5 Reasons Why I Love My 401k

I love my 401k! If your employer offers a 401k plan, don’t hesitate to take advantage of it. Actually, I like the 401k so much that I think it should be the first investment anyone makes.

I started contributing to my 401k in 1996 when I got my first full-time job right out of college. At the time, I didn’t want to invest in a retirement fund because I had better plans for those nice fat paychecks.

- My brothers were still in college and I wanted to help them out.

- I was driving an old jalopy that could break down at any moment. (In fact, it broke down a few months after I sold it in 1997. Boy, that intern was mad…)

- I just moved into an apartment and I didn’t have any furniture.

- Also, retirement was 45 years away! Why whould a 22 year old guy contribute to his 401k?

Luckily, my dad convinced me to start investing in my 401k. He didn’t really know how the 401k worked, but he knew I had to start investing as soon as possible. I started off slow, but increased my contribution pretty quickly. In a few years, I was hitting the annual 401k contribution limit and I’ve been doing so ever since. It’s amazing what happens when you always max out your 401k. Whew, am I glad I listened to my dad that time! Now that I’m a father, I must admit that dad is right sometimes. Thanks Dad, for helping me get started.

After FIRE

I wasn’t sure if I could continue to contribute to my 401k after I retired from my engineering career. I had some income from blogging, but it was nowhere near my old paychecks. However, Mrs. RB40 was still working so we were pretty comfortable financially. I opened an individual 401k with Vanguard and I maxed out my 401k every year since. I still love my 401k and I hope to keep contributing for as long as I can. Mrs. RB40 also maxed out her contribution every year. Our 401k accounts are the foundation of our investments and they are the biggest part of our net worth. Now, our 401k is worth way more than our home.

So why do I love my 401k so much? Here are 5 reasons why I think every investor should max out their 401k contribution.

1. It’s Easy

For most people, the 401k is the easiest way to invest. Nowadays, many employers automatically enroll you and you have to manually opt-out of investing. The contribution is taken out of the paycheck before you get it so you won’t miss the money. It’s a lot more painful to invest when the money is already in your savings account. The 401k is just really easy for anyone new to investing. All you need to do is pick the investments and you’re ready to start.

The automation aspect of it is really helpful to new investors. If I had to transfer money to the brokerage every month to invest, I wouldn’t have kept up. New investors should just put their contribution in the lowest fee index funds and concentrate on increasing their contribution every year. When you’re starting out, your saving rate matters much more than the performance of your investment. New investors should try to max out the annual 401k annual contribution as soon as possible. Once your 401k is bigger ($100k?), then you can worry more about maximizing the return.

2. Company Matching

Most companies match your 401k contribution up to a point. A typical company matches 50% of the 401k contribution for the first 6% of your salary. Every company is different so check your employer’s policy. Intel used to add 5-10% of my salary to my 401k no matter how much I contributed. I had to stay 5 years for it to fully vest, though. Anyway, many companies have some kind of matching plan so don’t miss out on this benefit.

3. Dollar Cost Averaging

When you contribute a portion of every paycheck to your 401k, you are dollar cost averaging. You don’t have to worry about the volatility of the stock market and you just need to keep investing. When the stock is going up, your whole investment is gaining. When the stock market is down, you are getting a discount on your purchases. The important thing to remember is to keep investing through the downturns. Don’t stop contributing to your 401k when the stock market is down because that’s when you get the best deals. 2020 was a huge buying opportunity for investors. I hope you kept investing when the market crashed because it recovered very nicely.

4. Tax Deferred

You don’t have to pay tax on the money you contributed to your 401k right now. This will lower your tax while you’re working. The tax will be deferred until you make withdrawals in retirement. Most people won’t have as much income in retirement so their tax rate should be lower. You should be able to keep more of your money when you invest in a tax-deferred account. Of course, if the tax rates increase in the future, then you might end up paying more. Hopefully, the government won’t shaft retirees like that.

5. Fees are more transparent now

When I first started investing in my 401k in the 90s, it was very difficult to find out how much I was paying to invest. Typically, you pay the mutual fund’s fee (expense ratio) and the plan administrative fee. Do you know there is an administrative fee to invest in your 401k? Most people aren’t even aware of this.

For example, I invest in VTSMX in my i401k. The expense ratio is 0.17% and Vanguard charges $20 per year (for each fund) to manage the i401k account. That administrative fee is dirt cheap! Many firms charge nearly 1% to manage your 401k. Also, the fee is waived when your account has over $50,000 in Vanguard assets. I have about $350,000 in my i401k so I don’t have to pay the $20/year/fund fee these days.

Anyway, it’s much easier to find out how much you are paying in administrative fees because of the recent DOL fee disclosure rule. Check your plan disclosure document to see how much you’re paying to invest in your 401k. Meanwhile, you can see an estimate of how much you’ll pay in fees over your working life at Personal Capital.

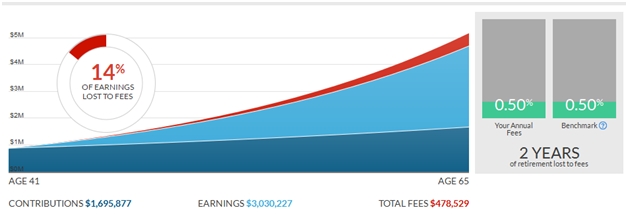

Our annual fees are about 0.15% of our retirement investment. That’s not bad, but we will still pay over $145,000 over the next 25 years. I’m not happy about that, but check this out.

If we had to pay the “benchmark” fee of 0.50%, our total cost to invest would shoot up to nearly half a million dollars. That’s a lot of money lost to fees.

Anyway, fees are a big deal. 0.35% can amount to over $300,000 in 25 years of investing. The fees you pay to invest is one of the few things you can control. Check how much fees you are paying and try to minimize them as much as possible.

You can try the retirement fee analyzer and other great tools at Personal Capital for free. Check them out if you don’t already have an account.

I Love My 401k!

So that’s why I love my 401k. It’s a great way to build your core investment and you don’t even have to know much about investing. The 401k is perfect for new investors. Here is the path to wealth.

- Start investing in your 401k ASAP. Even just 5% of your income is a good start.

- Increase your 401k contributions and max out your 401k every year. The max contributions in 2022 will be $20,500.

- After maxing out your 401k, start contributing to your Roth IRA.

- After maxing out your Roth IRA, invest in your brokerage accounts.

- Diversify into real estate through real estate crowdfunding, REITs, or rentals.

- Enjoy being a millionaire.

Do you love your 401k (or equivalent)? If you don’t, tell us why not?

*Sign up for a free account at Personal Capital to help manage your net worth and investment accounts. I log in almost every day to check on our accounts. It’s a great site for DIY investors. The Retirement Fee Analyzer tool is quite useful.

Passive income is the key to early retirement. This year, Joe is investing in commercial real estate with CrowdStreet. They have many projects across the USA so check them out!

Joe also highly recommends Personal Capital for DIY investors. They have many useful tools that will help you reach financial independence.

Latest posts by retirebyforty (see all)

Living on Social Security alone is not only possible, but many retirees already accomplish that very feat every year.…

Copyright © 2024 Retiring & Happy. All rights reserved.