etc.) as well as modeling rental income.

These tools not only enable entering Social Security values, but enable modeling different claiming strategies with great specificity.

High Fidelity Outputs

Much like low and medium fidelity tools, high fidelity tools ultimately will give you a likelihood of retirement success typically expressed as a probability and median terminal account balance.

However, the outcomes are much more robust compared to low fidelity tools. They include detailed tax projections year by year at both the federal and state levels.

These tools also provide insights into actions like choosing the best Social Security claiming strategy and exploring the impact of Roth conversions.

Professional Software Inputs and Outputs

Finally, I will share what my case looks like when run through professional software. The user interface, the way the data is entered, and the precise way data is analyzed and presented in output differs from tool to tool. Each tool has features that you may like more or less than the other.

The take home message I hope to provide is that there is no “secret formula” that professional software has compared to high fidelity consumer grade retirement calculators. The key is learning the tool you ultimately choose inside and out. This way, you can place an appropriate level of trust in the results so it is useful in improving decision making.

High Fidelity Strengths

A high fidelity calculator is on par with professional grade software with regards to the scenarios it is able to model and the quality of the output it provides. To reiterate, each tool has slightly different features, user interface, etc. that may make you like one better than the other. As a class, these are powerful tools capable of detailed modeling. They can help you make more informed data driven decisions.

High Fidelity Weaknesses

This is not to say that these tools are without weaknesses. They should not be overlooked.

The first is that these tools can be challenging to navigate, even for those who have a firm grasp on the basics of compounding, investment returns, inflation, their current spending, etc. Someone starting out may quickly be overwhelmed and throw their hands up if starting with high fidelity calculators before mastering basics.

Second, unlike low fidelity calculators, high fidelity tools require some investment. The financial cost is minimal, around $100. The time investment is significant.

Expect to spend at least an hour getting a feel for the tool and entering enough data to get any meaningful output. The best use of these tools is an iterative process where you gain mastery of the software and your own situation over time.

Third, every calculator is making assumptions. Some are made by the tool. Others are left up to the user. It is nice to be able to choose how you want to model future investment returns, inflation rates, and changes to laws and social programs you think will materialize. But do you recognize your biases and the challenges of predicting the future?

A crude simple tool won’t likely inspire great confidence. Having a high fidelity tool that is so powerful and detailed can lead to overconfidence in your results. Even the best tool with a knowledgeable user can’t predict the future.

The key variables that determine the outcome to retirement calculations are lifespan, expenses (including taxes and health care costs), investment returns, and inflation. All are unknowable. Humility is required.

Choosing the Right Calculator

There is no single “best” retirement calculator for everyone. Each offers different features and has its own strengths and weaknesses. Calculator fidelity is a great first filter to finding the right tool to meet your needs.

Calling both low fidelity and high fidelity tools “retirement calculators” is akin to calling steak knives and chainsaws “cutting devices.” At the most fundamental level, this is true. In practice, they are vastly different tools. Choose wisely.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

As we say all the time, it’s never too early or too late to start thinking about and saving…

Copyright © 2024 Retiring & Happy. All rights reserved.