Defining Retirement Success and Failure

I recently reviewed the concept of retirement calculator fidelity. Retirement calculators vary considerably. They range from simple tools with a few inputs and outputs to advanced tools on par with professional financial planning software.

As different as these tools are, they have one thing in common. Almost every retirement calculator gives you a measure of your likelihood of retirement success or failure. They present this as a dichotomy and define success and failure the same way.

So it is worth taking a step back. We’ll explore how success and failure are defined by these calculators, whether that matches your personal definition of success or failure, and how to interpret this retirement calculator output as you use these tools to assist your planning.

Retirement Calculator Definitions of Success and Failure

Retirement calculators at all fidelity levels tend to present two common outcomes:

- % Likelihood of Success or Failure

- Success is a terminal balance > $0

- Failure is a terminal balance of ≤ $0

- Median and/or Range of Terminal Account Balance

- Y-axis is account balance

- X-axis is years into retirement

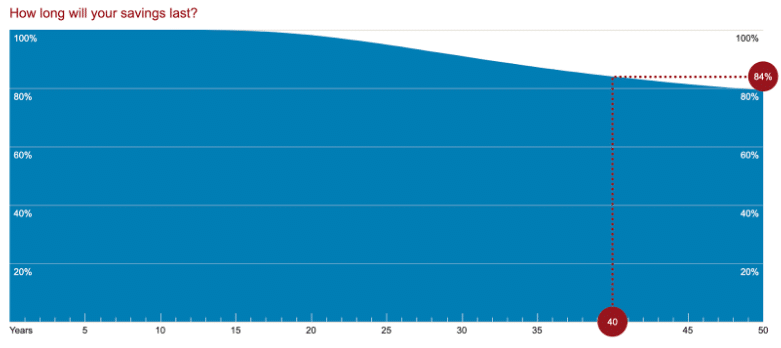

As an example of a low-fidelity calculator output, Vanguard’s Retirement Nest Egg Calculator provides a % success given a defined retirement period.

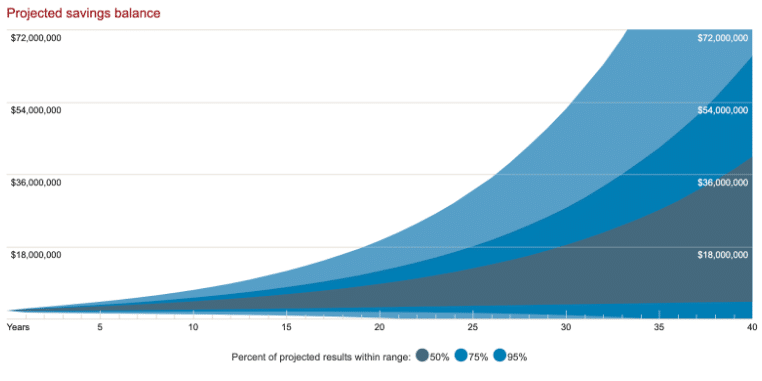

This tool also presents the range of terminal account balances in graphical form based on a thousand scenarios calculated with Monte Carlo simulations.

