Retirement Regrets Statistics: Advice for the Next Generation

We all have regrets. But when it comes to reflecting on your life and professional career, no collective of people may have better insight than retirees. 1 in 4 retired Americans say they have regrets now that they’ve retired, which can be used as a learning lesson for younger Americans who still have many professional working years left.

In a new study by MedicareFAQ, a Medicare learning resource center, more than 560 self-reporting retired Americans were surveyed to understand those regrets better and to see what advice they can offer to younger generations.

Table of Contents:

- Invest in Your Retirement

- What are Americans’ Biggest Retirement Regrets?

- Retirement Living: 23% Struggle To Find Fulfillment

- Reflecting on Career, Family, and Travel

- Top 10 Pieces of Advice from Retirees

Invest in Your Retirement

One of the biggest considerations in retirement is finances. Even once you’ve retired, there’s no guarantee you’ll feel financially secure. In fact, 59% of retirees have financial concerns about their retirement, and less than half (46%) have saved enough money for a comfortable retirement.

The majority (86%) wish they would have saved more before retiring, and 60% say they did not start investing in their retirement funds early enough. That’s a clear indication to younger Americans that it’s never too early to start saving for retirement, and for 67% of retirees that’s their biggest piece of advice.

Other advice regarding retirement includes prioritizing experiences over material possessions and finding a fulfilling work-life balance.

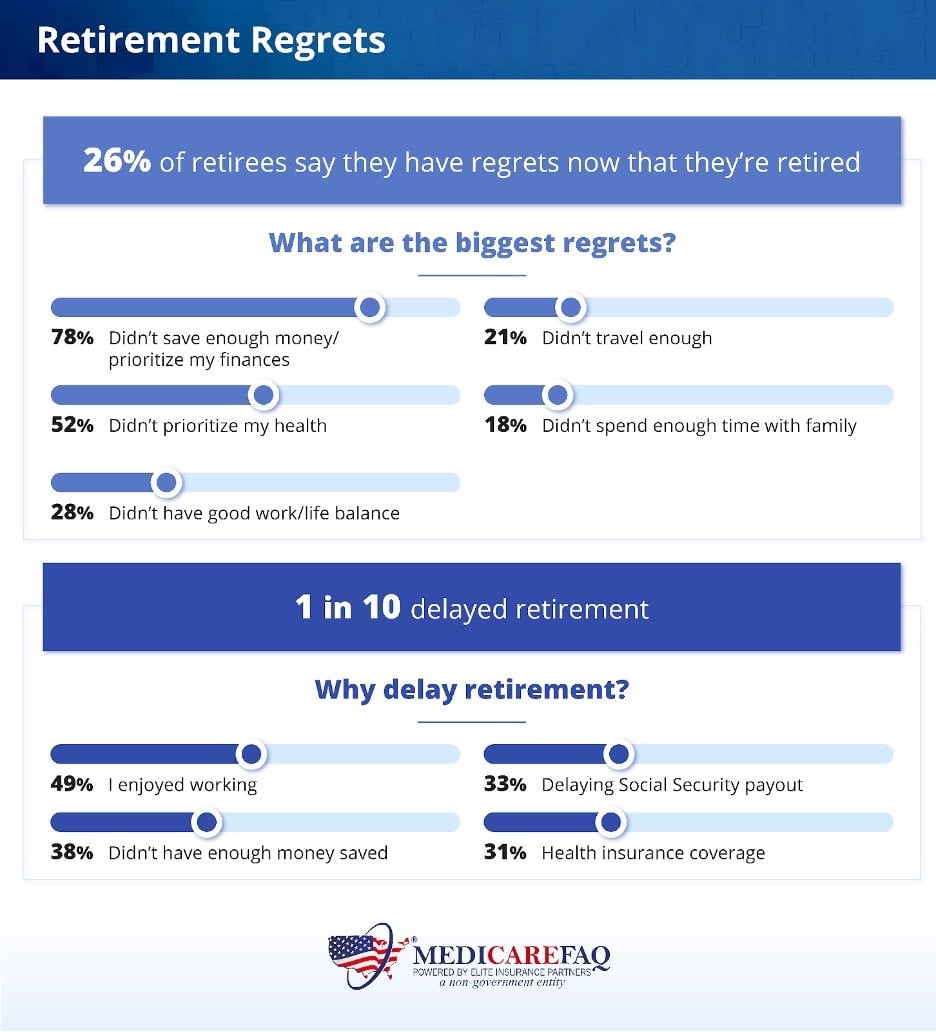

What are Americans’ Biggest Retirement Regrets?

