New Study Finds Nearly 2 in 5 Senior Citizens Has Fallen for a Scam

Table of Contents:

- Falling Victim to Scams

- Senior Citizens Encountering Scams

- Most Popular Scam Types

- Preventing Scams for Senior Citizens

Thanks in part to modern technology, scams are becoming more commonplace in America every day. When it comes to falling for scams, senior citizens often fall victim, especially when it comes to internet crimes.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

According to the Federal Bureau of Investigation’s (FBI) Internet Crime Report, there were 101,068 internet crime complaints by Americans 60 and older in 2023. These complaints were warranted, as internet crime resulted in a $3.4 billion loss in 2023 for this age group.

Our new study surveyed more than 680 senior citizens to understand their experience with internet crimes, specifically scams.

Falling Victim to Scams

While the majority (73%) of senior citizens know someone who has fallen for a scam, 37% admit to having fallen for a scam themselves. In fact, more than 1 in 6 victims have fallen for a scam in 2024.

As the FBI’s Internet Crime Report found, seniors are more susceptible to falling for a scam and losing money, and almost half (49%) of scam victims surveyed say they lost money when they were scammed. On average, losses totaled $3,590. Despite this loss, 59% did not report the scam to authorities. Three reasons why seniors don’t report the scam include not knowing how to report the scam (42%), not losing too much money to the scam (36%), or feeling embarrassed about falling victim (22%).

What scams are seniors falling for? The top scams where senior citizens have fallen victim include online shopping scams (30%), tech support scams (21%), phishing scams (17%), internet fraud (14%), and identity theft (9%).

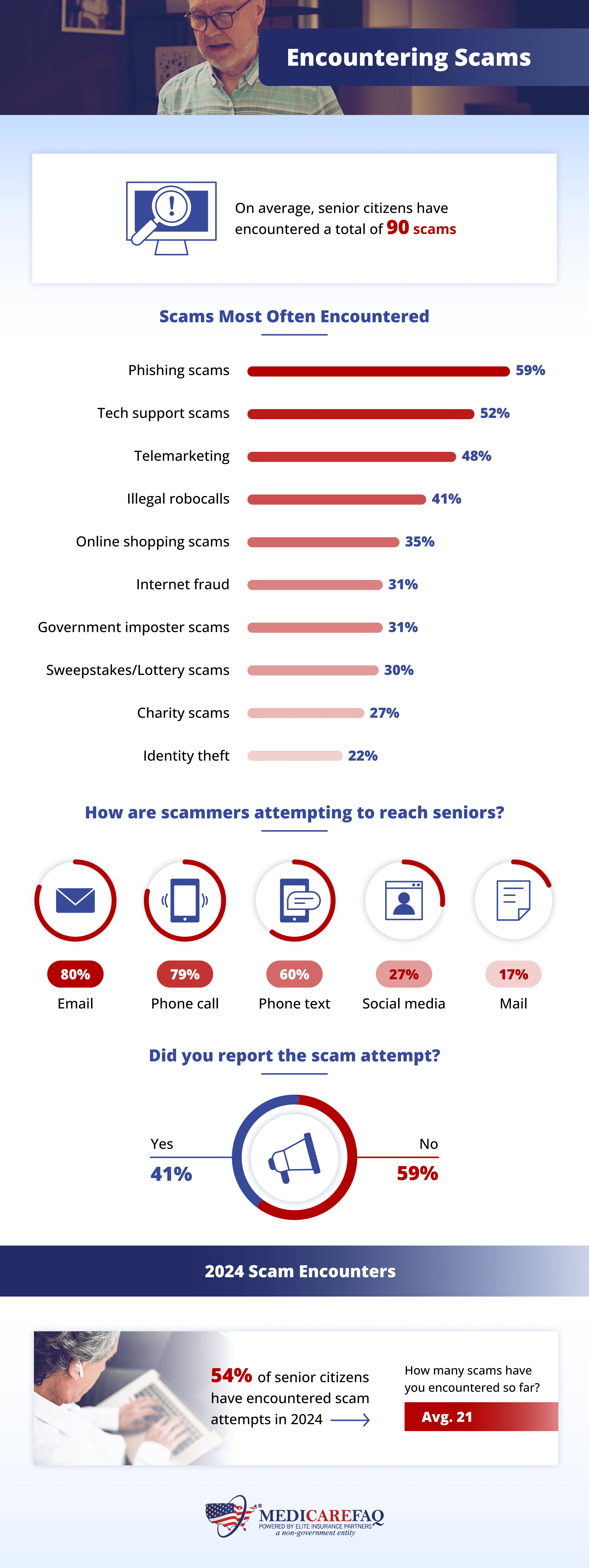

Senior Citizens Encountering Scams

Not all senior citizens have fallen for a scam, but they’ve all encountered them. On average, seniors have encountered 90 scams, with the most common attempts coming from phishing scams (59%), tech support scams (52%), and telemarketing scams (48%).