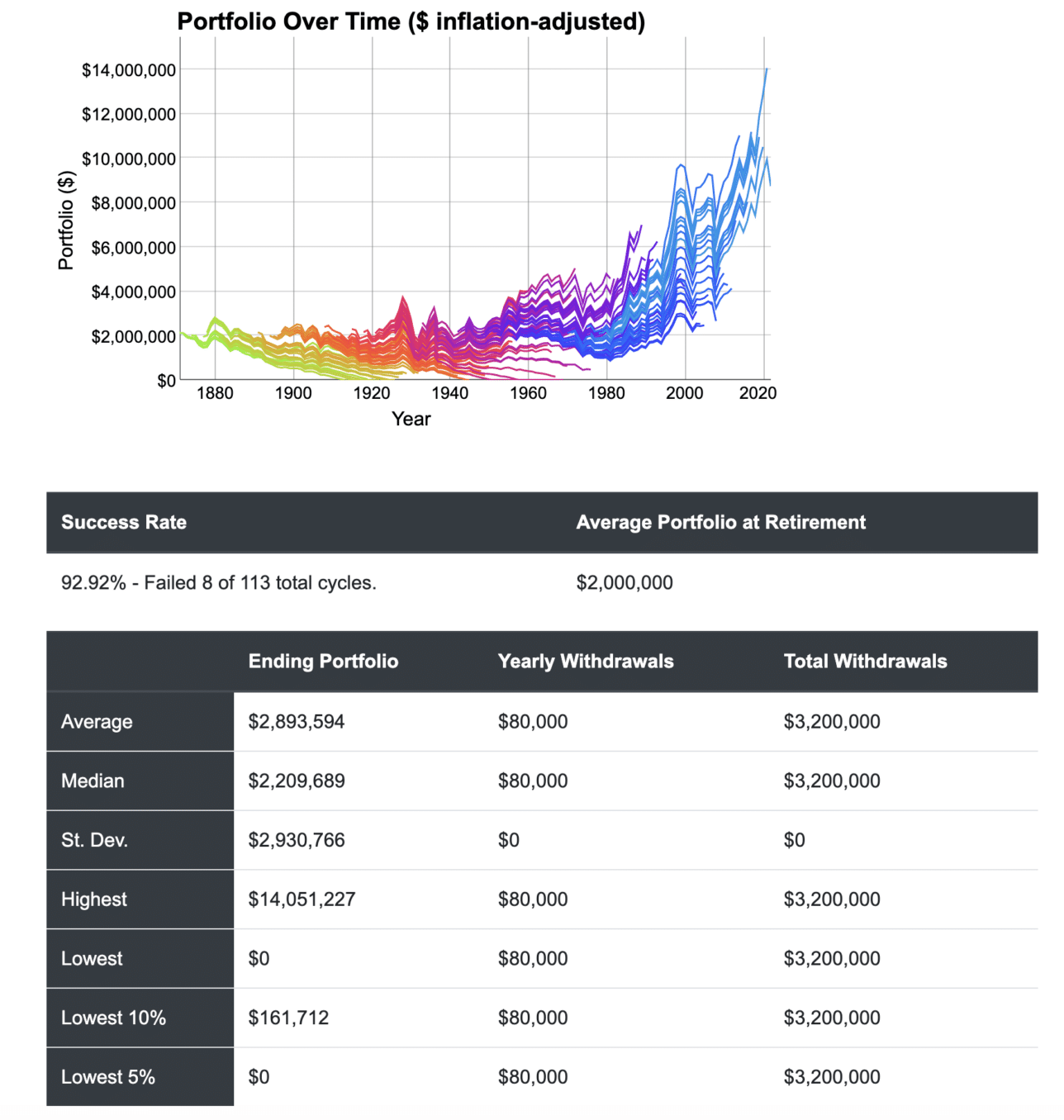

cFIREsim is a medium-fidelity calculator that models historical returns, so the graphical output looks a bit different than that created with Monte Carlo analysis. A closer look shows that you still get a % likelihood of success/failure and a wide variety of ending balances.

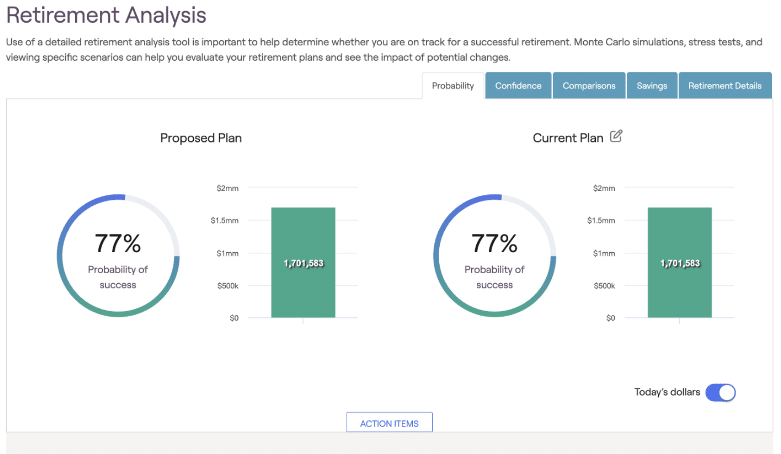

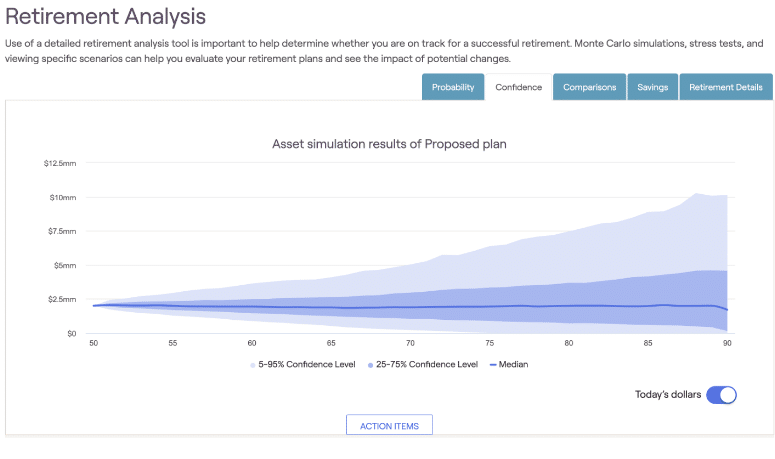

Let’s round this discussion out with the example outputs from RightCapital, the professional financial planning software I use with clients.