Most notably, 1 in 4 retired Americans have regrets. The biggest regret is financial, with retirees saying they didn’t save enough money or prioritize finances enough. Without substantial financial backing, retirement may be less than stellar. Throughout your working days, it is important to put back any additional income you have to prepare for retirement.

Other retirees regret not prioritizing their health. Prioritizing your health in retirement can look different depending on your situation. For some, prioritizing your health means staying active, following a fad diet, or reducing the amount of unhealthy food you consume. For others, prioritizing your health means prioritizing your healthcare. After you retire, your healthcare becomes an even more essential part of your daily routine.

Most retirees in the United States are enrolled in Medicare coverage. However, not all Medicare plans are the same. It is important to compare Medicare Supplement and Medicare Advantage coverage to ensure you are enrolling in the right coverage to be able to prioritize your health in retirement.

Additionally, not having a good work-life balance, not traveling enough, and not spending enough time with friends and family are major regrets seen throughout retirement.

1 in 10 decided to delay their retirement. Why? The top reason was that they simply enjoyed working, followed by not having enough money saved, a delayed social security payout, and reasons.

Retirement Living: 23% Struggle To Find Fulfillment

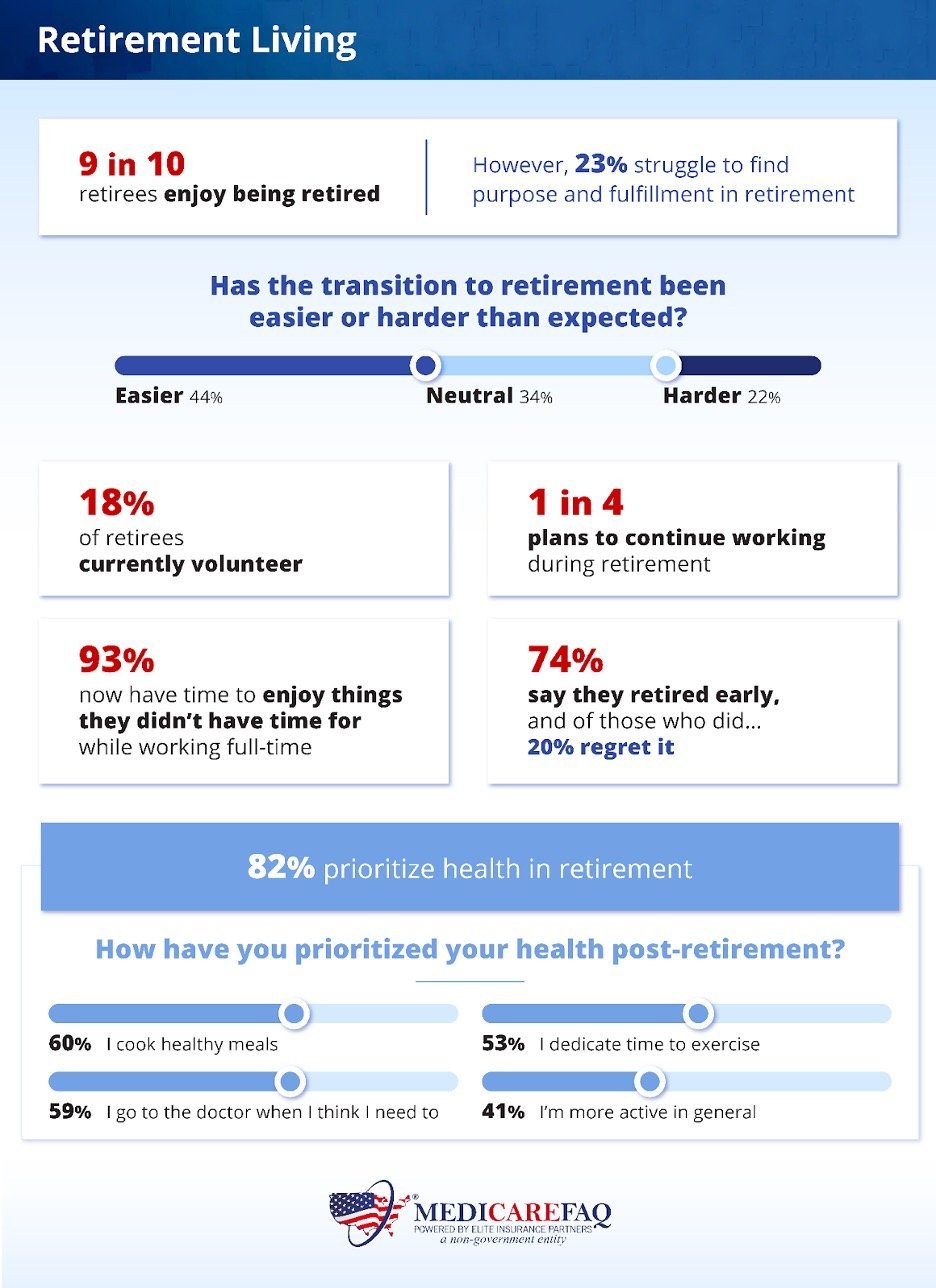

Overall, do Americans enjoy being retired? 9 in 10 say yes, however, nearly 1 in 4 say they struggle to find purpose and fulfillment in retirement. The transition from working full-time to being retired can be tough, and 22% of retirees say this transition was harder than they anticipated.

One thing that may help retirees with the transition, and also help those struggling to find a purpose, may be volunteering or working a part-time job. Currently, 18% of retirees volunteer, and 1 in 4 plan to continue working in some regard. The vast majority (93%) of retirees say retirement has given them the ability to enjoy things they didn’t have time for while working full-time.