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Scammers will do anything to try and get your money or your information, and they’ll reach out through a variety of mediums. Primarily, scammers are emailing (80%) or calling (79%), with text messages as another popular method (60%). 2 in 5 seniors say they’ve reported the scam attempts.

In 2024, more than half of senior citizens (54%) have already encountered a scam attempt. So far in 2024, they’ve encountered an average of 21 scam attempts.

Most Popular Scam Types

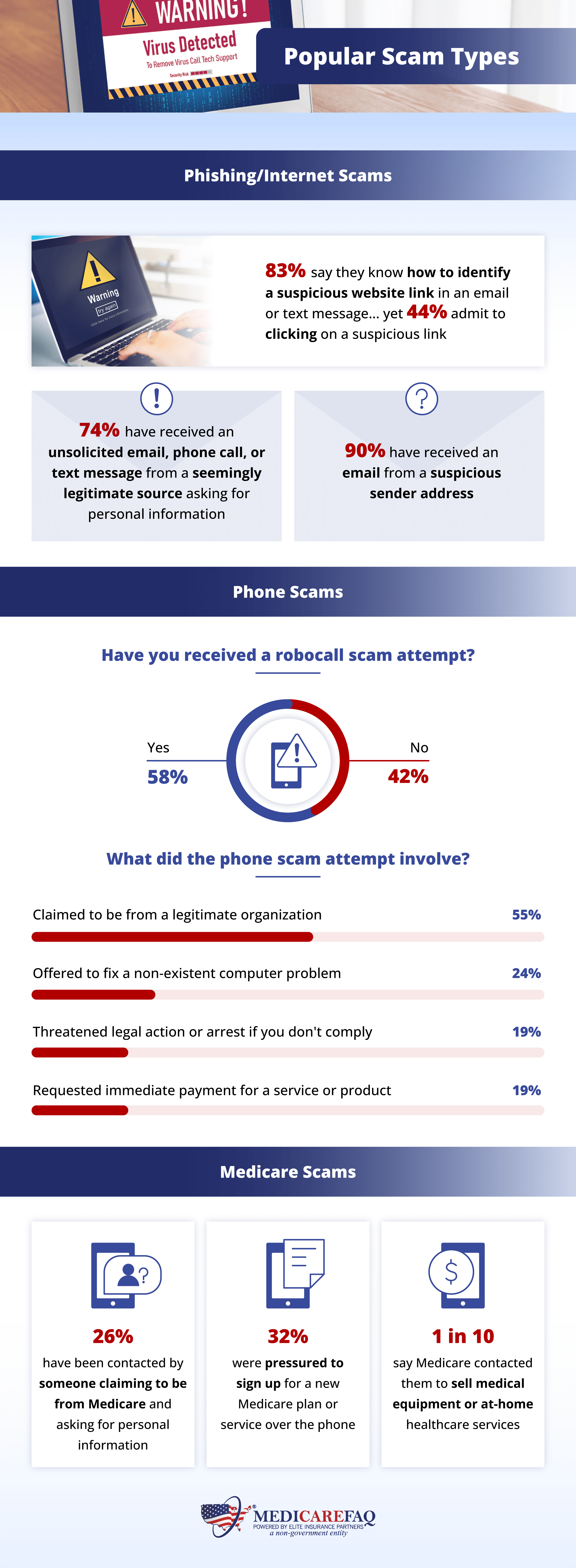

Chances are, senior citizens have encountered a phishing or internet scam. While 83% of seniors feel confident that they could identify a suspicious link in an email or text, 44% admit to having clicked on an unfamiliar link.

Nearly 3 in 4 have received an unwanted phone call, text message, or email from a source claiming to be legitimate that was asking for personal information. The majority (90%) have also received an email from a suspicious email address.

Over half (58%) have received a robocall scam attempt, usually from a source claiming to be from a legitimate company.

When it comes to Medicare scams, 1 in 4 say they’ve been contacted by someone claiming to be Medicare who asks for personal information, and 32% were pressured to sign up for a plan or service over the phone. 1 in 10 say Medicare contacted them to buy medical equipment or at-home healthcare services, which would not truly happen from a legitimate Medicare source.