You’ll see a familiar looking % success/failure with the median ending account balance.

And returning to Monte Carlo analysis, you get a graphical display showing a wide range of possibilities of terminal account balances.

Are All “Failures” Created Equally?

Each of these examples show the same case scenario entered into different retirement calculators. In that scenario, I assumed a married couple where each individual retired simultaneously at age 50.

A failure is defined by each of the calculators as their portfolio hitting the X-axis on the graph (i.e. $0 account balance) before the end of their plans, regardless of when this occurs. Let’s think about the logic of this.

Early Failures

Imagine retiring at age 50. Fifteen years into retirement you completely exhaust your investment portfolio. You are now 65 years old and broke.

Smaller Social Security Benefit

Presumably, someone who retires at age 50 would not have 35 years of earning history for Social Security. Therefore they have a smaller benefit than they could have accumulated if they worked longer.

Related: How Does Retiring Early Impact Social Security Benefits?

Less Social Security Claiming Options

Someone in this position would want to delay claiming Social Security to maximize their benefit they have earned to provide the greatest spending power as well as longevity insurance. However, they would need income now, limiting their claiming options.

Related: When to Take Social Security

Just Go Back to Work?

There is a common refrain in the FIRE community that in the worst case scenario of retiring too early and running out of money, you can always “just go back to work.” However, if you run out of money at age 65, or even if you realize you are on that trajectory in your late 50’s or early 60’s, you would have been out of your career for a long time.

In most careers, you can’t “just go back” after a decade. Skills will have atrophied. Social networks will have weakened. Licenses and certifications will have expired. You may no longer have the health you did.

Options may be limited to low-skilled, and thus often low-paid, work. Or you may not have the health to work at all.

Related: Going Back to Work

Failures that occur at this point are obvious points of concern. You would want to consider the factors that could lead to this poor outcome and plan carefully to prevent them or intervene early if you find yourself on this trajectory.

Late Failures

Now imagine the same retirement scenario, but simulated “failures” don’t start happening until age 85 rather than age 65. Running out of money is never desirable. However, it is worth acknowledging that this “failure” is quite different from running out of money two decades earlier.

Will You Still Be Around to “Fail”?

For starters, there is a reasonable chance you may not still be alive at age 85. Social Security’s Life Expectancy Calculator shows that a 50 year old male has a life expectancy of only 82.0 years (85.5 years for females).

It is true that we have to plan for our own individual case (two individuals if you are part of a couple) and we can’t rely on averages. Still, we need to be aware of probabilities and focus on the most likely scenarios.

Many people want to model plans to age 100 or longer. A different longevity calculator from the UK Office for National Statistics allows you to calculate the odds of becoming a centenarian. For a 50 year old male, your chances of living to 100 are 4.6%. For a female, 7.8%.

You can’t ignore the possibility of a long life, but you can plan for it. Delaying claiming Social Security allows you to maximize this inflation-adjusted source of lifetime income. Someone who reaches their mid-60’s with a healthy portfolio balance could easily afford this decision.

They could also consider annuitizing a portion of their portfolio to guarantee lifetime income, insuring against longevity risk.

Related: Annuities – The Good, The Bad, and the Ugly

Decreased Spending With Age

Statistics show that spending decreases over time after age 65 for Americans across the wealth spectrum. This is a contrast to retirement modeling which generally assumes consistent real spending, or spending that increases due to inflation. Factoring in lower spending later in life would decrease the odds of failures.

We all need to consider our individual circumstances. They include personal spending/giving goals, likelihood for longevity, and tolerance for risk.

Universally, we can agree that a scenario of running out of money late in retirement is not as bad of an outcome as running out early. All failures are not equal.

A Closer Look at “Success”

Retirement calculators define success as any outcome where your terminal account balance is greater than zero. In other words, dying with $1 in your checking account is considered a “success” just the same as dying with a $20 million portfolio.

Take a step back and apply a little bit of common sense. You’ll quickly see the problem with this definition of success.

Close Calls

A book that has generated a lot of buzz over the past few years is Bill Perkins’ Die With Zero (link to my review of the book).

Die With Zero = Ultimate Success?

In Perkins’ framework, any money you still have at your death represents a waste of your life energy. This is money you didn’t need to spend time earning or money that could have been spent on experiences to improve your life. Taking your last breath with $1 in your checking account would be viewed as the ultimate success.