At can you officially retire? For many Americans, that can depend on many factors, although the average age is 64. Among survey respondents, 74% say they were able to retire early, but of those who did, 20% regret that decision.

Although they may have regretted not keeping health top of mind when they were younger, 82% say they’re now in retirement. Retired Americans are cooking healthier meals, going to the doctor when they think they need to, reviewing their health coverage during the appropriate enrollment periods, dedicating time to exercise and are just more active in general.

Reflecting on Career, Family, and Travel

When reflecting further upon their careers, family, and travels, retirees have some insights. In their careers, 38% have career regrets and 35% wish they would have achieved better work-life balance while working full-time. 1 in 10 say they’ve had a “second-act” career, which is a major career change that occurs after retirement. This is also sometimes known as an encore career.

When it comes to family, more than half of retirees (56%) say they’re able to spend more quality time with their loved ones now that they’ve retired. More than 2 in 5 say that thanks to retirement, they’re able to spend more quality time with their partner.

Of retired Americans who don’t have children, more than 1 in 4 wish they had.

Travel is not a luxury everyone can afford, but according to the majority of retirees (89%), it’s an important part of life to experience. More than half (58%) wish they would have traveled more when they were younger.

Those who plan on traveling in retirement have prioritized their financial wellbeing and healthcare to allow them the freedom to explore new areas of the world. Traveling can be costly. Thus, it is important to be financially stable in retirement to be able to enjoy this luxury.

Additionally, you’ll want to have proper health coverage in case of an emergency abroad. Health insurance plans like Medicare Supplement Plan G and Plan F offer emergency foreign coverage for these unexpected situations.