Preventing Scams for Senior Citizens

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

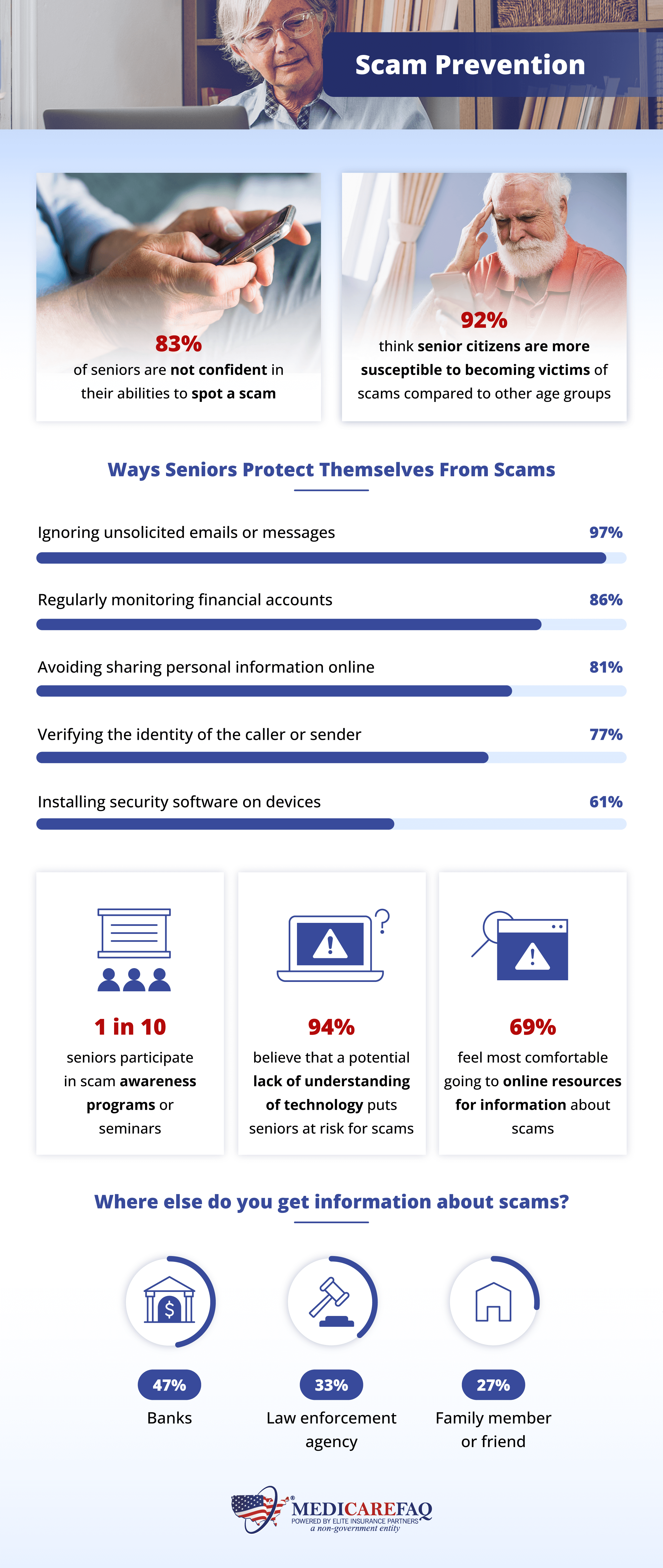

Senior citizens largely agree that seniors are more likely to fall victim to scams than other age groups. This may be due to a lack of experience and familiarity with the internet and technology, where many scams take place. This can impact their confidence, and most senior citizens (83%) are not confident in their abilities to spot a scam.

However, there are ways to prevent scams, or at least prevent yourself from falling victim. The main ways seniors protect themselves include ignoring unsolicited or suspicious emails and messages (97%), regularly monitoring their finances (85%), and avoiding sharing personal information online (81%).

1 in 10 seniors participate in scam awareness programs or seminars, while 69% feel most comfortable turning to online resources for information about scams. Seniors also rely on their banks, law enforcement agencies, or family and friends for information about scams and scam prevention.

If you suspect you’ve encountered or fallen victim to a scam, or you know someone who has, please contact the National Elder Fraud Hotline at 1-833-FRAUD-11(1-833-372-8311).

MedicareFAQ is an educational resource for seniors who are new to Medicare or who wish to make a change to their coverage. At MedicareFAQ, we can help determine your options by comparing Medicare Supplement plans, reviewing Medicare Advantage plans, and helping you understand how each plan type can affect your coverage.

Methodology: In April 2024, we surveyed 687 senior citizens about their experience with scams and encountering scam attempts. Respondents were 63% female and 37% male, with an age range of 65 to 84 and an average age of 69.

For media inquiries, contact Press@medicarefaq.com.

Fair Use

When using this data and research, please attribute by linking to this study and citing medicarefaq.com

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Sources:

MedicareFAQ is dedicated to providing you with authentic and trustworthy Medicare information. We have strict sourcing guidelines and work diligently to serve our readers with accurate and up-to-date content.

- Federal Bureau of Investigation’s Internet Crime Report 2023 https://www.ic3.gov/Media/PDF/AnnualReport/2023_IC3Report.pdf

Fair Use

When using this data and research, please attribute by linking to this study and citing MedicareFAQ.com

We relocated to the east coast, near Washington, DC, approximately 10 years ago. In all of that time, we…

Copyright © 2024 Retiring & Happy. All rights reserved.