In reality, we don’t know what day we’ll be taking our last breath. So the only way to literally “die with zero” while maintaining your desired lifestyle is to optimize Social Security, be lucky enough to have a generous pension, and/or convert your assets into annuities that provide desired income for life while leaving no residual benefit.

Die With Zero = A Stressful End?

Social Security only covers a portion of desired spending needs for most people. Not many people have pensions, and the number is getting smaller over time. Many people don’t want to place their entire financial future in the hands of insurance companies.

So many of us will ultimately either die with some residual account balance or exhaust our portfolio. Seeing balances dwindle while you potentially still have life left can produce stress and anxiety. Experiencing this would not be most people’s definition of “successful” retirement, regardless of what your calculator and a popular book say.

Ending Retirement With More Than You Started

At the other end of the “retirement success” spectrum, you can end up with an inflation adjusted portfolio that is several times your beginning portfolio. This is especially true for early retirees.

If you have a good early sequence of returns and don’t increase your spending and/or giving substantially, your investments can grow to eye popping numbers after several decades of compounding. But is starting retirement with $2 million and ending it with $10 million your definition of success?

Large Ending Balances = Security?

Some people want to create retirement scenarios that have a 100% chance of success. They see the security this provides as worth the trade-offs.

To be clear, those trade-offs mean starting with a very low drawdown rate leading to larger ending balances than you started with. The price of insuring against every possible worst case scenario means in most circumstances you will have substantially over saved.

This is a conscious decision for some people. If so, that’s your decision to make.

Large Ending Balances = Missed Opportunities?

When I discuss this topic with clients I often return to their stated goals. Common examples are to have a comfortable retirement, to spend time with kids and grandkids, to travel, etc.

I steer the discussion to the dueling risks of retirement planning. There is a risk you could run out of money before you run out of life. The opposite side of this coin is you could run out of life before you run out of money.

Security focused people tend to focus on the former and ignore the latter. Retirement calculator outputs can reinforce this way of thinking.

Dollars left at the end of life, particularly when they are in the hundreds of thousands or even millions may represent missed opportunities to create more life enriching experiences with family and friends and give more generously when you have the opportunity to appreciate the impacts.

Defining Success and Failure for Yourself

You get to decide how you define retirement success and failure. The point is that retirement successes and failures as defined by retirement calculators are not all created equally.

In my next post, I’ll continue on this theme and discuss better ways of using retirement calculators to assist planning, what an acceptable rate of success or failure is in calculations, and ways of planning for uncertainty. Until then, I challenge you to reflect on these ideas.

If you have a propensity to focus only on security, read the ideas Perkins’ shares in Die With Zero. If you are confident you likely already have enough (or more), check out Mike Piper’s book More Than Enough for practical ideas of using the wealth you’ve created to enhance your life and the life of others.

How do you define retirement success and failure? Let’s talk about it in the comments below.

* * *

Valuable Resources

- The Best Retirement Calculators can help you perform detailed retirement simulations including modeling withdrawal strategies, federal and state income taxes, healthcare expenses, and more. Can I Retire Yet? partners with two of the best.

- Free Travel or Cash Back with credit card rewards and sign up bonuses.

- Monitor Your Investment Portfolio

- Sign up for a free Empower account to gain access to track your asset allocation, investment performance, individual account balances, net worth, cash flow, and investment expenses.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire Yet? has partnered with CardRatings for our coverage of credit card products. Can I Retire Yet? and CardRatings may receive a commission from card issuers. Some or all of the card offers that appear on the website are from advertisers. Compensation may impact on how and where card products appear on the site. The site does not include all card companies or all available card offers. Other links on this site, like the Amazon, NewRetirement, Pralana, and Personal Capital links are also affiliate links. As an affiliate we earn from qualifying purchases. If you click on one of these links and buy from the affiliated company, then we receive some compensation. The income helps to keep this blog going. Affiliate links do not increase your cost, and we only use them for products or services that we’re familiar with and that we feel may deliver value to you. By contrast, we have limited control over most of the display ads on this site. Though we do attempt to block objectionable content. Buyer beware.

Join more than 18,000 subscribers.

Get free regular updates from “Can I Retire Yet?” on saving, investing, retiring, and retirement income. New articles weekly.

You’re Almost Done – Activate Your Subscription! You’ve just been sent an email that contains a confirmation link. Please click the link in that email to finish your subscription.

This month I’ll share different perspectives on reframing retirement risks and definitions of retirement success and failure. We’ll also…

Copyright © 2024 Retiring & Happy. All rights reserved.