Top 10 Pieces of Advice from Retirees

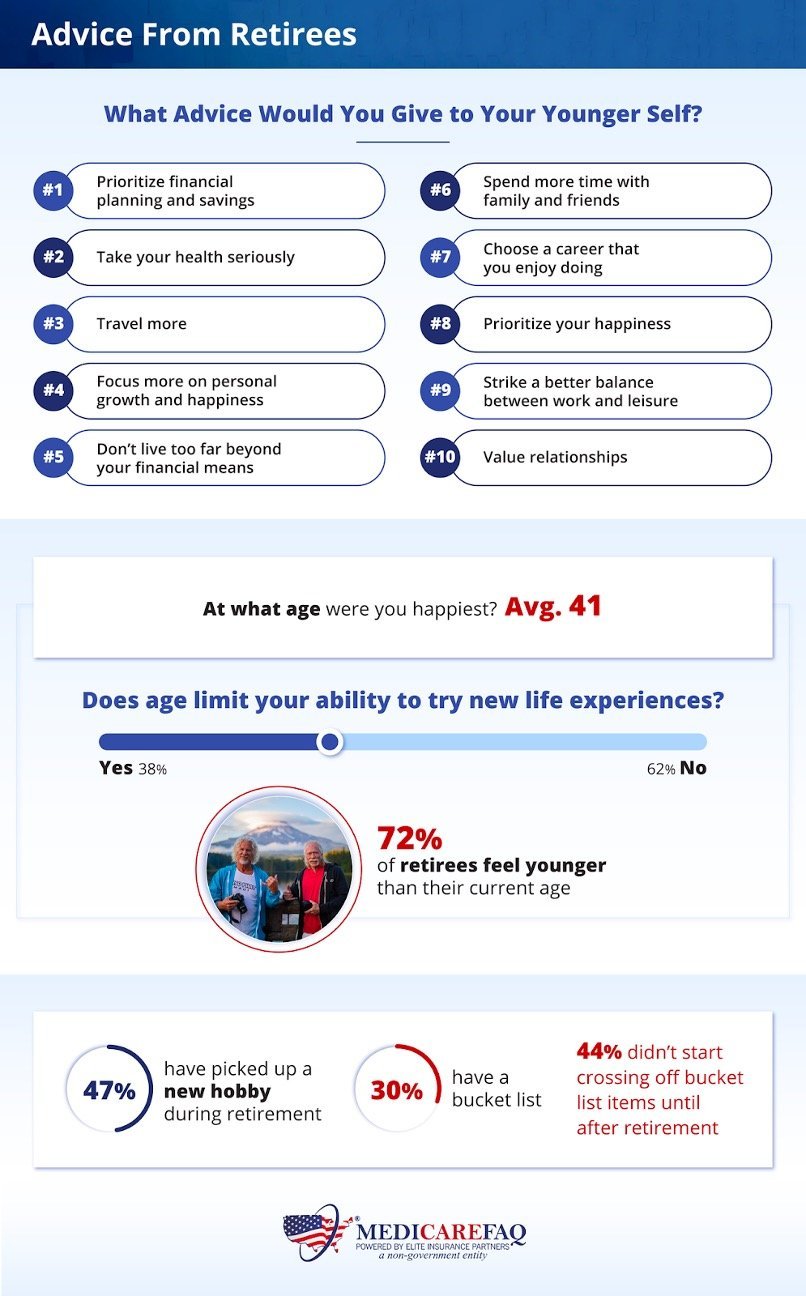

Although we should all listen to our elders, the saying holds true especially when it comes to advice given by retirees. What advice would they give to themselves? The biggest thing is to prioritize financial planning and savings. Other top pieces of advice include taking your health seriously, traveling more, focusing on personal growth and happiness, and not living too far beyond your financial means.

When it comes to the age at which they were happiest, retirees say the magic year was 41. As age is just a number, 62% add that age does not limit your ability to try new life experiences. In fact, most (72%) retirees say they feel younger than their current age.

It’s never too late to find a new passion or hobby, and retirement opens up the door for many Americans to find that new hobby or passion. Almost half (47%) have picked up a new hobby during retirement. One passion might be pursuing bucket list items, and 30% of retirees say they have a bucket list with many people starting to cross things off once retired.

MedicareFAQ is an educational resource for seniors who are new to Medicare or who wish to make a change to their coverage. At MedicareFAQ, we can help determine your options by comparing Medicare Supplement plans, reviewing , and helping you understand how each plan type can affect your coverage.

Methodology:In January 2024, we surveyed self-reporting retired 569 Americans to get their feedback on retirement and retired living. Respondents were 65% female and 35% male, with an age range of 27 to 90 and an average age of 65 years old. The average age of retirement amongst respondents was 58, with the majority having been retired for 5 or more years.

For media inquiries, contact Press@medicarefaq.com.

Fair Use

When using this data and research, please attribute by linking to this study and citing medicarefaq.com

Scotland. Paint a picture in your mind’s eye of everything you can imagine about Scotland and most likely you’d…

Copyright © 2024 Retiring & Happy. All rights reserved.